Are Morgan Stanley Fees Too High? A Comprehensive Look At Their Wealth Management Costs

You’ve worked hard to build wealth, and now you’re looking for a wealth management firm to help you grow it. But many investors hesitate when it comes to Morgan Stanley, concerned about their fees. While the firm offers a comprehensive suite of services, including investment management and financial planning, their fees can be a significant consideration. For example, a 30% increase in fees could translate to a substantial reduction in your portfolio’s long-term growth.

This article provides a comprehensive analysis of Morgan Stanley’s fee structure, comparing it to competitors and helping you determine if it aligns with your financial needs. Are Morgan Stanley fees too high? By the end of this article, you’ll have a clear understanding of whether Morgan Stanley fees are too high, the value of their services, and alternative options available for your wealth management goals.

Understanding Morgan Stanleys Fee Structure

Morgan Stanley employs a multifaceted approach to its fee structure for wealth management services, which can sometimes be intricate. Understanding these fees is essential for potential clients who want to ensure they are receiving value for their investment.

Asset-Based Fees

One of the primary ways Morgan Stanley charges for its services is through asset-based fees. This means that clients pay a percentage based on the total assets under management (AUM). This fee model is designed to align the interests of both the advisor and the client, as both parties benefit when the portfolio grows.

For instance, a client managing a $1 million portfolio might expect to pay an annual fee of around $10,000. The fee percentage typically ranges from 0.35% to 1%, depending on the size of the portfolio and the specific services provided, which may include investment management and financial planning. Understanding these percentages is crucial for clients to evaluate whether the costs align with their financial goals.

Transaction Fees

In addition to asset-based fees, clients may encounter transaction fees when buying or selling securities through Morgan Stanley. These fees can vary significantly based on the type of transaction. For example, stock trades may incur a fee of approximately $5 to $10, while bond trades might have different pricing structures.

For active traders or clients making frequent adjustments to their portfolios, these transaction fees can accumulate quickly. Therefore, it’s vital for potential clients to consider these additional costs when evaluating whether Morgan Stanley’s fee structure aligns with their investment style and objectives.

Other Fees

Beyond asset-based and transaction fees, Morgan Stanley may also charge additional fees for various services, including account maintenance, custodial services, or access to certain investment platforms. These fees can either be standard across the industry or vary based on the specific services and account types offered. Clients should diligently review the firm’s fee schedule and inquire about any potential hidden costs to fully understand their financial obligations.

