Utah homeowners may be surprised to learn that a significant number of property tax appeals in the state are successful. In fact, about 60% of property owners who appeal their assessments end up with a lower tax bill. This highlights the importance of understanding the appeals process and exercising your rights as a property owner. This comprehensive guide will equip you with the knowledge and tools to effectively how to fight property taxes in Utah.

Understanding Your Property Tax Assessment in Utah

How Property Taxes Work in Utah

In Utah, property taxes are primarily based on the assessed value of your property, which is determined by the county assessor. Your property tax bill is calculated by multiplying the assessed value by the local tax rate, set by various local governments.

- Assessed Value: This is the value assigned to your property by the assessor, which serves as the basis for your tax bill. In Utah, the assessed value is typically 55% of the property’s fair market value.

- Tax Rate: This percentage is applied to your assessed value to determine the amount of tax owed. Local governments in Utah set the tax rate, which can vary significantly from one area to another.

- Calculation: To calculate your property tax bill, simply multiply your assessed value by the tax rate: Assessed Value x Tax Rate = Your Property Tax Bill. For example, if your property is assessed at $300,000 and the tax rate is 1.2%, your tax bill would be $3,600.

Factors Influencing Your Assessment

Several key factors are considered when your property is assessed in Utah:

- Recent Comparable Sales: The sales prices of similar properties in your area are used to determine your home’s market value. Assessors look at homes with comparable characteristics, such as size, location, and condition.

- Property Condition: The overall condition of your property, including any renovations or maintenance, can impact its assessed value. Upgrades and improvements can increase your assessed value, while neglect or damage can decrease it.

- Market Conditions: Economic factors and local real estate trends are also taken into account during the assessment process. If the market is strong, property values may be assessed higher, while a downturn can lead to lower assessments.

Decoding Your Assessment Notice

When you receive your annual property assessment notice, it’s important to review it carefully for accuracy. Here are some key things to check:

- Property Details: Ensure that the square footage, number of bedrooms, bathrooms, and other features are correctly represented. Any discrepancies could lead to an inaccurate assessment.

- Assessed Value: Compare your assessed value to similar properties in your neighborhood to determine if you may be overvalued. Websites like Zillow or Realtor.com can help you find comparable properties and their assessed values.

- Appeal Deadline: Make note of the deadline for filing an appeal, which is typically 45 days from the date you receive your assessment notice. Missing this deadline can forfeit your right to appeal for that tax year.

Determining How to Fight Property Taxes if You Have Grounds for an Appeal

If you believe your property has been overvalued, you may have valid grounds to appeal your assessment. Here are some common reasons for appealing:

Common Reasons for Appealing

- Overvaluation: If your property’s assessed value is significantly higher than that of comparable properties, you may have a case for appeal. Gather evidence of recent sales of similar homes to support your claim.

- Assessment Errors: Errors in the assessment, such as incorrect square footage or misrepresented features, can be grounds for an appeal. Document any discrepancies you find in the assessment notice.

- Property Changes: If renovations or damage to your property have not been accounted for in the assessment, you may be eligible to appeal for a reassessment. For example, if you made significant improvements that increased your property’s value but were not reflected in the assessment, this could be a strong point in your favor.

Gathering Evidence

To strengthen your appeal, you’ll need to collect compelling evidence. Here are some key pieces of information to gather:

- Comparable Sales Data: Research recent sales of similar properties in your area to demonstrate your property’s true market value. Look for homes that are similar in size, age, and condition to your own.

- Property Appraisals: Consider obtaining a professional appraisal to provide an expert valuation of your property. An independent appraiser can offer an unbiased opinion that may support your case.

- Documentation of Property Changes: Keep records of any renovations or damages, including receipts, permits, or contractor agreements, to support your claim. This documentation can serve as evidence that your property’s assessed value should be adjusted.

The Utah Property Tax Appeal Process

Once you’ve determined that you have grounds for an appeal, it’s essential to understand the steps involved in the process:

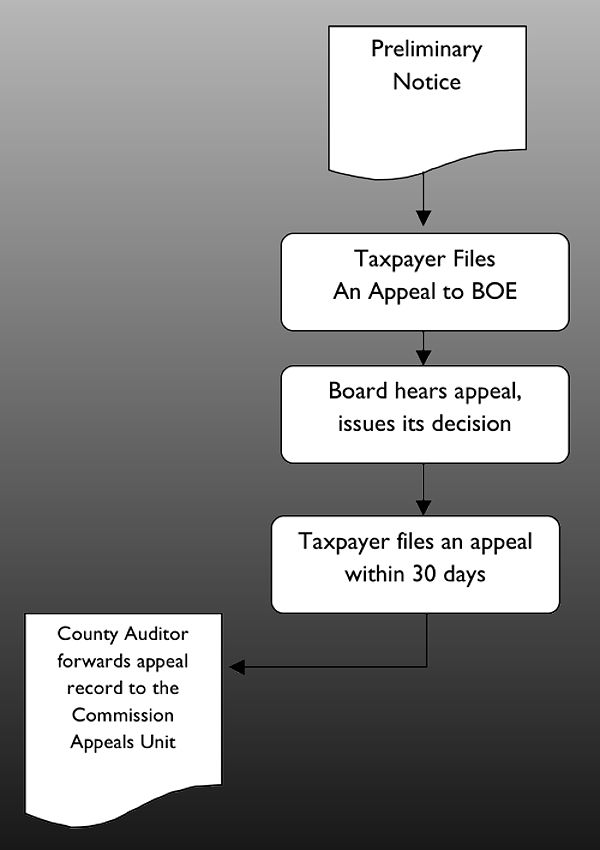

Filing an Appeal

The first step is to file an appeal with the Utah State Tax Commission. Here’s what you need to know:

- Deadline: You typically have 45 days from the date you receive your assessment notice to file your appeal. Mark your calendar to ensure you don’t miss this critical deadline.

