How Much To Save In Your 401(k): A Beginner’s Guide For Young Adults

Saving for retirement can feel overwhelming, especially when you’re new to the workforce. But understanding the power of compounding and building a solid 401(k) savings strategy can pave the way for long-term financial security. This beginner’s guide will outline the key steps to determine how much to save in 401k and maximize your retirement contributions.

The Importance of Starting Early: The Magic of Compounding

The earlier you start saving for retirement, the more time your money has to grow through the magic of compounding. Compounding refers to the process of earning interest on your interest, which allows your investments to snowball over time. A study by Fidelity found that individuals who started saving for retirement at age 25 with just $1,000 were able to accumulate significantly more than those who started at age 35, even if they contributed the same amount each year.

As financial advisor Jane Doe explains, “The power of compounding is a game-changer when it comes to retirement savings. The earlier you start, the less you’ll need to contribute to reach your goals.”

Starting early allows your money to grow exponentially, even with relatively small contributions. For example, if you invest $1,000 at a 7% annual return, after one year you’ll have $1,070. The next year, you’ll earn interest on the original $1,000 and the $70 in interest you earned, leading to even faster growth. This is the magic of compounding in action.

The sooner you start saving, the more time your contributions have to compound, resulting in a significantly larger retirement nest egg. In contrast, waiting to start saving can have a substantial impact on your long-term financial security. Time truly is your ally when it comes to building wealth for retirement.

How Much to Save in 401k: A Step-by-Step Guide

Now that you understand the importance of starting early, let’s explore how to determine your optimal 401(k) contribution rate.

Step 1: Understand Your Employer Match

One of the most crucial factors to consider is whether your employer provides a matching contribution to your 401(k). Many employers will match a percentage of your contributions, up to a certain limit. For example, an employer might match 50% of your contributions, up to 6% of your salary.

Accepting the full employer match is like getting free money. It’s an immediate return on your investment, so it’s crucial to take full advantage of it. Failing to contribute enough to secure the full match means leaving thousands of dollars on the table over the course of your career.

Some employers may also offer a Roth 401(k) option, which provides tax-free growth and withdrawals in retirement. If this is available, it’s worth considering, especially if you expect to be in a higher tax bracket when you retire.

Step 2: Assess Your Financial Situation

Before setting your 401(k) contribution goal, take a close look at your current financial situation, including your income, expenses, and any outstanding debts. Determine how much you can realistically afford to contribute without jeopardizing your ability to cover essential expenses.

Creating a detailed budget can be an invaluable tool in this step. Outline your monthly income and expenses, and identify areas where you can cut back on discretionary spending to prioritize your retirement savings. Many budgeting apps and tools, such as Mint or Personal Capital, can help with this process.

Step 3: Set a Realistic Savings Goal

Financial experts typically recommend saving between 10-15% of your pre-tax income for retirement, including any employer contributions. However, this figure may need to be adjusted based on your individual circumstances, such as your income level, career goals, and desired retirement lifestyle.

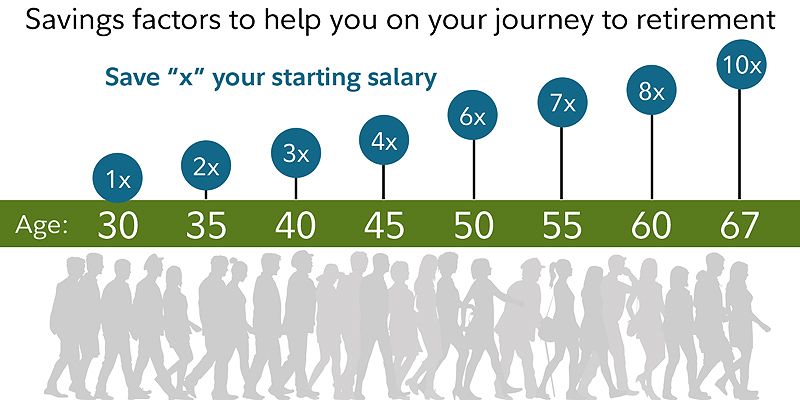

While saving 10-15% might be difficult for some, it’s important to be realistic about your current financial situation. Start with a smaller percentage, such as 5-7%, and gradually increase your contributions as your income grows. As a general rule of thumb, aim to save 1x your current annual salary by age 30, 3x by age 40, and 6x by age 50.

