Unlocking Your Freedom: A Landlord’s Guide To Selling Your Investment Property And Simplifying Life

Imagine finally saying goodbye to the constant demands of property management, the late-night calls from tenants, and the endless to-do list. This is the reality for landlords who choose to sell their investment property. In this comprehensive guide, we’ll walk you through the process of real estate investment property resale, offering practical strategies and insights to help you simplify your life and unlock your financial freedom.

We’ll explore the compelling reasons to sell, uncover techniques to maximize your returns, and provide a roadmap for reinvesting your proceeds into alternative opportunities that align with your evolving goals. Whether you’re seeking to reduce stress, adapt to life changes, or pursue new passions, this article will empower you to make informed decisions that lead to a more fulfilling and rewarding future.

The Case for Selling: Reclaiming Your Time and Freedom

Reduced Stress and Time Commitment

Managing a rental property involves a myriad of responsibilities, from addressing tenant concerns to handling maintenance issues and navigating legal requirements. These tasks can become increasingly burdensome, leading to stress and time constraints. As John, a busy entrepreneur, found, the constant demands of property management were taking a toll on his health and impacting his core business. After selling the property, he reported a significant decrease in stress levels, allowing him to focus on his entrepreneurial pursuits and spend more quality time with his family.

By choosing to sell, landlords can alleviate these pressures and reclaim their time, empowering them to redirect their energy towards personal goals and passions. This freedom from the day-to-day management of a rental property can be truly transformative, as it enables individuals to focus on what truly matters in their lives.

Shifting Priorities and Life Changes

Life events like retirement, relocation, or family expansion can significantly impact a landlord’s ability and desire to manage rental properties. For Sarah, a retiree, her growing travel plans made the ongoing management of her rental property a burden. Selling the property provided her with the financial flexibility to pursue her travel dreams without the hassle of property management.

As personal priorities evolve, the demands of rental property management may become less appealing. Selling can offer the flexibility needed to adapt to new life stages without the encumbrances of property ownership, allowing landlords to seamlessly transition into the next chapter of their lives.

Focusing on Other Interests and Goals

Selling a rental property can free up capital for new business ventures, investments, or other pursuits that align with a landlord’s evolving interests and goals. Mark, a passionate artist, realized that selling his rental property would provide him with the capital and time needed to pursue his dream of opening his own studio. By freeing himself from the demands of property management, he was able to dedicate his time and resources to his art.

This transition can be truly liberating, as it opens up new possibilities and allows landlords to pivot towards other passions or business ventures that they may have previously been unable to explore due to the constraints of property management.

While selling can offer freedom from management responsibilities, it’s important to carefully weigh the potential benefits against the drawbacks, such as relinquishing future income and appreciation potential. Landlords should consider their financial situation, risk tolerance, and long-term goals to make an informed decision.

Maximizing Returns: Strategies for a Successful Real Estate Investment Property Resale

