How To Pay Zero Taxes: A Legal Guide For High-income Earners

This comprehensive guide explores legal strategies high-income earners can use to minimize their tax liability, including offshore tax havens, investment optimization, and citizenship by investment programs. Learn how to pay zero taxes.

The Pursuit of Tax Freedom: Unlocking Strategies for High-Income Earners

It’s a widely held belief that paying taxes is a necessary burden, but what if you could legally reduce your tax liability to zero? This counterintuitive concept is gaining traction among high-income earners who are actively seeking loopholes and strategies to minimize their tax burden. While such tactics may seem like a dream, navigating the intricate legal landscape requires careful planning and expert guidance.

The quest to discover how to pay zero taxes is not just about avoiding taxes; it’s about strategic financial planning. Understanding the intricacies of tax laws and utilizing them to your advantage can lead to significant savings and wealth accumulation. This guide will delve into legal strategies that can empower you to keep more of your hard-earned income.

Advanced Strategies on How to Pay Zero Taxes for High-Income Earners

While traditional deductions and exemptions can provide some relief, high-income earners have access to more sophisticated tactics to reduce their tax obligations. From leveraging offshore tax havens to optimizing investment portfolios, these strategies can help you keep more of your hard-earned income.

Offshore Tax Havens: Safeguarding Your Wealth

Offshore tax havens, such as the Cayman Islands, Bermuda, and the British Virgin Islands, offer lower tax rates, greater privacy, and the potential for asset diversification. These jurisdictions have attracted trillions of dollars in wealth, with an estimated $32 trillion in assets held in tax havens globally. By carefully structuring your finances and investments, you can legally reduce your tax obligations while diversifying your portfolio.

The appeal of offshore tax havens lies in their tax advantages and privacy protections. Many high-net-worth individuals and corporations utilize these jurisdictions to safeguard their assets from political instability or unfavorable tax regimes in their home countries. However, it’s crucial to understand the risks associated with offshore tax havens. These include increased regulatory scrutiny, complex legal structures, and potential reputational damage.

To maximize the benefits of offshore tax havens, it is essential to engage with qualified tax attorneys and financial advisors. These professionals can help navigate the complexities of international tax law, ensuring compliance with all relevant regulations. They can also assist in creating a robust financial strategy that aligns with your goals while minimizing risks.

Investment Strategies for Tax Optimization

In addition to offshore tax havens, high-income earners can leverage various investment strategies to minimize their tax burden. Tax-efficient investments, such as real estate, private equity, and certain types of bonds, can provide opportunities for tax-free growth or lower tax rates on investment income.

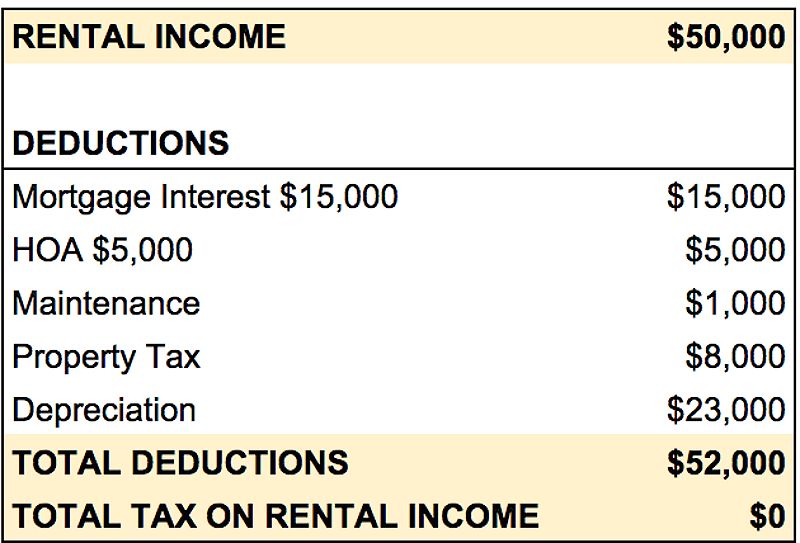

Investing in real estate, for example, allows you to take advantage of depreciation, a non-cash expense that can offset rental income. This can significantly reduce your taxable income while allowing your investment to appreciate in value over time. Additionally, the interest paid on mortgage loans can often be deducted from your taxable income, further reducing your overall tax liability.

Tax-advantaged accounts like 401(k)s, IRAs, and 529 college savings plans can also be powerful tools for high-income earners. These accounts allow you to contribute and grow your money with deferred or even tax-free withdrawals. By utilizing these tax-advantaged accounts, you can effectively lower your current taxable income while saving for retirement or education expenses.

Charitable giving is another effective strategy. By donating to qualified charitable organizations, you can reduce your taxable income while supporting causes you care about. This not only provides you with a sense of fulfillment but also helps you to create a positive impact in your community.

By working closely with financial advisors who specialize in tax-optimized investment strategies, you can build a diversified portfolio that generates returns while minimizing your tax liability. These professionals can help you identify tax-efficient investment vehicles and develop a personalized investment strategy that aligns with your financial goals.

The Ultimate Tax Freedom: Citizenship by Investment Programs

Beyond traditional tax minimization strategies, some high-income earners are turning to citizenship by investment (CBI) programs to achieve greater tax freedom. These programs offer a path to tax-friendly residency and citizenship in exchange for a qualifying investment in the host country.

CBI programs, often found in countries like Malta, Cyprus, and various Caribbean nations, typically require a significant investment in real estate, government bonds, or business ventures. In return, participants can obtain a second passport and potentially enjoy the benefits of low or even zero taxes on their global income, assets, and inheritance.

