Can I Afford A New Car? A Realistic Guide To Budget-conscious Car Buying

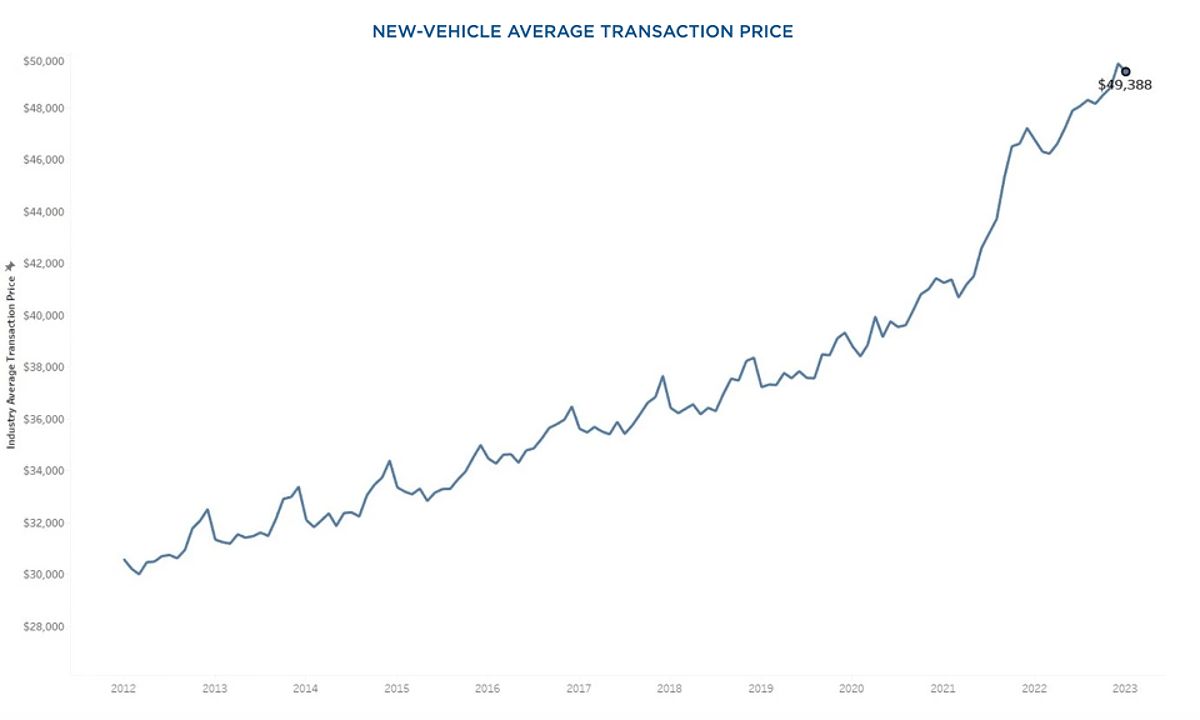

With the average price of a new car reaching nearly $50,000, many people are asking themselves, Can I afford a new car? The appeal of a brand-new vehicle is strong, but the financial implications can be overwhelming. Fortunately, there are strategies to effectively navigate the car-buying process, even with a limited budget.

Assessing Your Car Buying Budget

Calculating Your Monthly Car Payment

The first step in determining whether you can afford a new car is to establish a realistic monthly payment budget. A widely accepted guideline suggests that you should allocate no more than 10% of your net monthly income to your car payment. For example, if your take-home pay is $4,000, your car payment should be around $400.

It’s important to note that this calculation only covers the loan payment itself, and doesn’t include additional costs like fuel, insurance, and maintenance. To get a more comprehensive picture, you might want to adjust your budget to account for around 15% of your income for all vehicle-related expenses. Using a car loan calculator can help you estimate monthly payments based on different loan amounts, interest rates, and terms. Additionally, budgeting apps can be a useful tool for tracking your income and expenses effectively.

Identifying Hidden Costs

When assessing your budget, it’s crucial to factor in the hidden costs associated with vehicle ownership. These can include sales tax, registration fees, and documentation fees, which can collectively add several hundred dollars to the total purchase price. Depending on your location, sales tax can range from 5% to 10% of the vehicle’s cost, while registration fees can vary significantly, typically falling between $50 and $300.

For instance, if you’re looking at a car priced at $30,000, it’s a good idea to budget an additional $2,000 to $3,000 for taxes and fees. These extra costs can have a substantial impact on your overall budget, so thorough research is essential to understanding your financial obligations.

It’s also important to consider the ongoing costs of car ownership beyond the initial purchase, such as regular maintenance, tire replacements, and unexpected repairs. Setting aside a portion of your budget for these expenses is crucial, as they are often overlooked during the buying process.

Exploring Affordable Car Options: Can I Afford a New Car?

The Benefits of Buying Used

If you find yourself asking, “Can I afford a new car?” you may want to explore the option of purchasing a used vehicle instead. Used cars generally provide considerable savings compared to new models, with the average price of a used car significantly lower than that of a new one. While the average price of a new car hovers around $50,000, used cars often average about $27,000.

