History Of Roth Ira Contribution Limits: Understanding The Evolution

As a young professional starting your career, you’re likely exploring various options to secure your financial future. One retirement savings strategy that has gained popularity in recent years is the Roth IRA. Understanding the history of Roth IRA contribution limits can help you make informed decisions and maximize your retirement savings potential.

A Brief History of Roth IRA Contribution Limits

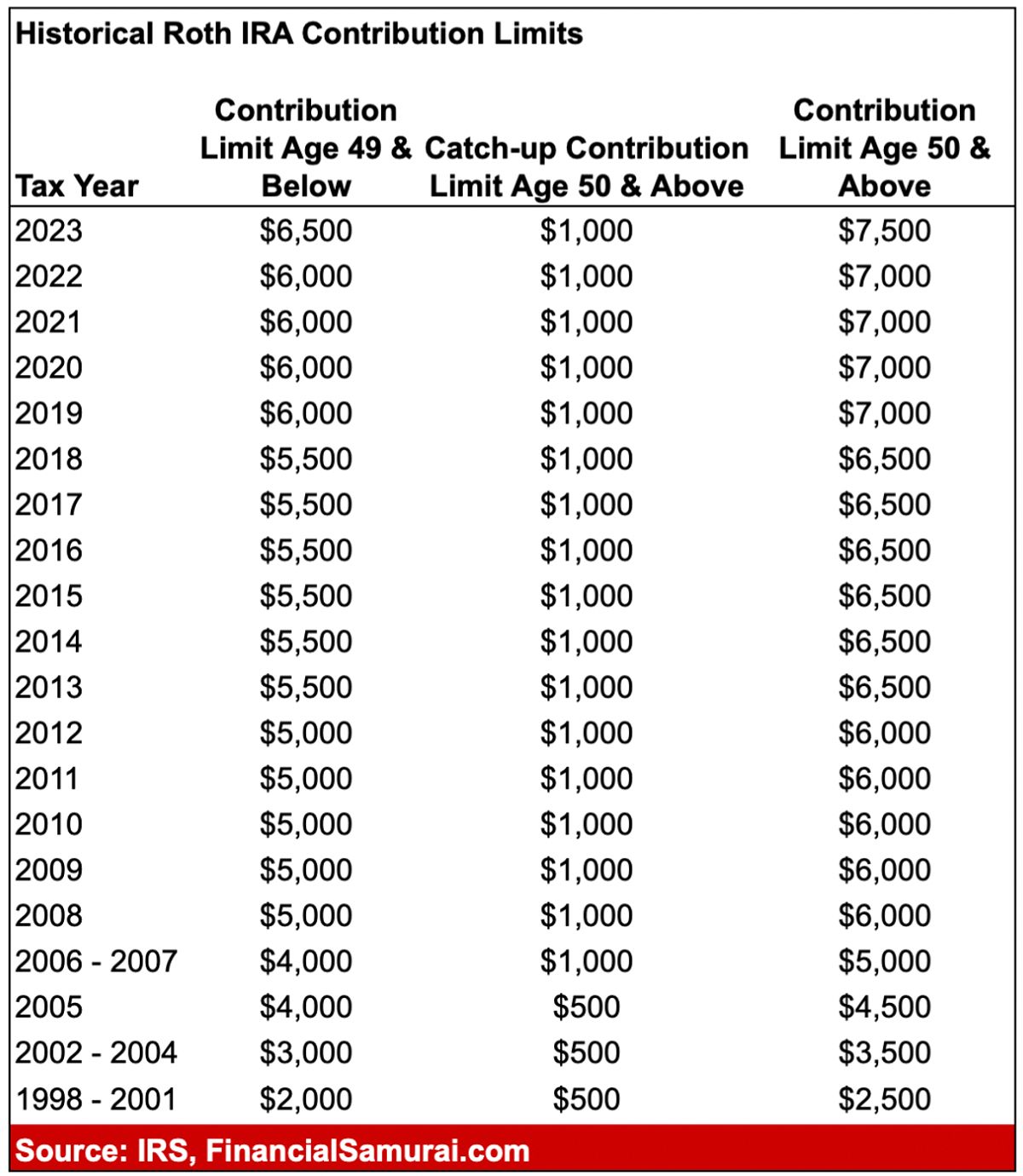

The Roth IRA was introduced in 1997 with an initial contribution limit of $2,000. Over the years, this limit has steadily increased to keep pace with inflation and encourage more individuals to save for their golden years.

The Early Years (1997-2007)

In the early days of the Roth IRA, the contribution limit remained at $2,000 until 2001, when it was raised to $3,000. The limit continued to increase, reaching $4,000 in 2005 and $5,000 in 2008. These gradual adjustments reflected the need to make Roth IRAs more accessible and attractive for retirement savers.

The Impact of the Financial Crisis (2008-2012)

The financial crisis of 2008 underscored the importance of having a robust retirement savings strategy. In response, the contribution limit for Roth IRAs was increased to $5,000 in 2008, and then to $5,500 in 2013. This represented a significant 175% increase from the initial $2,000 limit, demonstrating the government’s commitment to empowering individuals to take control of their financial future.

Recent Trends and Adjustments (2013-Present)

The upward trend in Roth IRA contribution limits has continued in recent years. In 2020, the limit was raised to $6,000, and in 2023, it reached $6,500 for individuals under the age of 50. These periodic adjustments reflect the ongoing efforts of the IRS to ensure that Roth IRAs remain a viable option for retirement savings, particularly in the face of rising living costs and economic fluctuations.