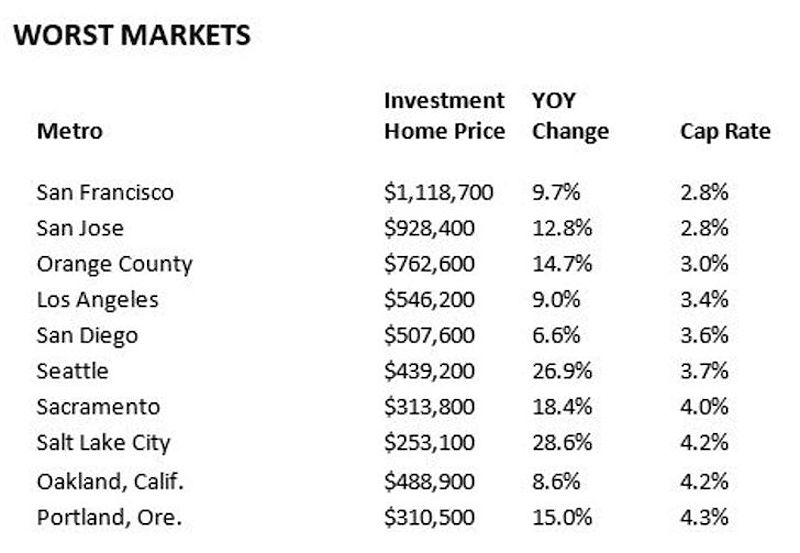

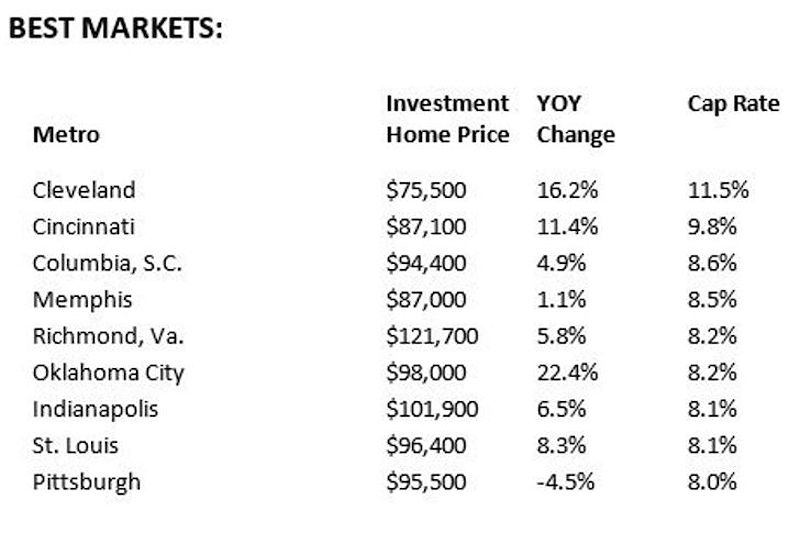

Market Trends and Timing

Understanding the local real estate market dynamics is crucial, as factors like interest rates, economic growth, and housing inventory can significantly impact property values. “It’s crucial to understand the local real estate market dynamics,” says Sarah Jones, a seasoned real estate agent. “Timing the sale strategically can maximize returns.” According to the National Association of Realtors, homes sold in a seller’s market typically achieve higher prices and faster sales times compared to a buyer’s market.

By closely monitoring market trends and identifying the optimal time to sell, landlords can potentially increase their financial returns and capitalize on favorable market conditions.

Pricing Strategies

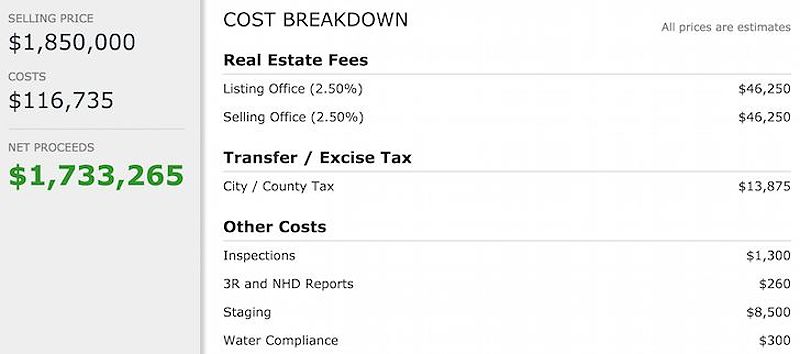

Investing in strategic improvements can enhance the property’s desirability and justify a higher asking price. As an example, a landlord who renovates their kitchen and bathroom before selling can potentially increase the property’s value by 5-10% compared to similar properties without these upgrades.

Setting the right asking price is crucial in the real estate investment property resale process. Consideration should be given to comparable sales in the area, current market demand, and any renovations or upgrades that may enhance the property’s value. Striking the right balance can lead to a quick sale without sacrificing profit margins.

Tax Implications

Tax implications can vary depending on the holding period and the property’s appreciation. “Tax implications can vary depending on the holding period and the property’s appreciation,” explains John Smith, a certified public accountant. “Consulting with a tax professional can help landlords navigate these complexities and potentially minimize their tax burden.”

Landlords should consult with a tax advisor to understand the specific tax implications of selling their property, including capital gains tax and depreciation recapture. By exploring tax-saving strategies, landlords can preserve more of their equity and maximize the financial benefits of the sale.

The 1031 Exchange: Deferring Capital Gains Taxes

The 1031 exchange can be a powerful tool for landlords seeking to defer capital gains tax and continue investing in real estate. As an example, a landlord who sells a rental property for $500,000 and immediately reinvests the proceeds into a new property worth $550,000 can defer capital gains tax on the $50,000 profit.

This strategy not only allows for tax deferral but also enables landlords to maintain their real estate investment portfolio, potentially leading to continued growth and long-term financial stability.

Reinvesting Your Proceeds: Exploring Alternative Options

After successfully selling your rental property, the next step is to consider how to reinvest the proceeds in a way that aligns with your financial goals and lifestyle. By exploring alternative investment avenues, landlords can diversify their portfolio, potentially enhance returns, and secure their financial future.

