This article examines credit cards for the rich, detailing the exclusive perks, benefits, and access to a life of luxury they offer. It will explore the top cards, their eligibility criteria, and whether these coveted cards are worth the investment.

Imagine a World of Exclusive Privileges

You might think the pursuit of the perfect credit card is driven by rewards points and travel miles, but for a select 20% of the population, the allure lies in exclusivity. These individuals aren’t just looking for a financial tool; they’re seeking a status symbol, a key to a world of private jets, curated events, and unparalleled concierge services.

In the realm of personal finance, credit cards have evolved from mere payment tools into gateways to an exclusive world of luxury and privilege. For high-net-worth individuals, the choice of a credit card is not just about the transaction; it’s about unlocking a lifestyle of unparalleled perks, benefits, and status. Welcome to the captivating domain of credit cards designed for the rich.

The Irresistible Allure of Exclusive Credit Cards

The Prestige and Status Factor

In the world of the wealthy, a credit card is more than just a means of payment; it’s a symbol of status, power, and exclusivity. The mere possession of an elusive “black card” or an invitation-only card carries an aura of prestige, instantly elevating the cardholder’s social standing and signaling their elite financial status. These cards have become the ultimate status symbol, with their mere existence sparking intrigue and envy among the general public.

Unparalleled Perks and Benefits

Beyond the allure of prestige, exclusive credit cards offer a suite of benefits that cater to the lifestyles of the affluent. From personalized concierge services that can handle everything from travel arrangements to event planning, to access to private airport lounges and exclusive experiences, these cards are designed to elevate every aspect of the cardholder’s life. The promise of first-class treatment, streamlined access, and curated experiences can be a powerful draw for those seeking a lifestyle of indulgence and convenience.

Financial Advantages for the Elite

While the prestige and perks of exclusive credit cards are undoubtedly enticing, these cards also offer tangible financial benefits that can appeal to the high-net-worth individual. Larger credit limits, robust rewards programs, and comprehensive travel insurance are just a few of the financial advantages that come with these premium cards. For those who can maximize the value of these benefits, the high annual fees may be a worthwhile investment in enhancing their overall financial strategy.

Unveiling the Top Credit Cards for the Wealthy

The Legendary Centurion Card from American Express

The Centurion Card from American Express, often referred to as the “Black Card,” is the epitome of exclusivity in the world of credit cards. Shrouded in mystery and lore, this legendary card is available by invitation only to a select few. With a reported annual spending requirement of $250,000 or more on an existing American Express Platinum Card, the Centurion Card promises unparalleled prestige, concierge services, travel upgrades, and access to exclusive events. However, the steep $5,000 annual fee and the challenge of obtaining an invitation make this card a true status symbol for the ultra-wealthy.