Understanding Roth IRA Contribution Limits for Young Professionals

Roth IRAs offer unique benefits that make them an attractive option for young professionals, particularly those in lower tax brackets. By understanding the intricacies of Roth IRA contribution limits, you can maximize your retirement savings and take advantage of the tax-free growth and withdrawals.

The Basics of Roth IRA Contributions

One of the key advantages of Roth IRAs is the ability to make contributions with after-tax dollars. This means that while you won’t receive an upfront tax deduction, your investments can grow tax-free, and withdrawals in retirement are entirely tax-free. This can be particularly beneficial for young professionals who are in a lower tax bracket, as they can lock in their current tax rate and enjoy the compounding effects of tax-free growth over the long term.

Annual Contribution Limits and Catch-Up Contributions

As of 2023, the annual Roth IRA contribution limit for individuals under the age of 50 is $6,500. This represents a significant increase from the initial $2,000 limit in 1997, reflecting the government’s efforts to encourage more individuals to save for retirement.

For those aged 50 and older, the “catch-up” provision allows for an additional $1,000 contribution, bringing the total annual limit to $7,500. This is particularly important for young professionals who may have started saving for retirement later in their careers and need to make up for lost time.

Income Limits and Eligibility

While Roth IRAs offer substantial benefits, they do come with income limits that can affect your eligibility to contribute. The IRS uses Modified Adjusted Gross Income (MAGI) to determine these limits.

In 2024, the MAGI limit for a full Roth IRA contribution is $146,000 for single filers and $230,000 for married couples filing jointly. The phase-out range extends from $146,000 to $161,000 for single filers and $230,000 to $240,000 for married couples filing jointly.

If your MAGI exceeds these limits, you may still be able to contribute to a Roth IRA through alternative strategies, such as a “backdoor Roth IRA” conversion. It’s essential to understand these income limits and explore all options to ensure you can maximize your retirement savings.

Strategies for Maximizing Your Roth IRA Contributions

As a young professional, making the most of your Roth IRA contributions can have a significant impact on your long-term financial well-being. Here are some practical strategies to help you achieve your retirement savings goals:

Budget and Prioritize

Incorporating Roth IRA contributions into your monthly budget is crucial. Treat these contributions as a fixed expense, just like your rent or utilities. This will help you maintain discipline and ensure that your retirement savings remain a top priority.

Automate Contributions

Setting up automatic transfers from your checking account to your Roth IRA can make the process seamless and hassle-free. Many financial institutions offer this feature, allowing you to consistently contribute without the need for manual transfers.

Increase Contributions with Income Growth

As your income grows over time, consider incrementally increasing your Roth IRA contributions. This proactive approach will allow you to maximize the available limits and significantly boost your retirement savings.

Utilize Catch-Up Contributions (If Applicable)

If you’re 50 or older, don’t overlook the catch-up contribution option. This additional $1,000 contribution can provide a substantial boost to your retirement savings, especially as you approach your golden years.

Choosing the Right Investments for Your Roth IRA

Roth IRAs offer a wide range of investment options, allowing you to tailor your portfolio to your specific goals and risk tolerance. Here are some key considerations when selecting investments for your Roth IRA:

Diversification

To mitigate risk, it’s crucial to build a diversified portfolio. Consider spreading your investments across different asset classes, such as stocks, bonds, mutual funds, and exchange-traded funds (ETFs). This approach can help you achieve more stable returns over time.

Risk Tolerance

Assess your comfort level with risk before making investment decisions. As a young professional, you may have a higher risk tolerance, allowing you to allocate a larger portion of your portfolio to growth-oriented investments. However, it’s essential to find the right balance based on your financial goals and time horizon.

Research and Education

Take the time to research potential investments and understand their fundamentals. Utilize resources such as financial news, investment analysis tools, and educational platforms to enhance your knowledge and make informed decisions.

Consult Financial Advisors

If you’re unsure about your investment choices, consider seeking guidance from a financial advisor. They can provide personalized recommendations based on your specific circumstances and help you develop a comprehensive retirement savings strategy.

Rebalance Your Portfolio

Regularly review and rebalance your Roth IRA portfolio to ensure it aligns with your investment goals and risk tolerance. Market fluctuations can cause your asset allocation to drift, so periodic adjustments are crucial to maintaining your desired balance.

FAQ

Q: Can I contribute to a Roth IRA if I’m already contributing to a 401(k)?

A: Yes, you can contribute to both a Roth IRA and a 401(k) as long as you meet the income requirements for each.

Q: What happens if I exceed the income limit for a Roth IRA?

A: If your income exceeds the limit, you may not be able to contribute directly to a Roth IRA. However, you can explore alternative strategies, such as a “backdoor Roth IRA” conversion, to still take advantage of the tax benefits.

Q: Can I withdraw my contributions from a Roth IRA before age 59 1/2?

A: Yes, you can withdraw your Roth IRA contributions at any time, tax-free and penalty-free. This can be particularly useful for unexpected expenses or emergencies.

Conclusion

The history of Roth IRA contribution limits highlights the ongoing efforts to make retirement savings more accessible and attractive for young professionals. By understanding these limits and incorporating Roth IRAs into your overall financial strategy, you can unlock the power of tax-free growth and withdrawals, setting yourself up for a more secure financial future.

Remember, the key is to start early, maximize your contributions, and choose investment options that align with your goals and risk tolerance. With discipline and a long-term mindset, your Roth IRA can become a powerful tool in your journey towards a comfortable retirement.

So, what are you waiting for? Dive into the world of Roth IRAs and start building your retirement savings today!

This text was generated using a large language model, and select text has been reviewed and moderated for purposes such as readability.

MORE FROM pulsefusion.org