A Comprehensive Look At The History Of 401(k) Contribution Limits: What Job Seekers Need To Know

The 401(k) plan has become a cornerstone of retirement planning for millions of Americans, but the contribution limits have not always been as generous as they are today. Understanding the evolution of these limits is essential for job seekers looking to maximize their retirement savings.

In this comprehensive guide, we’ll explore the history of 401(k) contribution limits, from the modest beginnings to the impressive heights reached in the 21st century. We’ll also delve into the importance of employer contributions and how to evaluate retirement benefits during the job search process. By the end, you’ll have a deeper understanding of how 401(k) plans have transformed and the steps you can take to secure a financially secure future.

The History of 401k Contribution Limits: A Timeline

The Early Days: A Modest Beginning (1978-1980s)

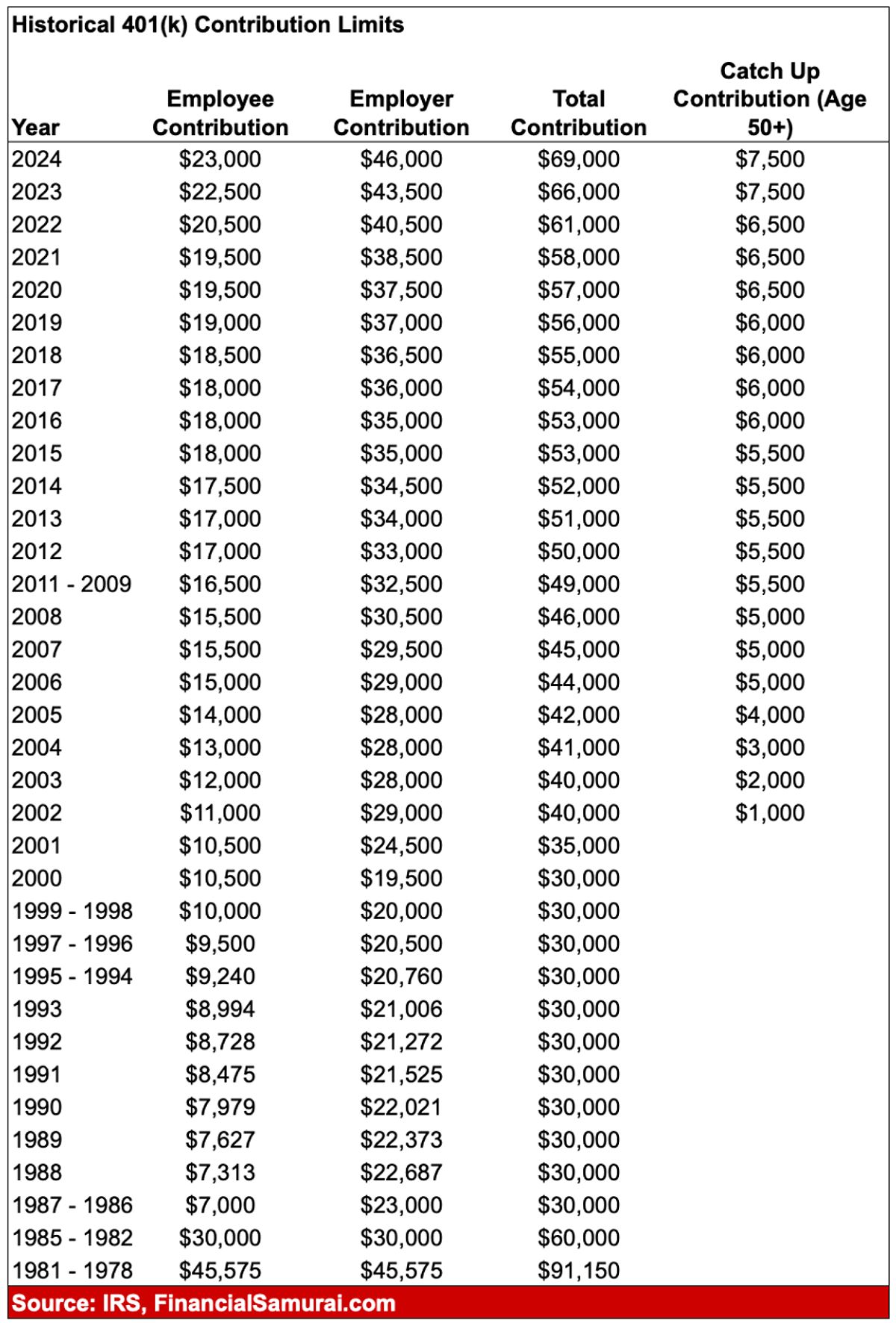

The 401(k) plan was introduced in 1978 as part of the Revenue Act, with an initial maximum contribution limit of just $2,000. This modest beginning reflected a time when traditional pension plans still dominated the retirement landscape, and the new 401(k) plans were met with some hesitation from both employers and employees.

