I Need A New Car: A First-time Buyer’s Guide To Smart, Budget-friendly Choices In 2024

The excitement of getting your first car is undeniable, but the process can feel overwhelming. You’re eager to hit the road, but you also want to make a smart financial decision. This guide will walk you through the steps of buying your first car, focusing on budget-friendly strategies and practical tips to help you find the perfect vehicle without breaking the bank. This guide is for you if you’re saying I need a new car.

Understanding Your Needs and Setting a Realistic Budget for I Need a New Car

Defining Your Needs

Before you start car shopping, it’s essential to take a closer look at your daily life and transportation requirements. Think about your daily commute, the size of your family, and the amount of cargo you typically need to transport. Do you have a long drive to work, or do you mainly stick to city streets? Do you need space for kids, pets, or outdoor gear? Answering these questions will help you prioritize your must-have features and avoid overspending on unnecessary extras.

Consider your commuting needs. If you have a long daily drive, fuel efficiency might be a top priority. On the other hand, if you have a short commute and mostly drive around the city, you may be able to prioritize other factors like cargo space or passenger capacity.

Think about your lifestyle and how you plan to use the car. If you frequently go on road trips or need to transport large items, a spacious SUV or minivan could be a better fit than a compact car. However, if you mainly use your car for solo commuting and running errands, a sedan or hatchback might be more suitable and budget-friendly.

Creating a Budget

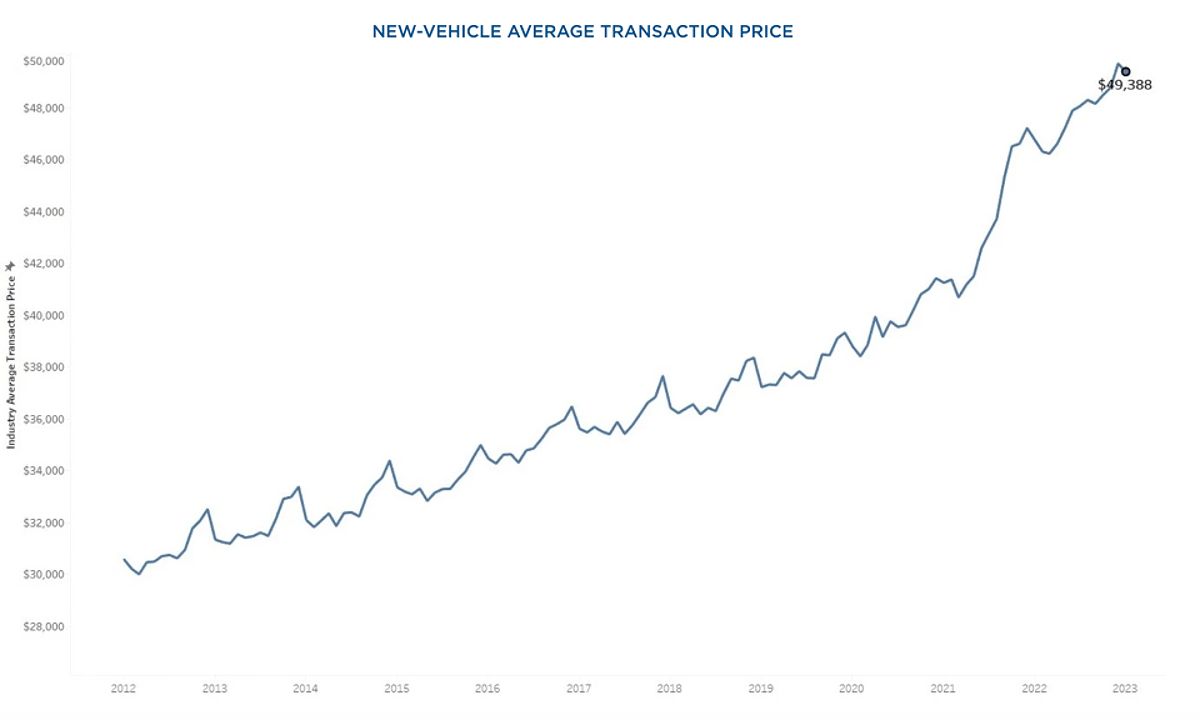

Budgeting is a crucial step in the car-buying process. Start by researching the average prices for the types of vehicles you’re interested in. Then, use online calculators to determine what you can realistically afford in terms of monthly payments, insurance costs, fuel expenses, and maintenance. Aim to keep your total car-related expenses within 20% of your take-home pay. This will help ensure you don’t overextend your finances.

