Maximize Your Savings: Wealthfront Savings Account Interest Rate Explained

In today’s low-interest environment, finding a savings account that can keep up with inflation can be a real challenge. However, the Wealthfront Cash Account offers a compelling solution, boasting a remarkable 5.00% APY (Annual Percentage Yield) as of August 2024. This interest rate is significantly higher than the national average of just 0.30%, making it an attractive option for those looking to maximize their short-term savings. The wealthfront savings account interest rate is a key factor in its appeal, offering a competitive edge in the current market.

Wealthfront Cash Account: A High-Yield Savings Option

The Wealthfront Cash Account is designed to help you enhance your short-term savings, which typically refers to funds you may need access to within the next few years, like an emergency fund or a down payment on a house. This account provides a convenient and secure place to park your money while earning a competitive interest rate.

Current Interest Rate and Comparison

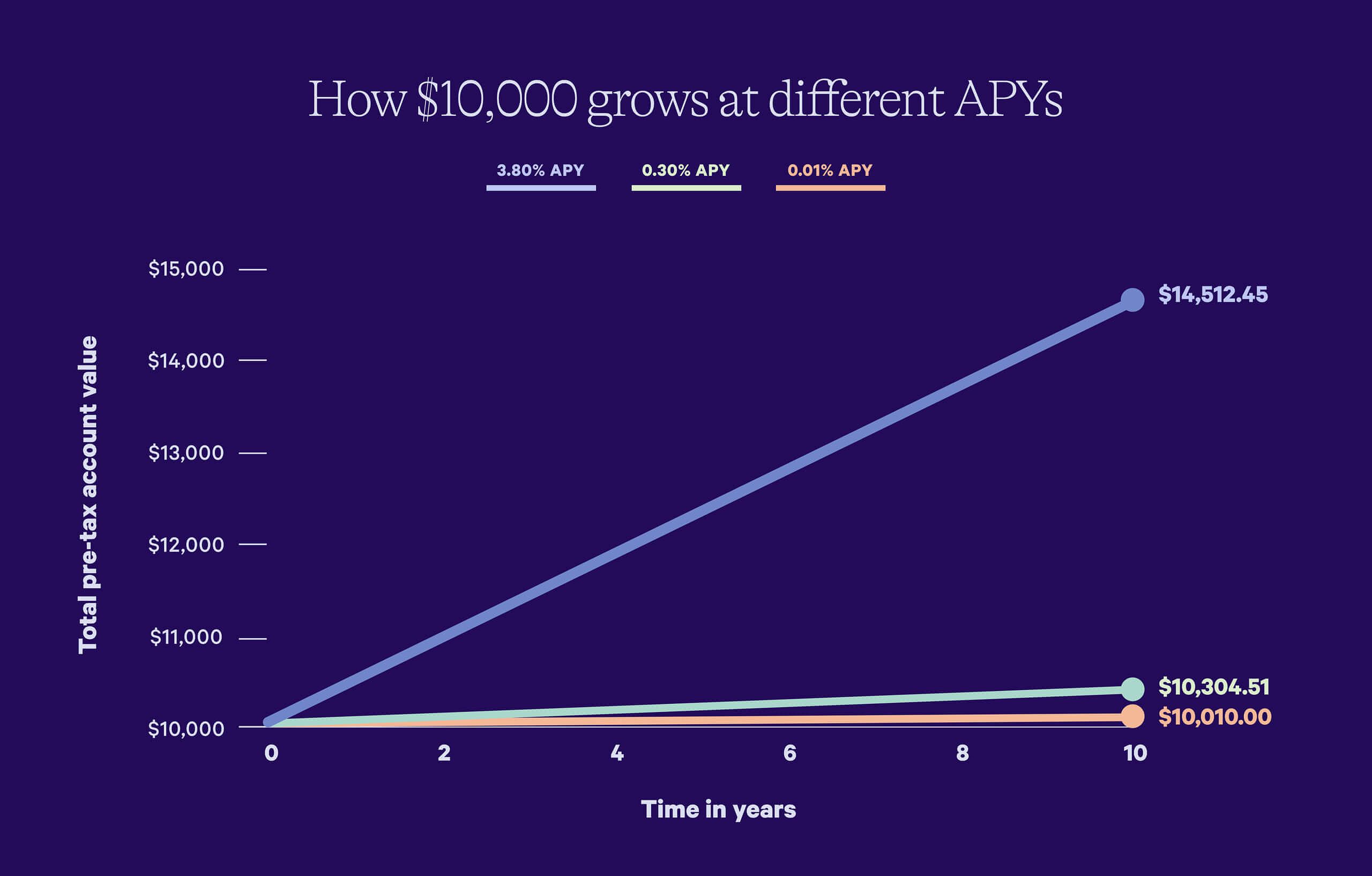

As of August 2024, the Wealthfront cash account interest rate stands at an impressive 5.00% APY. This is a significant increase from the historical lows seen in recent years, where rates were often below 1%. In comparison, the national average savings account rate hovers around just 0.30%.

To illustrate the impact of this difference: if you deposit $10,000 in a traditional savings account at the national average rate, you would earn approximately $30 in interest over a year. Conversely, that same amount in the Wealthfront Cash Account would yield an impressive $500 in annual interest. This difference is even more significant over longer periods due to the power of compounding, where interest earned on your initial deposit also earns interest.