For instance, Caribbean island nations have become popular destinations for CBI due to their attractive tax incentives. Countries like St. Kitts and Nevis or Dominica offer citizenship in exchange for a real estate investment or a donation to a national development fund. These countries often have no capital gains tax, inheritance tax, or estate tax, making them particularly appealing for high-income earners looking to optimize their tax situations.

The process of obtaining citizenship through investment can be complex, with specific eligibility requirements and investment thresholds. It’s crucial to work with reputable immigration lawyers and financial advisors to ensure a smooth and successful application process. Understanding the nuances of each program, including potential changes in laws and regulations, can help you make informed decisions about your investments and citizenship options.

Beyond the Tax Haven: Diversifying Your Portfolio and Lifestyle

Successful tax minimization strategies often go hand-in-hand with a holistic approach to wealth management and lifestyle diversification. By spreading your assets and experiences across multiple countries, you can further reduce your tax exposure, mitigate risk, and unlock new opportunities.

Asset Allocation and Geographic Diversification

Geographic diversification involves holding assets in different jurisdictions, each with its own tax and regulatory environments. This strategy not only provides a safety net in case of political or economic instability in any one country but also allows you to take advantage of favorable tax regimes.

For example, consider investing in foreign real estate markets where tax rates are lower or where property taxes can be minimized. Additionally, investing in international stocks or funds can expose you to markets with more favorable tax treatment for capital gains and dividends.

Furthermore, asset allocation is key to effective portfolio management. By investing in a mix of assets, including real estate, stocks, bonds, and alternative investments, you can reduce risk and potentially increase your returns. This diversified approach can be particularly beneficial in times of economic uncertainty, as different asset classes often respond differently to market conditions.

Lifestyle Diversification

Lifestyle diversification encourages high-income earners to explore new experiences and opportunities in different parts of the world. This can include establishing a second residence, traveling more extensively, or even relocating to a more tax-friendly country.

Living in a country with lower living costs and tax rates can free up more of your income for investment and savings. Countries such as Portugal and Mexico have become popular among expatriates for their favorable tax regimes and affordable lifestyles. By spending more time in these jurisdictions, you can take advantage of their tax benefits while enjoying a higher quality of life.

Moreover, lifestyle diversification can lead to personal growth and expanded perspectives. Engaging with different cultures and communities can enhance your understanding of global markets and investment opportunities, ultimately benefiting your financial portfolio. It opens doors to new networks and potential business ventures, further enriching your financial journey.

The Importance of Professional Guidance

Navigating the complex world of tax minimization strategies requires the expertise of qualified professionals. Engaging with experienced tax attorneys, financial advisors, and immigration lawyers is essential to ensure compliance with all relevant laws and regulations while maximizing your tax savings.

Tax attorneys can provide invaluable guidance on the latest tax policies, investment opportunities, and citizenship by investment programs. Their expertise in international tax law can help you identify potential risks and ensure that your strategies are legally sound.

Financial advisors, on the other hand, can assist in developing an investment strategy that aligns with your financial goals. They can help you identify tax-efficient investment vehicles and create a diversified portfolio that minimizes tax exposure while maximizing returns.

It’s crucial to conduct thorough research, seek referrals from trusted sources, and carefully review all contracts and fees before engaging with any professional. The investment in professional guidance can pay dividends in the form of substantial tax savings and long-term financial security.

FAQ

Q: What is the difference between tax avoidance and tax evasion?

A: Tax avoidance is the legal use of strategies to reduce your tax liability, while tax evasion is the illegal act of deliberately hiding income or falsifying information to avoid paying taxes.

Q: Is it legal to pay zero taxes?

A: While it may not be possible for everyone to pay zero taxes, there are legal strategies that can significantly reduce your tax burden, potentially reaching zero in some cases.

Q: What are the risks associated with offshore tax havens?

A: Offshore tax havens can come with increased regulatory scrutiny, complex legal structures, and potential reputational risks. It’s essential to work with qualified professionals to navigate these challenges.

Q: How can I find a qualified tax professional?

A: Seek referrals from trusted sources, conduct thorough research, and carefully review all contracts and fees before engaging with any tax professional. Look for individuals or firms with expertise in international tax planning, asset protection, and citizenship by investment programs.

Q: Can charitable donations really help reduce my tax burden?

A: Yes, donating to qualified charitable organizations can provide tax deductions, thereby reducing your taxable income. It’s a way to support causes you care about while also benefiting financially.

Conclusion

As a high-income earner, you have the opportunity to explore advanced tax minimization strategies that can potentially reduce your tax liability to zero. By leveraging offshore tax havens, optimizing your investment portfolio, and even exploring citizenship by investment programs, you can keep more of your hard-earned wealth while diversifying your assets and lifestyle.

Remember, navigating these complex strategies requires the guidance of qualified professionals, so be sure to work closely with tax attorneys, financial advisors, and immigration lawyers to develop a personalized plan that aligns with your financial goals and risk tolerance. With the right approach, you can unlock a world of tax-free opportunities and build lasting wealth for yourself and your loved ones.

By taking proactive steps today, you can ensure a financially secure tomorrow, free from the burden of excessive taxation. The journey to learn how to pay zero taxes is not just about finding shortcuts; it’s about making informed decisions that pave the way for your financial future. Embrace the possibilities that lie ahead, and take control of your financial destiny with confidence.

MORE FROM pulsefusion.org