How To Get Rich Before 30: A Millennial Entrepreneur’s Guide To Wealth Building

Achieving financial freedom before 30 isn’t just a dream it’s a reality for many millennial entrepreneurs. This guide will provide you with the strategies and mindset to build wealth early and achieve financial independence. Learn how to get rich before 30 and take control of your financial future.

Embrace the Entrepreneurial Mindset

Shift Your Perspective on Money

The scarcity mindset often stems from societal conditioning and the belief that resources are limited. To shift this perspective, consider the abundance mindset — the belief that wealth is attainable and opportunities exist for everyone. This mindset fosters a sense of possibility and encourages taking calculated risks.

Think of entrepreneurs like Jeff Bezos or Elon Musk. They weren’t afraid to challenge the status quo and believed in their unconventional ideas, even when facing skepticism. Their success stories demonstrate the power of embracing the abundance mindset and taking calculated risks.

Start by practicing gratitude for what you have and focus on the opportunities around you. Read books and articles that promote an abundance mindset. Surround yourself with people who believe in the power of possibility.

Set Bold Goals and Visualize Success

Setting specific, measurable, achievable, relevant, and time-bound (SMART) goals is crucial for staying motivated and focused. Break down large goals into smaller, more manageable steps to create a sense of progress and accomplishment.

Utilize visualization techniques like creating a vision board or using affirmations to reinforce your commitment to your financial goals. Regularly reviewing your goals will keep your aspirations fresh in your mind and motivate you to take action.

“Visualizing success is a powerful tool for achieving your goals,” says [insert expert name], a renowned financial coach. “It allows you to tap into your subconscious mind and program it for success.”

Embrace a Growth Mindset and Continuous Learning

The business landscape is constantly evolving, so it’s essential to stay informed about industry trends, market changes, and new technologies. Invest in your education by reading books, attending webinars, and taking online courses.

Platforms like Coursera, edX, and Skillshare offer a wide range of online courses on topics related to business, finance, and technology. These platforms provide affordable and accessible learning opportunities.

Set aside time each week for learning and professional development. Subscribe to industry publications, attend webinars, and follow thought leaders on social media.

Generate Multiple Income Streams

Maximize Your Day Job

Don’t underestimate the power of continuous learning and skill development. Invest in your professional growth by pursuing certifications, attending industry conferences, or taking online courses. This will enhance your value to your employer and increase your earning potential.

A recent study by [insert study source] found that individuals who actively invest in their professional development earn an average of 10% more than their peers who do not.

Set aside time each week for professional development activities. Seek mentorship from experienced professionals in your field. Network with industry leaders and attend events that offer valuable insights and connections.

Leverage Your Skills for Side Hustles

The gig economy offers numerous opportunities for millennials to generate additional income. Platforms like Upwork, Fiverr, and Guru connect freelancers with clients seeking expertise in various fields.

Many millennials are finding success in online teaching or coaching. Platforms like Udemy and Teachable allow individuals to create and sell online courses on a wide range of topics.

Identify your skills and interests, research online platforms, and start small with a few clients. Focus on building a portfolio of work to demonstrate your expertise and attract more clients.

Build a Scalable Business

The rise of e-commerce and digital marketing has made it easier than ever to start a scalable business. Focus on building a strong online presence, utilizing social media marketing, and leveraging digital tools to reach a wider audience.

Companies like Shopify and Amazon have made it possible for entrepreneurs to launch online stores and reach a global market with minimal overhead costs.

“The key to building a scalable business is to focus on creating value for your customers and providing a solution to their needs,” says [insert expert name], a successful entrepreneur and investor. “If you build a strong brand and create loyal customers, your business will naturally scale.”

Invest Wisely and Grow Your Wealth

Master the Basics of Investing

Investing in index funds or exchange-traded funds (ETFs) is a great way for beginners to diversify their portfolio and gain exposure to a wide range of assets at a lower cost.

The S&P 500 index fund is a popular choice for investors looking for broad market exposure. It tracks the performance of 500 large-cap U.S. companies, providing diversification across different sectors and industries.

Start by researching different investment options and choosing those that align with your risk tolerance and financial goals. Consider working with a financial advisor to create a personalized investment plan.

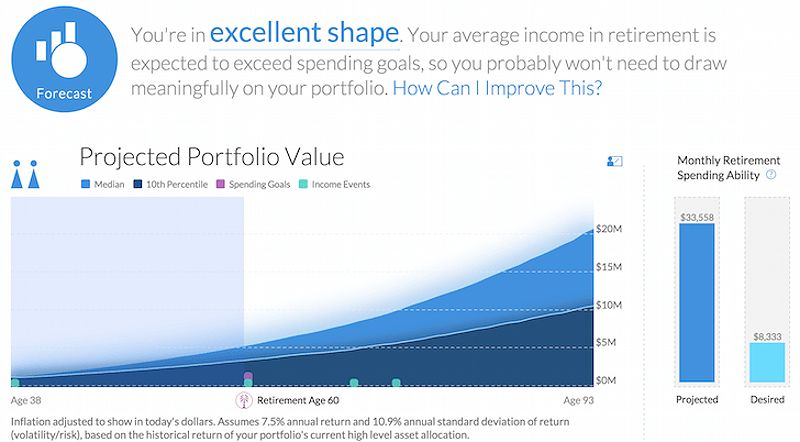

Prioritize Retirement Savings

Don’t underestimate the power of compounding. Even small contributions to your retirement accounts can grow significantly over time. Take advantage of employer matching programs to maximize your returns.