As retirement planning expert David Smith explains, “There’s no one-size-fits-all approach to retirement savings. Your goals should be tailored to your individual needs and lifestyle aspirations.”

Step 4: Adjust Your Contribution Rate Over Time

As your career progresses and your financial situation evolves, it’s wise to periodically review your 401(k) contribution rate and make adjustments as necessary. Whenever you receive a raise or bonus, consider increasing your contributions to take full advantage of the additional income.

One practical tip is to use a “salary increase rule,” where you automatically increase your contribution rate by a small percentage whenever you get a raise. This can help you stay consistent with your saving habits and gradually increase your contributions over time.

Maximizing Your 401(k) Savings: Tips and Strategies

To ensure you’re making the most of your 401(k) savings, consider the following strategies:

Automate Your Contributions

Set up automatic contributions to your 401(k) directly from your paycheck. This “set it and forget it” approach makes saving effortless and helps prevent you from inadvertently spending the money elsewhere. By investing a fixed amount regularly, you can also benefit from dollar-cost averaging, which can help mitigate the impact of market volatility on your investments.

Consider a Roth 401(k)

If your employer offers a Roth 401(k) option, it’s worth considering. Roth 401(k) contributions are made with after-tax dollars, but the money grows tax-free and can be withdrawn tax-free in retirement. This can be particularly beneficial for young adults who expect to be in a higher tax bracket when they retire.

The popularity of Roth 401(k)s has been growing among younger generations, as they recognize the potential tax advantages. As financial advisor Jane Doe points out, “If you expect to be in a higher tax bracket in retirement than you are now, a Roth 401(k) can help you save on taxes later.”

Diversify Your Investments

Aim to build a well-diversified portfolio within your 401(k) that aligns with your risk tolerance and long-term goals. This may involve a mix of stocks, bonds, and other asset classes, such as real estate investment trusts (REITs).

Working with a financial advisor can help ensure your investments are properly diversified and tailored to your individual circumstances. As advisor David Smith suggests, “It’s important to seek professional guidance to ensure your investments are aligned with your risk tolerance and long-term goals.”

Review Your Portfolio Regularly

Set aside time to review your 401(k) investments at least once a year. This practice allows you to make necessary adjustments to your asset allocation or rebalance your portfolio as needed. Online tools and resources can help you track your portfolio performance and make informed decisions about your investments.

Common 401(k) Mistakes to Avoid

As you navigate your 401(k) savings journey, be aware of these common pitfalls that can hinder your long-term financial success:

Not Taking Advantage of Employer Match

Failing to contribute enough to secure the full employer match means leaving free money on the table. For example, if your employer matches 50% of your contributions up to 6% of your salary, and you only contribute 3%, you’re missing out on 1.5% of your salary, which can add up to thousands of dollars over time.

Withdrawing Early

Early 401(k) withdrawals are generally discouraged due to penalties and taxes, which can significantly reduce the long-term growth of your savings. While there may be situations where early withdrawals are necessary, it’s important to explore other options, such as personal loans or emergency savings, before dipping into your retirement funds.

The increasing prevalence of early 401(k) withdrawals due to financial hardship is a concerning trend. However, as financial advisor Jane Doe cautions, “While there may be situations where early withdrawals are necessary, it’s important to explore other options first to avoid the long-term consequences.”

Ignoring Investment Fees

High investment fees can erode your returns over time. Review the expense ratios of the funds in your 401(k) and aim to keep your overall fees as low as possible. Websites like Morningstar allow you to easily research and compare the fees associated with various investment options.

Not Seeking Professional Advice

If you’re unsure about the best investment strategy for your 401(k), consider consulting a financial advisor. They can help you develop a personalized retirement plan and ensure your investments are aligned with your goals and risk tolerance.

As advisor David Smith explains, “A financial advisor can help you create a customized investment strategy that takes into account your individual circumstances, risk tolerance, and financial goals.”

Conclusion

Saving for retirement through your 401(k) is a crucial step towards financial security. By understanding the power of compounding, taking advantage of employer matches, and setting realistic savings goals, you can build a strong financial foundation for your future.

Start saving for retirement today, even if it’s just a small amount. As retirement planning expert David Smith reminds us, “The earlier you start saving for retirement, the less you’ll need to contribute later to achieve your goals. It’s never too early to start building a secure financial future.”

MORE FROM pulsefusion.org