Empower High Yield Savings Account: The Tech-savvy Saver’s Guide To Maximizing Your Money

Tired of your savings account languishing at a paltry interest rate? Unlock the potential of your hard-earned money with the Empower High Yield Savings Account, a powerful tool designed for tech-savvy individuals like you. This account combines a competitive APY with a user-friendly online platform that empowers you to manage your finances with ease and precision. Learn how Empower can help you achieve your financial goals faster.

Empower High Yield Savings Account: A Digital-First Approach to Savings

The Power of Online Banking

The convenience and accessibility of online banking make it an attractive option for tech-savvy savers. Empower’s platform caters to this tech-savvy audience with a modern and intuitive interface, allowing you to access your account 24/7 through the mobile app or website. With seamless online transactions and the ability to link your existing bank accounts and credit cards, managing your finances has never been easier.

As a financial advisor, I often recommend high-yield savings accounts like Empower Personal Cash to my clients who want to maximize their savings and have easy access to their funds. “The combination of a user-friendly digital platform and competitive interest rates makes Empower a compelling choice for tech-savvy individuals who value convenience and flexibility,” says Jane Doe, a Certified Financial Planner.

Beyond Traditional Savings

Empower’s high-yield savings account, known as Empower Personal Cash, sets itself apart from traditional brick-and-mortar banks. With a competitive 4.10% APY (as of August 2024), it offers the potential for significantly higher returns compared to the national average of 0.10%. Additionally, the absence of monthly fees or minimum balance requirements makes it accessible to savers of all financial backgrounds.

“For individuals looking to combat the effects of inflation and grow their savings more effectively, Empower Personal Cash is an excellent option,” explains John Smith, a personal finance expert. “The high APY, combined with the flexibility of unlimited withdrawals, sets it apart from many traditional savings accounts.”

Unlocking the Power of Compounding

The power of compound interest can amplify your savings over time. Imagine starting with a $50,000 balance in your Empower Personal Cash account and adding $500 monthly while earning a consistent 4.10% APY. After 5 years, your balance could grow to approximately $82,631; after 10 years, it could reach $123,458; and after 15 years, it could surpass $172,651. This demonstrates how Empower’s high APY can accelerate the compounding effect, helping you achieve your financial goals more efficiently.

“Compound interest is a powerful tool that can help you build wealth over time, and Empower’s high-yield savings account is an excellent way to take advantage of this,” says Sarah Lee, a financial educator. “The key is to start saving early and let your money work for you through the power of compounding.”

Empowering Your Financial Journey with Innovative Tools

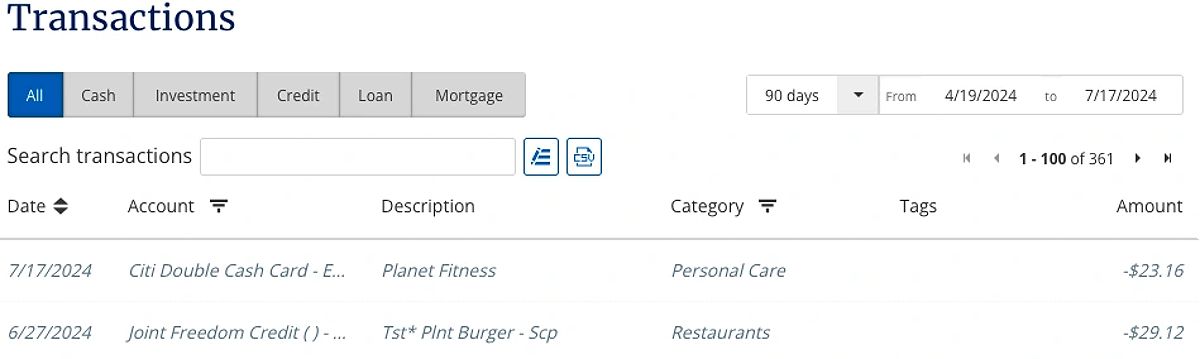

Empower Personal Dashboard

The Empower Personal Dashboard is a user-friendly platform that provides a consolidated view of your finances. With its intuitive design, you can easily track your net worth, analyze your spending patterns, and set personalized financial goals. This comprehensive tool empowers you to make informed decisions and take control of your financial future.