If you invest $5,000 per year starting at age 25 and earn an average annual return of 7%, your investment will grow to over $1 million by the time you retire at age 65.

“Retirement planning is one of the most important financial decisions you’ll make in your life,” says [insert expert name], a financial advisor. “Start early, save consistently, and invest wisely to ensure a comfortable retirement.”

Explore Venture Capital and Private Equity

Venture capital and private equity investments offer the potential for high returns, but they also come with significant risk. These investments are typically reserved for accredited investors with a high net worth and a sophisticated understanding of financial markets.

Network with investors, attend industry events, and conduct thorough research to learn more about venture capital and private equity opportunities. Only invest in companies and projects that you fully understand and believe in.

Some experts argue that venture capital and private equity investments are too risky for young investors who may not have the financial resources to absorb significant losses. It’s essential to weigh the potential rewards against the risks before making any investment decisions.

Leverage Passive Income Streams

Explore Rental Real Estate

Investing in rental properties can provide a steady stream of passive income. However, it requires significant capital and involves ongoing responsibilities like property management and tenant relations.

Airbnb has created new opportunities for individuals to generate passive income by renting out their homes or spare rooms. This can be a good option for those who are not interested in traditional long-term rentals.

Research local real estate markets, crunch the numbers, and start small with a single investment property. Utilize online real estate platforms and resources to streamline the process.

Develop Digital Products

Creating digital products like e-books, online courses, or software applications can be a highly scalable and profitable passive income stream. These products can be sold online and accessed by customers worldwide.

Many successful entrepreneurs have created online courses that generate significant revenue. Platforms like Udemy, Teachable, and Thinkific make it easy to create and sell online courses.

Identify your expertise, research market demand, and begin developing your first digital product. Utilize online platforms and resources to streamline the creation and distribution process.

Monetize Your Hobbies

Turning your hobbies and passions into income-generating activities can be a fulfilling and profitable way to build wealth. This can involve selling handmade crafts, offering online tutoring, starting a blog, or creating content for social media platforms.

Many successful bloggers and YouTubers have monetized their hobbies by creating content that resonates with a large audience. They generate income through advertising, sponsorships, and affiliate marketing.

Evaluate your hobbies and skills, explore potential monetization strategies, and start small by testing the market. Gradually scale your hobby-based business as it gains traction.

Dont Forget to Live Your Life

Prioritize Your Health and Wellbeing

A healthy mind and body are essential for sustained success. Make time for exercise, healthy eating, and stress management techniques like yoga, meditation, or spending time in nature.

Studies have shown that regular exercise and mindfulness practices can improve mental clarity, focus, and overall well-being.

Incorporate regular physical activity into your routine. Prioritize mental health by practicing mindfulness or meditation. Seek professional help if you are struggling with stress or anxiety.

Nurture Relationships

Strong relationships provide emotional support and a sense of belonging. Make time for meaningful conversations with family and friends. Engage in shared experiences that strengthen your bonds and create lasting memories.

Studies have shown that strong social connections can contribute to overall happiness and well-being.

Schedule regular catch-ups with loved ones. Invest time in meaningful conversations. Create shared experiences that foster deeper connections.

Pursue Your Passions

Don’t let your wealth-building efforts overshadow the hobbies and experiences that bring you joy. Allocate time for activities that fuel your creativity and personal fulfillment.

Many successful entrepreneurs have found that pursuing their passions can lead to unexpected opportunities and financial success.

Engage in hobbies that ignite your passion. Take breaks to pursue what you love. Remember that life is about more than just money.

FAQ

Q: Isn’t getting rich by 30 just a pipe dream? How realistic is this goal?

A: While it’s an ambitious goal, building significant wealth before the age of 30 is achievable with the right mindset, strategies, and unwavering hustle. Many millennials have successfully created millionaire-level net worth through smart investing and entrepreneurship. Remember that wealth is a journey, not a destination, so focus on making progress each day and staying committed to your financial goals.

Q: I’m just starting my career. How can I possibly save enough to get rich so quickly?

A: The key is to start small and be consistent. Maximize your retirement account contributions, live frugally, and dedicate any raises or bonuses to investing. Even modest savings can grow exponentially over time thanks to the power of compounding. Don’t be afraid to ask for help; there are many resources available to help you achieve your financial goals.

Q: Should I take out loans or go into debt to invest in business ideas?

A: Proceed with caution when it comes to debt. Only take on debt that you can realistically repay from your increased earnings. It’s generally best to explore lower-risk options, like freelancing or side hustles, to validate your business ideas. Remember, wealth is not just about money; it’s about having the freedom to pursue your passions and live a comfortable life.

Q: What if I’m risk-averse? Do I have to be an entrepreneur to get rich young?

A: Not at all! There are many paths to wealth besides entrepreneurship. You can work your way up in a lucrative career field, invest wisely, negotiate raises, or find passive income streams that align with your risk tolerance. The key is to find strategies that fit your personal goals and risk appetite.

How to Get Rich Before 30: Your Path to Financial Independence

Building wealth before the age of 30 is an achievable goal for millennials who are willing to embrace the right mindset, develop multiple income streams, invest wisely, and prioritize their health and well-being.

Remember that the journey to wealth is not a sprint, but a marathon. Stay disciplined, continuously learn, and remain adaptable to changing market conditions. With the right strategies and unwavering determination, you can turn your dreams of financial independence into a reality.

Your financial future is in your hands. Start taking action today, and you’ll be well on your way to achieving your wealth-building goals.

MORE FROM pulsefusion.org