“The early years saw limited adoption as traditional pension plans remained the norm,” explains [Financial Expert Name], a leading retirement planning consultant. “Many workers were simply unaware of the potential benefits of this new savings vehicle.”

The Rise of 401(k)s: Growing Popularity and Increasing Limits (1980s-1990s)

As the 1980s progressed, a shift occurred, with 401(k) plans gaining traction among employers and employees. This growing popularity prompted gradual increases in contribution limits, reflecting the rising importance of these plans in securing financial stability for retirees.

By the end of the 1980s, the maximum employee contribution limit had increased to $7,500, and this upward trend continued into the following decades. The Tax Reform Act of 1986 played a significant role in this evolution, introducing changes to the tax code that spurred further adoption of 401(k) plans.

The 21st Century: Reaching New Heights (2000s-Present)

The 21st century has witnessed substantial increases in 401(k) contribution limits, driven by a combination of economic growth and adjustments for inflation. As of 2024, the maximum employee contribution limit has reached an impressive $23,000, while employers can contribute up to $46,000, bringing the total potential contribution to $69,000.

“The shift from traditional pensions to 401(k) plans was a pivotal moment in the history of retirement planning,” says [Financial Expert Name]. “Employees now have greater responsibility for managing their own retirement funds, making it crucial to understand the contribution limits and take full advantage of these tax-advantaged savings vehicles.”

Understanding Employer Contributions: Beyond the Match

When evaluating retirement benefits, job seekers must consider not only their own contributions but also the potential employer contributions. This section explores the various types of employer contributions, emphasizing their value in enhancing overall retirement savings.

Matching Contributions: A Valuable Incentive

A common feature of many 401(k) plans is the matching contribution offered by employers. This arrangement means that for every dollar an employee contributes to their 401(k), the employer matches a certain percentage, up to a predetermined limit. The most prevalent matching contribution is 50 cents for every dollar contributed, capped at 6% of the employee’s salary.

These matching contributions can significantly boost your retirement savings. For instance, if you earn $60,000 and contribute 6% of your salary ($3,600), your employer would contribute an additional $1,800 if they provide a 50% match. Over time, these matching contributions can make a substantial difference in the growth of your retirement nest egg.

Profit Sharing: Sharing in Company Success

In addition to matching contributions, some employers offer profit-sharing plans, where a portion of the company’s profits is allocated to employee 401(k) accounts. These contributions can be considerable, often exceeding the typical matching percentages. Generous profit-sharing plans can be particularly advantageous for employees at established, profitable companies.

“Profit-sharing contributions can vary significantly from one company to another,” explains [Financial Expert Name]. “Some employers may contribute a fixed percentage of salary, while others base their contributions on overall company profitability. This can create a substantial boost to retirement savings, especially during periods of strong financial performance.”

Other Employer Contributions: Expanding Retirement Benefits

Employers may also offer additional types of contributions, such as Roth 401(k) options or contributions to health savings accounts (HSAs). A Roth 401(k) allows employees to contribute after-tax dollars, which can then grow tax-free. This option can be particularly appealing for younger employees who expect to be in a higher tax bracket in retirement.

By understanding the full spectrum of an employer’s retirement benefits, job seekers can make more informed decisions about which job offer aligns best with their long-term financial goals.

Evaluating Retirement Benefits in Your Job Search

When interviewing for a new job, it’s crucial to ask questions about the employer’s 401(k) plan and other retirement benefits. This can help you assess the overall value of the compensation package and ensure that you are making the best choice for your future.

Asking the Right Questions: Uncovering the Details

To gain clarity about the employer’s retirement offerings, consider asking the following key questions during the interview process:

- What is the employer’s matching contribution to the 401(k) plan?

- Does the employer offer a profit-sharing plan, and if so, how does it operate?

- What are the vesting schedules for employer contributions?

- What investment options are available within the 401(k) plan?

- Does the employer provide any additional retirement savings vehicles, such as a Roth 401(k) or an HSA?