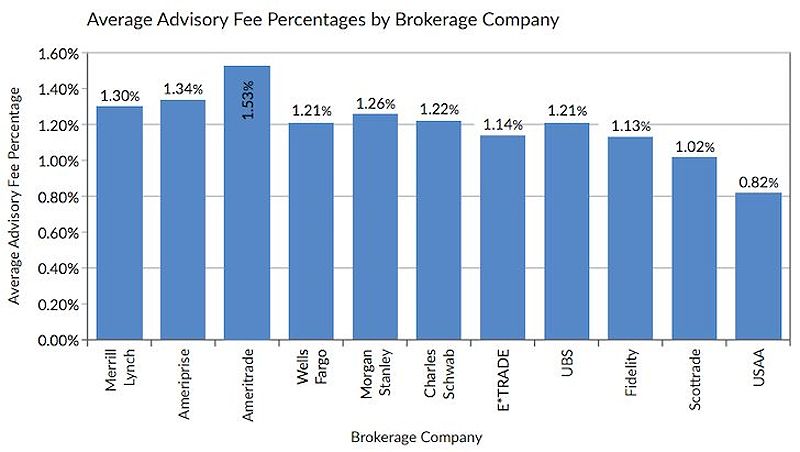

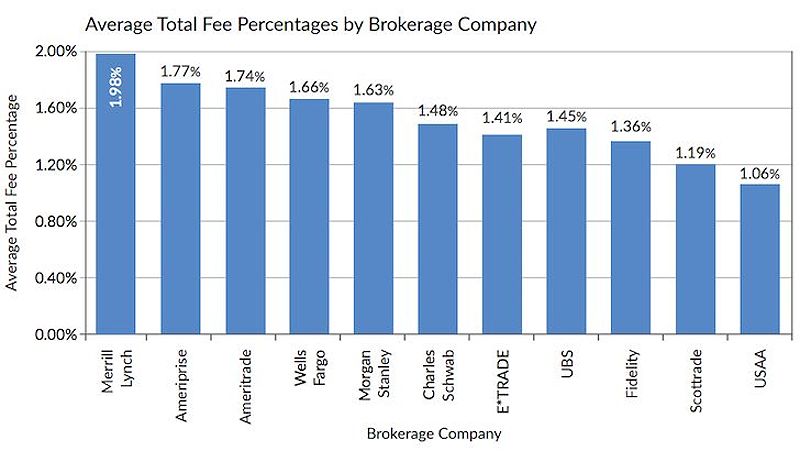

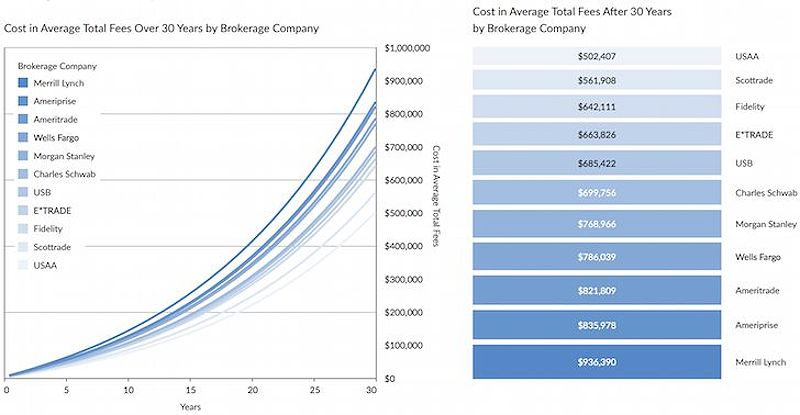

Comparing Morgan Stanley Fees to Competitors

To better assess whether Morgan Stanley fees are too high, it is essential to compare them with those of other prominent wealth management firms. Understanding the broader fee landscape can help potential clients make more informed decisions.

Firms such as Fidelity, Charles Schwab, and Merrill Lynch also provide wealth management services, each with its own unique fee structures. For example, Fidelity typically charges lower asset-based fees, which range from 0.35% to 0.75%. This can be particularly attractive for cost-conscious investors. Conversely, Merrill Lynch may have higher average fees but offers a wider array of personalized services.

When comparing Morgan Stanley’s fees to those of its competitors, it becomes apparent that while Morgan Stanley may not offer the lowest fees in the market, it often compensates for this with comprehensive services and a strong reputation. Clients must weigh the benefits of Morgan Stanley’s offerings against the potential cost savings of choosing a competitor.

Pros and Cons of Morgan Stanley Fees

Pros:

- Access to Expertise: Morgan Stanley provides clients with a team of experienced advisors who offer personalized investment strategies and financial planning.

- Comprehensive Services: The firm offers a broad range of services, including estate planning and tax optimization, which may justify higher fees.

- Strong Reputation: As a well-established firm, Morgan Stanley’s reputation can instill confidence in clients regarding their investments.

Cons:

- Higher Costs: Some clients may perceive Morgan Stanley’s fees as higher than those of other firms, especially for basic investment management services.

- Additional Fees: The presence of transaction and other ancillary fees can lead to unexpected costs, potentially impacting overall returns.

Are Morgan Stanley Fees Too High? Factors to Consider

When determining whether Morgan Stanley fees are too high, clients should consider several factors that can influence their decision. Individual financial goals, risk tolerance, and investment needs play crucial roles in assessing the appropriateness of fees.