When creating your budget, don’t forget to factor in costs beyond the sticker price. Insurance premiums, registration fees, and even unexpected repairs can add up quickly. By considering all these expenses upfront, you’ll be better equipped to make an informed decision that aligns with your financial capabilities.

Balancing Needs and Budget

Finding the right balance between your needs and your budget might require some compromise. Focus on the essential features, and be willing to make trade-offs to stay within your financial limits. For example, you might opt for a compact car instead of a spacious SUV if your daily commute and cargo needs are modest. Staying realistic about your requirements will help you make a smart, budget-friendly choice.

Remember, it’s easy to get caught up in the allure of the latest tech or luxury features, but those add-ons can quickly inflate your budget. Resist the temptation and prioritize the features that truly matter to you, even if it means sacrificing some bells and whistles.

New vs- Used: Weighing the Pros and Cons

New Cars

Buying a brand-new car comes with some appealing benefits, such as the latest technology, safety features, and a full factory warranty. This can provide peace of mind and potentially lower your insurance premiums. However, new cars also come with a higher upfront cost and rapid depreciation, meaning you could end up underwater on your loan if you decide to sell it too soon.

The allure of a new car is understandable, especially when it comes to the latest safety and tech features. Advanced driver-assistance systems, like automatic emergency braking and adaptive cruise control, can not only provide an extra layer of protection but may also qualify you for insurance discounts. Additionally, a new car’s factory warranty can give you the assurance that any manufacturing defects will be covered, at least for the first few years of ownership.

Used Cars

Used cars, on the other hand, are generally more budget-friendly. You can find quality vehicles for a fraction of the cost of a new model, and they’ve already experienced the steepest depreciation. Certified pre-owned (CPO) vehicles are particularly attractive, as they undergo rigorous inspections and come with extended warranties. The potential downside is the possibility of hidden problems and higher maintenance costs as the car ages.

Buying a used car can be an excellent way to get more value for your money. While you may miss out on the latest features, a well-maintained used car can still provide reliable transportation at a significant discount. Certified pre-owned (CPO) vehicles, in particular, offer the best of both worlds — the affordability of a used car with the added reassurance of a warranty and rigorous inspection process.

Certified Pre-Owned (CPO) Vehicles

Certified pre-owned (CPO) vehicles can be an excellent compromise between new and used. These cars have undergone comprehensive inspections and often come with extended warranties, providing added peace of mind. Additionally, some dealerships offer special financing rates for CPO vehicles, making them an even more budget-friendly option.

CPO vehicles can be a great choice for first-time buyers who want the benefits of a used car, but with some of the protections of a new one. The extended warranty and detailed inspection process can help alleviate concerns about hidden issues, while the potential for lower financing rates can make the purchase more accessible.

Navigating the Car-Buying Process

Researching and Comparing Vehicles

Before you start visiting dealerships, take the time to research and compare different car models online. Websites like Kelley Blue Book, Edmunds, and Consumer Reports can provide detailed information on features, pricing, and reviews. Test-driving multiple vehicles will also help you get a feel for what you like and what works best for your needs.

Thorough research is key to making an informed decision. Take advantage of the wealth of information available online to narrow down your options and identify the vehicles that best fit your needs and budget. Don’t be afraid to test-drive several models — this hands-on experience can give you valuable insights that might not come across in online reviews alone.