These questions can provide valuable insight into the employer’s commitment to your financial well-being and help you compare the retirement benefits offered by different employers.

Comparing Retirement Benefits: Making Informed Choices

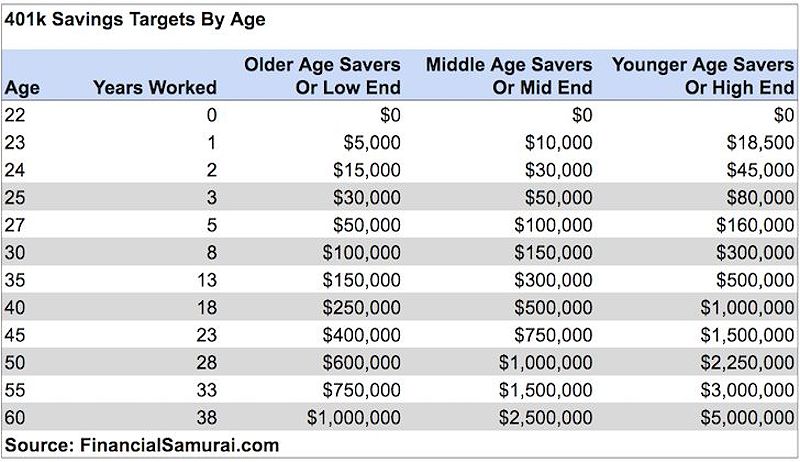

When evaluating job offers, it’s critical to compare the retirement benefits provided by different employers. Consider not only the contribution limits but also the overall value of the plan. A job that offers a slightly lower salary but includes a robust retirement plan with generous employer contributions may ultimately be more beneficial in the long run.

Remember to also consider the vesting schedules for employer contributions. Some companies require employees to remain with the company for a certain number of years before they are entitled to the employer’s contributions. Understanding these timelines can help you assess the true value of the retirement benefits being offered.

The Importance of a Comprehensive Retirement Strategy

While the 401(k) is a critical component of a robust retirement plan, it should not be the only consideration. A comprehensive approach to retirement planning involves several other elements that contribute to long-term financial security.

Other Retirement Savings Options: Diversifying Your Portfolio

In addition to a 401(k), contributing to traditional or Roth IRAs can supplement your retirement savings. IRAs offer additional tax advantages and flexibility, allowing you to diversify your retirement portfolio. Traditional IRAs provide tax-deferred growth, while Roth IRAs allow for tax-free withdrawals in retirement.

Beyond Retirement Savings: A Holistic Approach to Financial Planning

Effective financial planning extends beyond retirement savings. It encompasses budgeting, debt management, and investing. A comprehensive retirement strategy requires a holistic view of your financial situation, enabling you to make informed decisions that align with your goals.

Seeking Professional Advice

If the complexities of retirement planning feel overwhelming, consider consulting with a financial advisor. They can provide personalized guidance based on your unique financial situation and help you develop a comprehensive retirement strategy that aligns with your goals.

The Importance of Ongoing Education

As the financial landscape continues to evolve, staying informed about changes to retirement plans, tax laws, and investment options is essential. Regularly educating yourself on these topics empowers you to make informed decisions about your retirement savings and investments.

FAQ

What is the difference between a 401(k) and a 403(b)?

A 401(k) plan is typically offered by private companies, while a 403(b) plan is designed for non-profit organizations, schools, and government agencies. Both plans provide tax-advantaged retirement savings, but they have different eligibility requirements and contribution limits.

How can I find out if a company offers profit sharing?

To determine if a potential employer provides profit-sharing, research the company online, review their website, or contact their HR department. Details about profit-sharing plans may also be included in job descriptions or company benefits packages.

Should I prioritize a high salary or a generous 401(k) plan?

Consider the long-term value of a robust retirement plan in comparison to other factors, such as salary and career growth potential. A generous 401(k) plan can significantly enhance your retirement savings over time, making it a critical consideration in your job search.

Conclusion

Understanding the evolution of 401(k) contribution limits and the value of employer contributions is crucial for job seekers aiming to secure their financial future. By taking the time to evaluate retirement benefits during the job search process, you can prioritize employers who offer strong retirement plans and make informed decisions about your long-term financial well-being.

Remember, your retirement planning starts today. By taking advantage of the benefits offered by your employer and developing a comprehensive retirement strategy, you can pave the way for a brighter financial future. Stay informed, stay proactive, and take control of your retirement savings.

MORE FROM pulsefusion.org