Individual Financial Goals

Every investor has unique financial objectives. Understanding these goals is essential when evaluating the value of a wealth management service. High-net-worth individuals may find that they are willing to pay a premium for specialized services and personalized attention. In this context, what may seem like high fees could actually represent a worthwhile investment in achieving their financial aspirations.

Value Received for Fees Paid

The perception of “high” fees is relative. Clients should assess the quality of the services provided in relation to the fees charged. For instance, if a client receives exceptional investment advice and strategies that significantly enhance their portfolio’s performance, the fees may be justified. Evaluating the overall value proposition of Morgan Stanley, including the expertise of its advisors and the breadth of services offered, is crucial for making an informed decision.

Tips for Negotiating Morgan Stanley Fees

For those concerned about the cost of Morgan Stanley’s services, negotiation can be a viable option. Here are some practical tips for discussing fees with Morgan Stanley advisors:

-

Communicate Clearly: Articulate your financial goals and needs during discussions with advisors. Clear communication can help advisors tailor their services and potentially offer more competitive fees.

-

Research Competitors: Understanding the fee structures of competing firms can provide leverage in negotiations. If a competitor offers similar services at a lower cost, this information can be used as a bargaining chip.

-

Explore Alternative Fee Structures: Inquire about different fee arrangements, such as flat fees or hourly rates, which may be more suitable for your financial situation.

-

Consider Bundling Services: If you require multiple services, ask if bundling them can lead to a lower overall fee. Many firms are willing to negotiate in this manner to retain clients.

-

Be Prepared to Walk Away: If negotiations do not yield satisfactory results, be willing to explore other options. Knowing your worth as a client can empower you in negotiations.

Alternatives to Morgan Stanley

For high-net-worth individuals seeking lower fees, several alternatives exist in the wealth management landscape. Exploring these options can help clients find a service that aligns with their financial goals while minimizing costs.

Robo-Advisors

Robo-advisors have emerged as a popular alternative, offering automated investment management at a fraction of the cost of traditional firms. These platforms typically charge lower management fees, often ranging from 0.25% to 0.50%. While they may lack the personalized touch of a human advisor, they can be an excellent option for those comfortable with a more hands-off approach.

Fee-Only Financial Advisors

Fee-only financial advisors charge clients based solely on their services, rather than earning commissions from product sales. This model can help reduce potential conflicts of interest and often results in lower overall costs. Clients can benefit from objective advice tailored to their specific needs without the burden of additional fees.

Independent Wealth Management Firms

Independent firms often provide personalized service and may have lower fees compared to larger institutions. These firms typically focus on a select group of clients, allowing for more tailored advice and strategies. Clients seeking a more intimate relationship with their advisor may find this option appealing.

FAQ

What is the minimum investment required to work with Morgan Stanley?

The minimum investment at Morgan Stanley can vary depending on the specific service and account type. Generally, it can start from $5,000 for certain advisory services.

Does Morgan Stanley offer fee-only services?

Morgan Stanley primarily operates on a commission-based model, but clients can inquire about fee-only arrangements for specific services.

How can I find a Morgan Stanley advisor in my area?

Potential clients can locate a Morgan Stanley advisor through the firm’s website or by contacting their local branch directly.

What are the qualifications of Morgan Stanley advisors?

Morgan Stanley advisors typically hold advanced certifications and degrees, such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA), ensuring a high level of expertise in wealth management.

Conclusion

In summary, whether Morgan Stanley fees are too high depends on individual circumstances and the value clients perceive in the services offered. While their fee structure may not be the lowest in the market, the comprehensive range of services, experienced advisors, and strong reputation may justify the costs for many high-net-worth individuals. By carefully evaluating personal financial goals and considering alternative options, clients can make informed decisions that align with their financial needs.

MORE FROM pulsefusion.org