How To Invest In Paper Assets: A Comprehensive Guide

Imagine a future where your investments generate passive income, allowing you to pursue your passions or enjoy a comfortable retirement. This comprehensive guide will equip you with the knowledge and strategies to turn that vision into reality, revealing how 60% of successful investors prioritize long-term growth and financial independence. This guide will explore how to invest in paper assets, providing insights into building a diversified portfolio that aligns with your financial goals.

Understanding the World of Paper Assets

Investing in paper assets is a crucial step towards building a diversified portfolio. Paper assets refer to intangible financial instruments that signify ownership or debt, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), options, and digital currencies.

What are Paper Assets?

Paper assets are distinct from tangible assets like real estate, as they exist in a digital format. This makes them easier to trade and store, but also susceptible to cyber threats and regulatory changes. Examples of paper assets include shares in a company, bonds issued by governments or corporations, and units in investment funds.

The Allure of Investing in Paper Assets

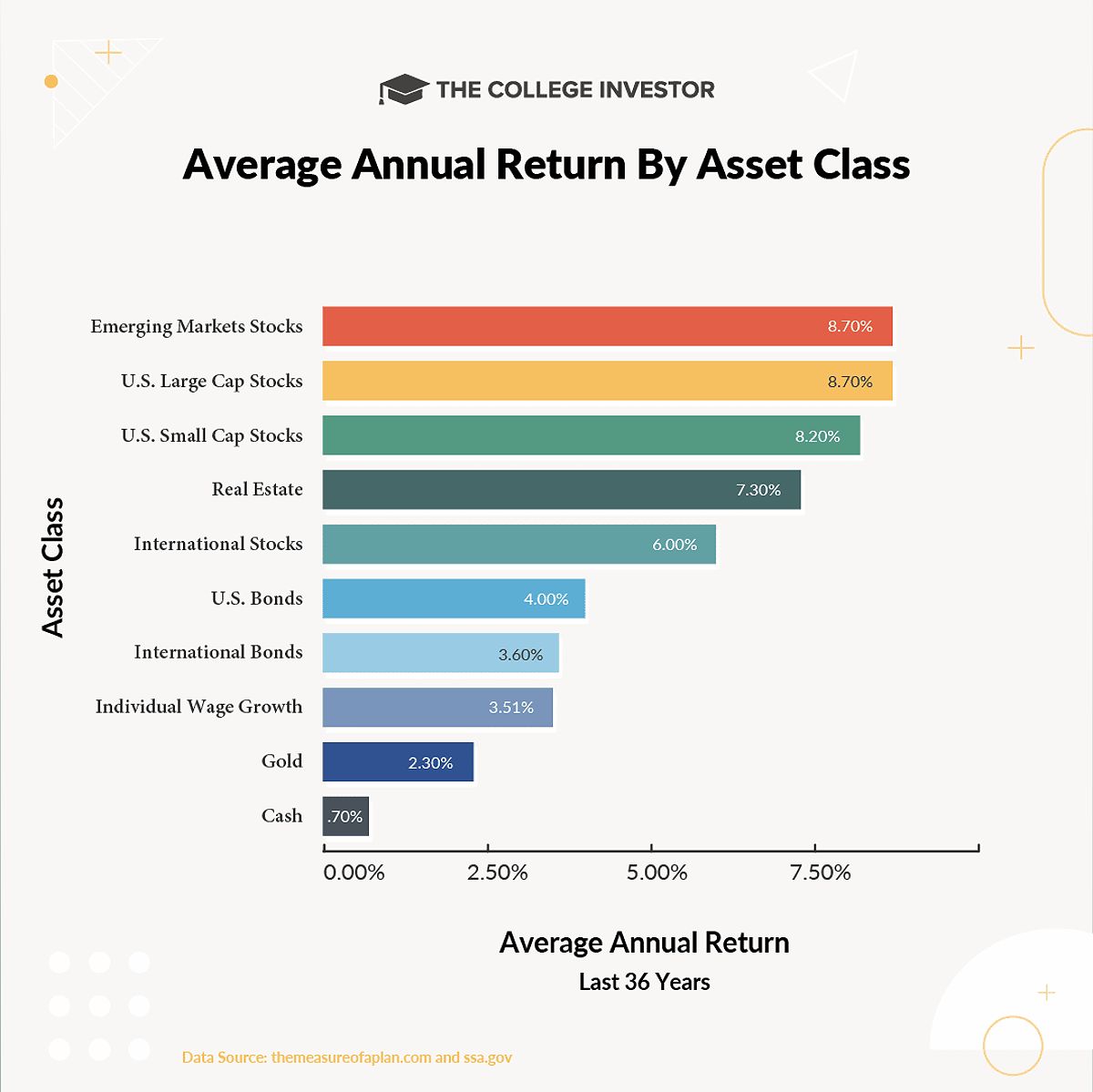

Paper assets offer significant growth potential, income generation, and liquidity. Historically, stocks have outperformed inflation, providing an average annual return of 9.2% over the past century. Bonds and dividend-paying stocks can yield regular income, making them attractive for income-focused investors. Additionally, the ease of buying and selling paper assets allows for flexibility in your investment strategy.

Navigating the Risks

While paper assets hold immense potential, they also come with inherent risks. Stock prices can fluctuate significantly due to various factors, and broader market downturns can adversely impact your investments. Inflation can also diminish the purchasing power of your returns. However, a well-structured approach and diversification can help manage these risks effectively.

Conducting Thorough Research

Before making any investment decisions, it’s crucial to delve into the details and understand the underlying factors. This section outlines the key steps to research and evaluate your investment options.

Analyzing Company Fundamentals

Examine a company’s financial performance, debt levels, and management team to gauge its overall health and stability. Metrics like revenue growth, profit margins, and return on equity can provide valuable insights. Assessing a company’s debt-to-equity ratio and interest coverage can also indicate its financial resilience.

Evaluating Industry Trends

Analyze the growth potential of the industry in which the company operates, the competitive landscape, and any regulatory environment that could impact its performance. This will help you identify promising investment opportunities and potential risks.

Choosing the Right Investment Options

Familiarize yourself with various types of stocks, bonds, mutual funds, and ETFs, understanding their unique characteristics. This will enable you to select investment options that align with your risk tolerance and financial goals.