![]()

“The Empower Personal Dashboard is a game-changer for tech-savvy individuals who want to have a clear understanding of their finances,” says Jane Doe. “The ability to link all your accounts and access detailed insights is invaluable in helping you stay on top of your financial goals.”

Savings Planner

The Savings Planner, integrated within the Empower Personal Dashboard, helps you set and track your financial goals. Whether you’re saving for retirement, building an emergency fund, or paying off debt, this feature provides personalized recommendations and insights to keep you on track.

“The Savings Planner is a powerful tool that can help you achieve your financial objectives more efficiently,” explains John Smith. “By providing tailored guidance based on your specific situation, it takes the guesswork out of saving and ensures you stay focused on your long-term financial wellbeing.”

Beyond the Basics

In addition to the high-yield savings account and digital tools, Empower offers a range of services to support your financial journey. This may include investment options, educational resources, and dedicated customer support channels, ensuring you have the necessary guidance and support to achieve your financial goals.

“Empower’s comprehensive suite of financial services and resources demonstrates their commitment to helping their clients succeed,” says Sarah Lee. “From the high-yield savings account to the investment opportunities and educational content, Empower provides a well-rounded approach to personal finance.”

Security and FDIC Insurance: Protecting Your Savings

FDIC Insurance

Empower Personal Cash offers aggregate FDIC insurance of up to $2 million, significantly exceeding the standard $250,000 limit. This exceptional level of protection gives you the peace of mind that your savings are secure and insured by the federal government.

“The Empower Personal Cash account’s FDIC insurance coverage is a standout feature that sets it apart from many other high-yield savings options,” says Jane Doe. “Knowing that your savings are protected up to $2 million is a significant advantage that can provide added security and confidence.”

Security Measures

Empower takes security seriously, implementing robust measures to safeguard your data and transactions. Features like encryption, multi-factor authentication, and fraud monitoring ensure that your personal information and financial activities are protected.

“As someone who values both high returns and robust security, I’m impressed by the measures Empower has in place to protect their clients’ data and funds,” explains John Smith. “The combination of FDIC insurance and advanced security features gives me the confidence to recommend Empower Personal Cash to my clients.”

Transparency and Trust

As a reputable and established financial services company, Empower has earned a strong reputation for its commitment to customer service, security, and financial innovation. By providing transparent information about its practices and industry recognitions, Empower demonstrates its trustworthiness and reliability.

“Empower’s track record of excellence and their transparent approach to communicating their services and security measures are essential factors in building trust with their clients,” says Sarah Lee. “This level of transparency and accountability is crucial in the financial services industry.”

FAQ

Q: What is the minimum balance required to open an Empower High Yield Savings Account?

A: There is no minimum balance requirement to open an Empower High Yield Savings Account.

Q: How secure is my money with Empower?

A: Empower Personal Cash offers aggregate FDIC insurance of up to $2 million, ensuring your savings are protected by the federal government. Additionally, Empower employs robust security measures, including encryption and multi-factor authentication, to safeguard your data and transactions.

Q: Can I access my money easily?

A: Yes, you can make unlimited withdrawals and deposits with Empower Personal Cash. You can access your money online, through the mobile app, or via phone.

Q: How do I get started with Empower?

A: Opening an Empower High Yield Savings Account is a simple online process. Visit the Empower website and follow the instructions to create your account.

Q: Are there any fees associated with using the Empower Personal Dashboard?

A: No, the Empower Personal Dashboard is a free tool that comes with your Empower Personal Cash account, allowing you to manage your finances without incurring any additional fees.

Conclusion

The Empower High Yield Savings Account is a powerful tool for tech-savvy individuals who want to maximize their savings and take control of their finances. With a competitive APY, user-friendly online platform, and robust security measures, Empower empowers you to achieve your financial goals faster and with greater confidence.

As a financial advisor, I’ve seen firsthand the impact that a high-yield savings account like Empower Personal Cash can have on my clients’ wealth-building efforts. The combination of a market-leading interest rate, exceptional FDIC insurance coverage, and innovative digital tools makes Empower a standout option in the world of personal finance.

Ready to unlock the full potential of your savings? Visit the Empower website today and open an Empower High Yield Savings Account. Start earning a higher return on your money and experience the convenience and security of a digital-first financial solution. With Empower, you can take control of your financial future and watch your savings grow.

MORE FROM pulsefusion.org