Opting for a used car not only helps you save money upfront, but it also mitigates the rapid depreciation that new cars experience, particularly within the first few years. Used cars have already undergone this steep depreciation, making them a more financially prudent choice. Additionally, insurance premiums for used cars are typically lower, further enhancing their cost-effectiveness.

The used car market offers a vast array of makes, models, and price points, allowing you to find a vehicle that meets your needs without straining your finances. Many reputable dealerships and online platforms specialize in used cars, providing detailed histories and inspections to assist in making an informed decision.

Negotiating a Great Deal

Once you’ve settled on the type of vehicle you’re interested in, it’s crucial to research the fair market value of that model. Knowing the average price will empower you during negotiations. When visiting dealerships, be prepared to discuss the vehicle’s condition and point out any flaws that might justify a lower price.

Being willing to walk away from a deal can also enhance your negotiating power. If you feel pressured or the terms seem unfavorable, don’t hesitate to step back. There are numerous alternatives available, and exercising patience can lead to a better deal.

In addition to negotiating the purchase price, consider discussing financing options with the dealer. Sometimes, dealerships offer promotional financing rates that may make a new car more affordable in the long run. However, it’s essential to scrutinize the fine print and understand the total cost of the loan before committing.

Financing Your Car Purchase

Auto Loan Options

Securing financing is a crucial step in the car buying journey. Various types of auto loans are available, including traditional bank loans, dealership financing, and third-party lenders. Each option has its own pros and cons that can significantly impact your overall costs.

Traditional bank loans typically offer lower interest rates, especially for borrowers with good credit ratings. On the other hand, dealership financing can be more convenient but may come with higher rates. Third-party lenders might provide more flexible terms but can also charge elevated interest rates. It’s advisable to compare different lenders and their terms to find the most suitable option for your financial situation.

When evaluating loans, pay close attention to the annual percentage rate (APR), loan term, and any additional fees. A lower interest rate can result in substantial savings over the life of the loan, while a longer loan term may yield lower monthly payments but could lead to higher overall interest payments.

Improving Your Credit Score

Your credit score plays a significant role in the interest rates and loan amounts available to you. A higher credit score can substantially reduce your interest rate, making your loan more affordable. If your score is less than ideal, consider taking steps to enhance it before applying for a loan.

Timely bill payments, reducing credit card balances, and avoiding new credit inquiries can help improve your score. Even minor enhancements can impact the interest rates you receive, potentially saving you thousands over the loan’s duration.

Obtaining a free credit report can also provide valuable insights into your credit standing, allowing you to identify areas for improvement and take proactive measures to boost your score before seeking financing.

Beyond the Price Tag: Essential Considerations

Insurance Costs

Insurance is another critical element to consider when determining if you can afford a new car. Premiums can vary significantly based on the vehicle’s make and model, your driving history, and your geographical location. For instance, sports cars often command higher insurance rates due to their performance capabilities and elevated repair costs.

To secure the best deal, it’s wise to obtain quotes from multiple insurance providers. This approach enables you to compare rates and coverage options, ensuring you select a policy that aligns with your budget. Additionally, consider bundling your car insurance with other policies, such as homeowners or renters insurance, as many companies offer discounts for combined coverage.

Maintenance and Repairs

Owning a car also entails ongoing maintenance and repair expenses. While new cars typically require less frequent repairs, they can still incur significant costs for routine upkeep. Conversely, older vehicles might demand more frequent repairs, which can accumulate rapidly.

It’s prudent to allocate a portion of your monthly budget for these potential expenses. Research the average maintenance costs for the specific make and model you are considering to gain a clearer understanding of what to expect. Some manufacturers offer maintenance plans that can help you budget for these costs over time.

Moreover, establishing a relationship with a trustworthy mechanic can facilitate navigating repairs and maintenance. Having a reliable professional can save you money in the long run by providing quality service and advice.

FAQ

Q: What is a good down payment for a car?

A: Aim for a down payment of at least 20% of the car’s purchase price. This strategy will reduce your loan amount and monthly payments.

Q: How long should I finance a car for?

A: While longer loan terms offer lower monthly payments, they also result in paying more interest over time. Aim for a loan term of 5-7 years.

Q: What if I can’t afford a new car?

A: Consider buying a used car, leasing a vehicle, or exploring alternative transportation options like public transit or ride-sharing services.

Q: What are some tips for negotiating a lower car price?

A: Research the fair market value, be prepared to walk away, and highlight any flaws in the vehicle to justify a lower price.

Conclusion

In conclusion, determining whether you can afford a new car requires thorough budgeting and careful consideration of various factors. Start by calculating your monthly car payment and factoring in all associated costs, including insurance and maintenance. Exploring used car options can also yield substantial savings, making car ownership more manageable.

By understanding your financing options and striving to improve your credit score, you can position yourself for a more affordable car purchase. Ultimately, the objective is to make a well-informed decision that aligns with your financial situation and long-term goals. With the right preparation and knowledge, you can confidently navigate the car buying process and find a vehicle that meets both your needs and your budget.

MORE FROM pulsefusion.org