How Wealthfront Achieves High APY

Wealthfront can offer such an attractive APY by collaborating with a network of multiple FDIC-insured banks. By distributing deposits across these “program banks,” Wealthfront accesses wholesale interest rates that are typically higher than those available to individual consumers. These wholesale rates are negotiated between banks and large institutions, allowing them to access more competitive rates. This strategic model allows Wealthfront to pass those elevated rates on to account holders, making it an appealing choice for those seeking high returns on their savings.

Key Features and Benefits of the Wealthfront Savings Account Interest Rate

The Wealthfront Cash Account comes with a variety of features that make it an attractive option for your short-term savings.

FDIC Insurance: Secure Your Savings

One of the most significant benefits of the Wealthfront Cash Account is its FDIC insurance coverage. The FDIC (Federal Deposit Insurance Corporation) is a government agency that insures deposits in banks and savings associations, meaning that if a bank fails, the FDIC will reimburse depositors up to the insured limit. Through its network of partner banks, Wealthfront provides insurance for deposits up to $8 million per account, substantially higher than the standard $250,000 limit.

No Fees or Minimums: Access and Flexibility

Another appealing aspect of the Wealthfront Cash Account is its commitment to being fee-free. There are no account maintenance fees, withdrawal fees, or minimum balance requirements, which makes it accessible to a broad spectrum of savers. This means you can start saving with any amount and won’t be penalized for low balances or frequent withdrawals.

Convenience and Accessibility: Manage Your Money Easily

The Wealthfront Cash Account is designed for easy management of your finances. It offers features like a debit card, access to 19,000 fee-free ATMs, and seamless fund transfers. For example, you can use your Wealthfront debit card to make purchases or withdraw cash at any ATM in the Allpoint network without paying fees.

Considerations and Things to Keep in Mind

While the Wealthfront Cash Account presents numerous advantages, it’s essential to consider a few potential drawbacks before opening an account.

Potential for Interest Rate Fluctuations

The Wealthfront savings account interest rate is variable, meaning it can change depending on the broader economic landscape. Factors like the Federal Reserve’s interest rate policy, inflation, and overall economic growth can influence the interest rates offered by banks. While Wealthfront aims to maintain a competitive rate, fluctuations are possible, which could affect your expected returns over time. To mitigate the risk of interest rate fluctuations, consider diversifying your savings across multiple accounts with different interest rate structures.

Limited Investment Integration

One notable limitation of the Wealthfront Cash Account is that it currently does not allow for direct transfers between the Cash Account and Wealthfront investment accounts. To move funds, you would need to withdraw them to an external checking account first, then re-deposit into your investment account. This extra step may be seen as inconvenient by some users, but Wealthfront is actively working on integrating its cash management and investment platforms to streamline this process in the future.

Understanding the APY Calculation

The interest rate for the Wealthfront Cash Account is represented as an Annual Percentage Yield (APY), which includes the effects of compounding. APY is the effective annual rate of return, taking into account the interest earned on both the principal and previously accrued interest. This means that your savings grow faster over time as the interest compounds. Understanding this distinction is crucial, as it indicates the total interest you can earn on your deposits over a year, rather than just the simple interest rate.

Alternatives to Consider

While the Wealthfront Cash Account is an excellent high-yield savings option, there are other alternatives worth exploring depending on your financial needs and preferences.

Online Banks

Several online banks are known for their competitive savings account rates that may rival or even exceed the Wealthfront cash account interest rate. Some reputable options include Ally Bank, Marcus by Goldman Sachs, and American Express National Bank. Online banks are becoming increasingly popular due to their competitive rates, lower fees, and user-friendly digital platforms.

High-Yield Savings Accounts at Traditional Banks

Even traditional brick-and-mortar banks have begun to adapt to the demand for better savings rates. Institutions like Chase, Bank of America, and Wells Fargo offer high-yield savings accounts that may be worth considering if you prefer the familiarity of a local branch.

FAQ

Q: Is the Wealthfront Cash Account FDIC insured?

A: Yes, the Wealthfront Cash Account is FDIC insured up to $8 million per account through its network of partner banks.

Q: What are the fees associated with the Wealthfront Cash Account?

A: There are no account fees, withdrawal fees, or minimum balance requirements.

Q: Can I transfer money from my Wealthfront Cash Account to my Wealthfront investment account?

A: Currently, direct transfers between the Cash Account and Wealthfront investment accounts are not possible. You’ll need to withdraw funds to your external checking account and then re-deposit them into your investment account, but Wealthfront is working on integrating these platforms.

Q: How secure are my funds in the Wealthfront Cash Account?

A: The Wealthfront Cash Account is insured by the FDIC up to $8 million per account. This means that your funds are protected even if Wealthfront or one of its partner banks were to experience a financial crisis. Additionally, Wealthfront uses industry-standard encryption technology to protect your personal information and financial data.

Conclusion

In summary, the Wealthfront Cash Account offers a compelling high-yield savings option for individuals looking to maximize their short-term savings. With a current 5.00% APY, robust FDIC insurance coverage, and a completely fee-free structure, this account stands out as an attractive choice for savvy savers.

While there are some considerations, such as the potential for interest rate fluctuations and limited investment integration, the overall benefits make the Wealthfront Cash Account worth exploring. If you’re looking to earn a competitive interest rate on your savings while enjoying the convenience and security of FDIC insurance, the Wealthfront Cash Account is worth considering. Don’t let your savings languish in a low-interest account; take charge of your financial future today!

This text was generated using a large language model, and select text has been reviewed and moderated for purposes such as readability.

MORE FROM pulsefusion.org