Financing Options

Get pre-approved for a loan before you start shopping. This will give you a clear idea of what you can afford and strengthen your negotiating position. Consider exploring financing options from banks, credit unions, and online lenders, as they may offer more competitive interest rates and terms than the dealership.

Being pre-approved for financing can put you in a stronger position when it comes time to negotiate at the dealership. It shows that you’ve done your homework and have a clear understanding of your budget, which can help you avoid getting pushed into a deal that doesn’t align with your financial capabilities.

Negotiating the Price

When it comes to negotiating, knowledge is power. Research the fair market value of the car you’re interested in and be prepared to compare offers from multiple dealerships. Don’t be afraid to walk away if the deal doesn’t align with your budget. Visiting dealerships during off-peak hours can also help you avoid aggressive sales tactics, allowing for a more relaxed negotiation process.

Negotiating can be intimidating, but it’s an important step in ensuring you get the best possible deal. Arm yourself with information about the fair market value of the car, and don’t hesitate to use that knowledge to your advantage. If one dealership isn’t willing to meet your price, be prepared to walk away and try your luck elsewhere.

Avoiding Add-On Costs

Dealerships often try to sell you various add-ons, such as extended warranties and rustproofing. While some of these services can be beneficial, they’re often overpriced. Do your research and explore more affordable alternatives to avoid overspending.

It’s important to be wary of add-on costs at the dealership, as they can quickly inflate your total purchase price. Extended warranties, paint protection, and other extras are often marked up significantly. Take the time to research these items independently and determine if they’re truly worth the added cost or if you can find more affordable alternatives elsewhere.

Minimizing Long-Term Costs

Maintenance and Repairs

Staying on top of your car’s regular maintenance is crucial for preserving its longevity and preventing costly repairs down the line. Follow the manufacturer’s recommended service schedule, and consider learning how to perform simple tasks like oil changes and tire rotations yourself to save money.

Proper maintenance is key to keeping your car running smoothly and avoiding expensive repairs. Follow the manufacturer’s recommended service schedule, which typically includes oil changes, tire rotations, and other routine checkups. If you’re mechanically inclined, you can save even more by learning to do some basic maintenance tasks yourself, like changing the oil or replacing the air filter.

Fuel Efficiency

Fuel costs can quickly add up, so focus on maximizing your vehicle’s fuel efficiency. Adopt driving habits like maintaining steady speeds, avoiding rapid acceleration, and keeping your tires properly inflated. Regular maintenance can also help improve your car’s fuel economy.

Maximizing your car’s fuel efficiency can make a significant difference in your long-term costs. Simple habits like avoiding sudden stops and starts, maintaining steady speeds, and keeping your tires properly inflated can all contribute to better gas mileage. Regular maintenance, such as replacing air filters and spark plugs, can also help your vehicle run more efficiently.

Insurance Considerations

Shopping around for car insurance can help you find the best rates and coverage. Compare quotes from multiple providers, and take advantage of any available discounts, such as those for good driving records or safety features.

Don’t forget to factor in insurance costs when budgeting for your car purchase. Shop around with multiple providers to find the best rates and coverage levels for your needs. Be sure to take advantage of any available discounts, such as those for good driving records, safe vehicles, or bundling your insurance policies.

FAQ

Q: What’s the best time of year to buy a car?

A: The best time to buy a car often depends on your individual needs and circumstances. However, you might find better deals during the end of the month, during holidays, or during model year transitions.

Q: How can I improve my credit score to get a better loan rate?

A: Pay your bills on time, keep your credit utilization low, and avoid applying for too much credit.

Q: What are some good resources for researching car models and prices?

A: Kelley Blue Book, Edmunds, and Consumer Reports are all reputable resources for researching car models and prices.

Conclusion

This guide has provided you with the essential knowledge and tips for buying your first car. Remember to define your needs, set a realistic budget, research and compare vehicles, and negotiate the best price. Start your car-buying journey today and use the information in this guide to make informed decisions and find the perfect vehicle for your needs and budget.

MORE FROM pulsefusion.org