The Prestigious JP Morgan Reserve Card

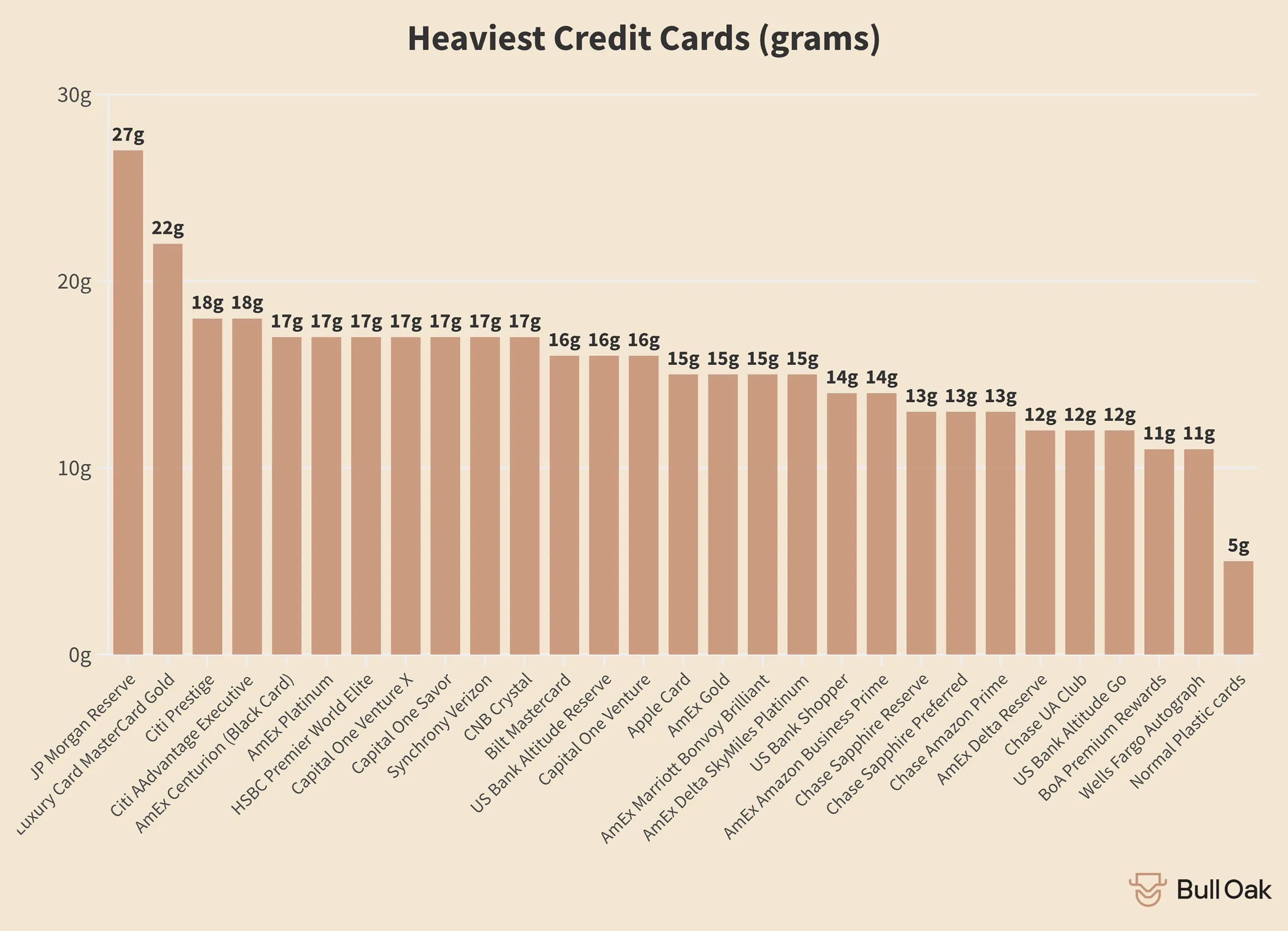

The JP Morgan Reserve Card, also known as the Palladium Card, is an invitation-only offering reserved for the bank’s private clients with a minimum of $10 million in managed investments. This bespoke financial tool seamlessly integrates the cardholder’s spending power with their investment portfolio, offering a suite of rewards and benefits tailored to the needs of the high-net-worth individual. With its hefty 27-gram weight, made of brass and palladium, the JP Morgan Reserve Card is a tangible representation of its owner’s financial prowess and exclusivity.

The Rarest Credit Card: Dubai First Royale Mastercard

Considered by many to be the rarest credit card in the world, the Dubai First Royale Mastercard boasts an extremely limited number of cardholders, rumored to be less than 200. This card is primarily focused on catering to the luxury travel and lifestyle needs of its elite clientele, offering exclusive benefits such as access to private jets, a dedicated concierge service, and tailored experiences within the United Arab Emirates. The Dubai First Royale Mastercard is a true testament to the extraordinary wealth and status of its owners.

Weighing the Value: Are Exclusive Credit Cards Worth the Cost?

When it comes to the value proposition of exclusive credit cards, the answer is not a simple one-size-fits-all. The true worth of these cards lies in the alignment between their benefits and the cardholder’s lifestyle and financial goals.

For those who can fully capitalize on the concierge services, travel upgrades, and exclusive experiences offered by these cards, the high annual fees may be a worthwhile investment. However, for those who do not actively utilize these benefits, the cost-benefit analysis may not be as favorable. It’s essential to carefully consider whether the perks and rewards of these cards truly enhance your financial strategy and day-to-day activities.