- Appeal Form: Obtain the necessary appeal form from the Tax Commission’s website or your local county assessor’s office. Many counties offer online submission options, making the process more convenient.

- Supporting Documentation: Be sure to include all relevant evidence to support your case when submitting your appeal, such as your comparable sales data, appraisal, and documentation of property changes.

Hearing Before the Tax Commission

After filing your appeal, it will be reviewed by the Utah State Tax Commission. Here’s what to expect:

- Review: The Tax Commission will review your appeal and schedule a hearing for you to present your case. You will receive a notice with the date and time of the hearing.

- Presentation: During the hearing, present your evidence and arguments clearly and concisely. Prepare a brief presentation outlining your key points and be ready to answer any questions the Commission may have.

- Decision: After the hearing, the Tax Commission will issue a decision regarding your appeal. You will be notified of their decision in writing, which will outline whether your appeal was successful or denied.

Appealing to the Utah State Tax Court

If you’re not satisfied with the Tax Commission’s decision, you have the option to appeal to the Utah State Tax Court. This step involves more complexity:

- Option: You can appeal if you disagree with the Tax Commission’s decision. The appeal must be filed within a specified time frame, usually 30 days from the date you receive the Commission’s decision.

- Process: This will typically require legal proceedings and may necessitate hiring a property tax attorney to represent you effectively. An attorney can help navigate the legal complexities and present your case in the most favorable light.

Tips for a Successful Property Tax Appeal in Utah

To maximize your chances of success in your property tax appeal, consider the following strategies:

Research Comparable Properties

One of the most critical aspects of your appeal is providing data on recent sales of similar properties in your area. Utilize online resources such as Zillow or Realtor.com to gather this information. Work with real estate professionals to ensure you have accurate and relevant data. The stronger your evidence, the better your chances of a favorable outcome.

Seek Professional Assistance

Hiring a property tax attorney or professional appraiser can significantly improve your chances of success. Their expertise and experience can help you navigate the appeals process and present your case effectively. While this may involve upfront costs, the potential savings on your property tax bill can far outweigh the initial investment. Many homeowners find that the guidance of a professional leads to more substantial reductions than they could achieve on their own.

Negotiate with the Assessor’s Office

Before proceeding to a formal hearing, consider reaching out to the assessor’s office to discuss your assessment. An informal negotiation can often lead to a resolution without the need for a lengthy appeals process. If you can present compelling evidence, they may be willing to adjust your assessment. This proactive approach can save you time and stress.

Persistence is Key

If your initial appeal is denied, don’t give up. You have the right to pursue further appeals, and many successful property tax appeals result from persistence and strategic follow-up. Stay committed to advocating for a fair assessment. Remember, the process may require patience, but staying engaged can lead to a favorable outcome.

Additional Considerations

Understanding the Importance of Timing

Timing plays a crucial role in your property tax appeal. Be sure to file your appeal promptly after receiving your assessment notice, as missing the deadline can forfeit your right to appeal for that tax year. Additionally, consider the timing of the real estate market when gathering evidence; if property values are increasing, this can strengthen your argument for a lower assessment. Staying informed about market trends can provide you with valuable insights that enhance your appeal.

Seeking Community Support

Consider reaching out to local homeowner associations or community groups that may offer resources and support for property tax appeals. Engaging with others who have navigated the process can provide you with valuable insights and strategies that improve your chances of success. Shared experiences and collective knowledge can be invaluable when fighting your property taxes.

FAQ

Q: What if I disagree with the Tax Commission’s decision?

A: If you’re not satisfied with the Tax Commission’s decision, you can appeal to the Utah State Tax Court. This process may involve additional legal fees, but it could lead to a more favorable outcome.

Q: How much can I expect to save by appealing my property taxes?

A: Savings vary based on individual circumstances, but successful appeals in Utah have led to reductions of hundreds or even thousands of dollars. Some homeowners have reported savings of up to 15% on their property tax bills.

Q: What if I don’t have the time or resources to handle the appeal process myself?

A: You can hire a property tax attorney or appraiser to assist with the appeals process, which can significantly enhance your chances of success. Many professionals offer free consultations, allowing you to gauge their potential effectiveness without a financial commitment.

Q: Is there a fee to file a property tax appeal in Utah?

A: There may be a nominal filing fee, but it is typically minimal compared to the potential savings from a successful appeal. Always check with your local assessor’s office for specific fee information.

Conclusion

As a Utah homeowner, understanding how to fight your property taxes is essential to ensuring you’re not overpaying. By reviewing your assessment notice, gathering evidence, and navigating the appeals process, you can potentially lower your tax burden.

Remember, the key is to be proactive, persistent, and, if necessary, seek professional assistance. With the right strategy and determination, you can advocate for a fair assessment and avoid paying more than your fair share.

Take the first step today by carefully reviewing your property tax assessment notice. Don’t hesitate to appeal if you believe your property has been overvalued. Your financial well-being depends on it.

Whether you decide to handle the appeal process yourself or enlist the help of a professional, the potential savings make it a worthwhile endeavor. With the information and tips provided in this guide, you’ll be well on your way to fighting for a more equitable property tax assessment in Utah.