Real Estate Crowdfunding

Real estate crowdfunding has gained significant popularity in recent years, offering accessible investment opportunities for individuals with limited capital. “Fundrise, a leading real estate crowdfunding platform, allows investors to participate in diversified portfolios of commercial real estate projects for as little as $1,000,” providing an alternative to direct property management.

This innovative approach to real estate investing often comes with lower investment minimums and reduced management responsibilities, making it an attractive choice for those seeking a more passive approach to growing their wealth.

REITs (Real Estate Investment Trusts)

REITs offer a relatively low-risk and liquid investment option for those seeking passive income and potential capital appreciation. “Vanguard Real Estate Index Fund ETF (VNQ) is a popular REIT ETF that provides exposure to a broad range of real estate sectors.”

Investing in REITs provides exposure to income-generating real estate without the need to manage properties directly. These publicly traded entities typically offer regular dividend payouts and the potential for capital appreciation, making them a compelling alternative for landlords who prefer a hands-off investment strategy.

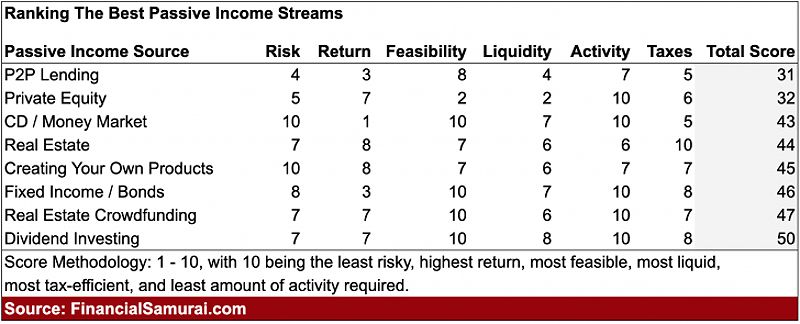

Other Passive Income Streams

Beyond real estate, landlords can explore various passive income opportunities such as dividend-paying stocks, bonds, or peer-to-peer lending. “Diversification is key to managing investment risk,” advises Jane Doe, a financial advisor. “Investing in a mix of assets, such as dividend-paying stocks, bonds, and peer-to-peer lending, can create a balanced portfolio that aligns with individual risk tolerance.”

Diversifying investments across different asset classes can reduce overall risk and enhance potential returns, allowing for a balanced portfolio that reflects an individual’s financial goals and risk appetite.

Tips for a Smooth Transition

Ensuring a seamless transition during the sale of your investment property is crucial for maximizing returns and minimizing potential challenges.

Preparing Your Property

Investing in staging and minor repairs can make a substantial difference in the perceived value and desirability of the property. “A landlord who paints the interior, cleans the carpets, and removes clutter can significantly improve the property’s appeal to potential buyers.”

By enhancing your property’s appeal, you can attract more interested buyers and potentially secure a higher sale price.

Choosing the Right Real Estate Agent

Landlords should carefully research and interview potential agents, considering their experience, track record, and communication skills. “A good real estate agent can provide valuable guidance throughout the selling process,” says Sarah Jones. “They can help you price the property accurately, market it effectively, and negotiate favorable terms.”

Selecting an experienced real estate agent who understands your local market can significantly impact the success of your real estate investment property resale.

Negotiating a Favorable Sale

Understanding the current market conditions, comparable sales, and the buyer’s motivation can empower landlords to negotiate a favorable sale price. “Understanding the current market conditions, comparable sales, and the buyer’s motivation can empower landlords to negotiate a favorable sale price.”

By staying informed and maintaining a strategic approach to negotiations, landlords can secure the best possible outcome while protecting their interests.

Closing the Deal

The closing process involves several steps, including financing arrangements, inspections, and necessary legal documentation. Landlords should work closely with their real estate agent and attorney to ensure a smooth and efficient closing.

Conclusion

Selling your rental property can be a strategic move to simplify your life and free up capital for new opportunities. Whether you’re seeking to reduce stress, adapt to life changes, or pursue new interests, this comprehensive guide has provided you with the tools and insights to make informed decisions.

From understanding market trends and maximizing returns to exploring alternative investment options, this article has equipped you with the knowledge needed to navigate the real estate investment property resale process with confidence. Unlock your freedom and embark on a new chapter of your life.

Contact a trusted real estate agent to discuss your options, explore real estate crowdfunding platforms, or consult with a financial advisor to create a personalized investment plan. Your path to a more fulfilling and rewarding future awaits.

MORE FROM pulsefusion.org