To maximize the value of exclusive credit cards, it’s crucial to:

- Utilize all the benefits: Actively engage with the concierge services, take advantage of travel upgrades, and attend exclusive events to extract the full value from your card.

- Strategize your spending: Focus your spending on categories that earn higher rewards, such as travel and dining, to amplify the value of your card.

- Negotiate the fees: Explore options to reduce or waive the annual fees, as these can be a significant barrier to the card’s overall value proposition.

By aligning your lifestyle and financial goals with the unique features of these exclusive credit cards, you can unlock a world of luxury and convenience that may be well worth the investment.

Securing an Exclusive Credit Card: The Path to Prestige

Obtaining an exclusive credit card is not a straightforward process, as many of these cards are invitation-only. The eligibility criteria for these coveted cards often go beyond just a high credit score and substantial income; they typically require a demonstrated history of high spending, significant net worth, and strong banking relationships.

For example, the American Express Centurion Card is rumored to be extended only to those who already hold the Platinum Card and spend a minimum of $250,000 annually on the card. Similarly, the JP Morgan Reserve Card is available exclusively to the bank’s private clients with a minimum of $10 million in managed investments.

If you’re aspiring to become an owner of an exclusive credit card, here are some tips to increase your chances:

- Build a strong credit history: Maintain an excellent credit score and demonstrate responsible spending habits on your existing credit cards.

- Showcase your wealth: Provide clear evidence of your high income, significant assets, and substantial spending power.

- Cultivate relationships with bank representatives: Network with private bankers or credit card executives to increase your visibility and demonstrate your worth as a potential cardholder.

It’s important to note that the application process for these exclusive cards is often shrouded in secrecy, and the final decision rests solely with the card issuer. However, by positioning yourself as a high-value, high-spending client, you may improve your chances of receiving that coveted invitation.

The Future of Credit Cards for the Rich: Trends and Innovations

As the world of finance continues to evolve, the landscape of exclusive credit cards is poised to undergo its own transformation. Trends such as increased digitalization, personalized experiences, and a focus on sustainability are expected to shape the future of these premium cards.

Cardholders may see a greater integration of mobile apps and digital features, allowing for seamless management of their accounts and even more personalized rewards and benefits. Additionally, card issuers may start to cater to the evolving preferences of the wealthy, offering tailored experiences and eco-friendly options that resonate with their values.

As the demand for exclusivity and luxury continues to grow, the competition among card issuers to offer the most enticing and innovative products is likely to intensify. The elite credit card market is expected to remain a highly coveted space, with card providers constantly seeking to redefine the boundaries of what it means to be a member of the financial elite.

FAQ

Q: What are the most common perks offered by exclusive credit cards?

A: Common perks of exclusive credit cards include concierge services, travel upgrades, access to luxury experiences and events, high credit limits, and robust rewards programs.

Q: How much do I need to spend to qualify for an exclusive credit card?

A: There is no set spending requirement, but generally, you need to demonstrate consistent high spending on existing credit cards, often in the range of $250,000 or more annually.

Q: Are exclusive credit cards worth the high annual fees?

A: The value proposition of these cards depends on your lifestyle and spending habits. If you can fully utilize the benefits, the high fees may be justified. However, if you don’t actively take advantage of the perks, the cost may outweigh the benefits.

Q: Can I apply for an exclusive credit card online?

A: Most exclusive credit cards are invitation-only, so you cannot apply online. You may need to contact the issuing bank directly to express your interest and see if you meet their eligibility criteria.

Conclusion: Unlocking a Life of Luxury and Privilege

The world of credit cards for the rich is a captivating realm that promises exclusivity, luxury, and a lifestyle of unparalleled perks and benefits. From the legendary Centurion Card to the elusive Dubai First Royale Mastercard, these coveted cards offer a tantalizing glimpse into the financial lives of the elite.

As the demand for exclusivity and personalized experiences continues to grow, the landscape of premium credit cards is poised to evolve, incorporating cutting-edge digital features and tailored offerings that cater to the ever-changing preferences of the wealthy. Whether you’re a seasoned high-roller or aspiring to join the ranks of the financial elite, understanding the unique qualities and eligibility criteria of these exclusive cards can open the door to a world of luxury and privilege that few can ever experience.