Selecting the Ideal Investment Platform

The choice of investment platform is a critical step in your investment journey. Consider factors such as fees, investment options, research tools, and customer support to find a platform that meets your needs.

Exploring Investment Platform Options

Brokerage accounts, robo-advisors, and mutual fund companies offer distinct advantages and features. Understand the pros and cons of each option to determine the best fit for your investment approach.

Evaluating Platform Suitability

Thoroughly compare the costs associated with different platforms, ensure the availability of your desired investment options, and assess the quality of research and educational resources provided. Additionally, consider the level of customer support to ensure a seamless investing experience.

Constructing a Diversified Portfolio

Diversification is a fundamental principle of investing that can help manage risk and potentially improve long-term performance. Understand the importance of asset allocation and rebalancing to achieve your financial objectives.

The Power of Diversification

Diversification involves spreading your investments across various asset classes and sectors to reduce risk. A well-diversified portfolio can help cushion against the volatility of individual investments.

Crafting an Optimal Asset Allocation

Explore strategies like the classic 60/40 portfolio, age-based allocation, and risk tolerance-based allocation to create a portfolio that aligns with your financial goals and risk appetite.

Maintaining Balance Through Rebalancing

Regularly rebalancing your portfolio is essential to ensure your investments remain aligned with your desired asset allocation and financial objectives.

Resources for Continuous Learning on How to Invest in Paper Assets

Investing is a lifelong journey, and ongoing education is crucial for navigating the complexities of the financial markets. Explore a variety of resources to deepen your understanding of investing in paper assets.

Recommended Reading and Online Courses

Consider foundational texts like “The Intelligent Investor” by Benjamin Graham and “A Random Walk Down Wall Street” by Burton Malkiel. Supplement your learning with reputable financial websites and online courses focused on investing in paper assets.

Seeking Personalized Guidance

Consulting with a financial advisor can provide you with tailored advice and strategies based on your unique financial situation and goals.

Embracing the Investment Journey

Investing in paper assets can be a rewarding path to building wealth and securing your financial future. By understanding the fundamentals, conducting thorough research, selecting the right investment platform, and diversifying your portfolio, you can navigate the world of paper assets with confidence.

Remember, patience and discipline are key to successful investing. Start your journey today and take control of your financial destiny. With dedication and knowledge, you can turn your investment goals into reality.

MORE FROM pulsefusion.org