What To Do With My Money: A Beginner’s Guide To Investing

The traditional way of saving money – putting it in a savings account – may no longer be enough to keep up with inflation. While savings accounts offer security, they often provide minimal returns. Investing a portion of your money in the stock market or other assets can help you grow your wealth and stay ahead of inflation, ensuring your money retains its value over time.

Understanding what to do with my money is not just about accumulating wealth it’s about achieving your financial goals and building a secure future. This guide will provide practical advice and actionable steps for new investors looking to confidently start their investment journey.

Understanding What to Do with My Money: The Basics of Investing

What Is Investing?

Investing is the act of allocating your money to various assets with the expectation of generating a return over time. This can involve purchasing stocks, bonds, real estate, or other investment vehicles. By investing, you’re essentially making your money work for you, aiming to increase your wealth through asset appreciation or earning income.

The earlier you start investing, the more time your money has to grow, thanks to the power of compound interest. This means that not only will you earn returns on your initial investment, but you will also earn returns on the returns over time. Understanding how to effectively manage and grow your money is crucial to achieving long-term financial success.

Why Invest?

Investing offers numerous benefits beyond simply growing your wealth. It can help you achieve significant financial milestones, such as buying a home, funding your children’s education, or securing a comfortable retirement. Historically, investments have outperformed traditional savings accounts, providing higher returns over the long term. For example, the stock market has historically returned an average of around 7% annually after inflation, making it a compelling option for wealth building.

Furthermore, investing serves as a hedge against inflation. As inflation rises, the purchasing power of your money decreases. By investing, you aim to earn returns that outpace inflation, ensuring your money retains its value over time. This is particularly crucial for long-term goals, such as retirement, where you want your savings to grow significantly over several decades.

Common Investment Vehicles

Exploring Stocks

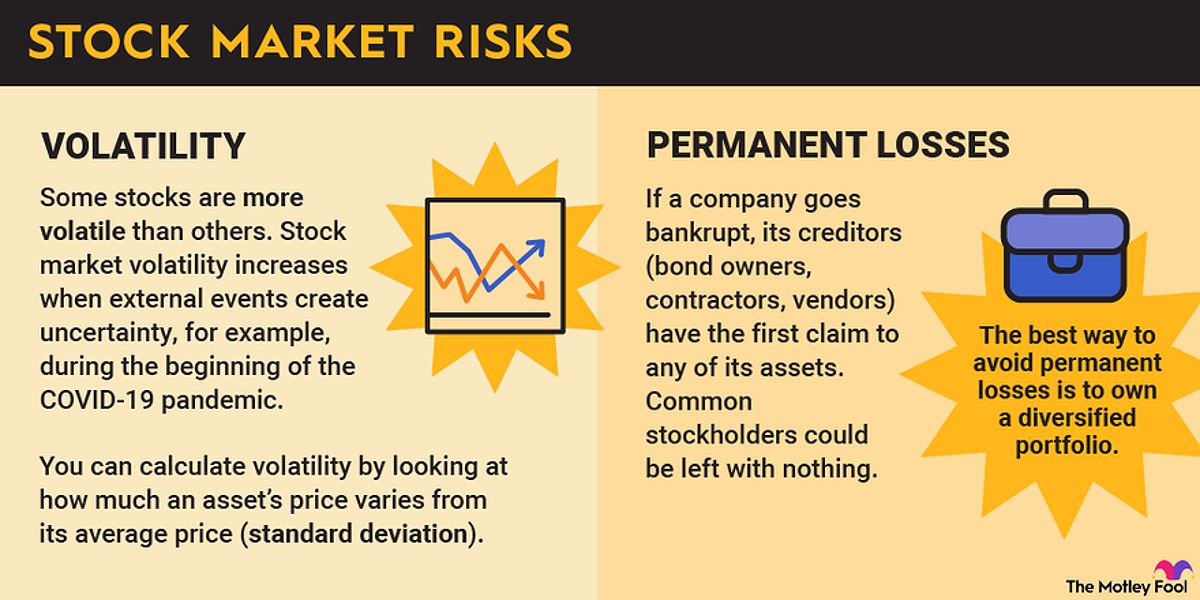

Stocks represent ownership in a company and are a popular choice for many investors. When you buy shares, you become a part-owner and can benefit from the company’s growth and profits. However, stocks are subject to market fluctuations, meaning their value can rise and fall significantly. While they offer the potential for high returns, they also carry inherent risks.

Investing in well-established companies can be a safer bet, as these stocks tend to be more stable. Conversely, investing in smaller or emerging companies may yield higher returns but comes with greater risk. Understanding the different types of stocks—such as growth stocks, dividend stocks, and value stocks—can help you make informed decisions.

- Growth Stocks: These are shares in companies expected to grow at an above-average rate compared to their industry or the overall market. These stocks typically do not pay dividends, as companies reinvest earnings to fuel further growth.

- Dividend Stocks: These provide regular income in the form of dividends, making them attractive for income-focused investors.

- Value Stocks: These appear undervalued based on fundamental analysis, offering potential for appreciation as the market corrects itself.

Understanding Bonds

Bonds are generally a more conservative investment option compared to stocks. When you purchase a bond, you are essentially lending money to a government or corporation in exchange for periodic interest payments and the return of the bond’s face value at maturity. Bonds are typically less volatile than stocks, making them appealing to risk-averse investors.

There are various types of bonds, including government bonds, corporate bonds, and municipal bonds. Each type carries different risk levels and potential returns. While bonds typically offer lower returns than stocks, they can provide a steady income stream, especially for those nearing retirement. For instance, U.S. Treasury bonds are considered low-risk investments backed by the government, while corporate bonds can offer higher yields but come with increased risk based on the issuer’s creditworthiness.

Mutual Funds and ETFs

Mutual funds and exchange-traded funds (ETFs) are excellent options for investors seeking diversification without the need to pick individual stocks. These funds pool money from multiple investors to create a diversified portfolio of stocks, bonds, or other assets.

- Mutual Funds: These are managed by professionals and are priced once a day at market close.

- ETFs: These trade on exchanges like stocks and can be bought and sold throughout the trading day.

Both options allow you to spread your investments across various asset classes, reducing risk while aiming for growth. One of the key advantages of mutual funds and ETFs is diversification. By investing in a single fund, you can gain exposure to a broad range of securities, which can help mitigate risk. Additionally, many funds are designed to target specific sectors, regions, or investment strategies, allowing you to tailor your portfolio according to your interests and market outlook.

Building Your First Investment Portfolio

Setting Your Investment Goals

Before diving into investing, it’s crucial to establish clear investment goals. Consider what you want to achieve—whether it’s saving for retirement, a major purchase, or funding your children’s education. By setting specific financial targets and timelines, you can tailor your investment strategy to meet these objectives.

When defining your goals, think about the time frame for each. Short-term goals, such as saving for a vacation, may require a different investment approach compared to long-term goals like retirement. For short-term goals, you might prefer more conservative investments to minimize risk, while for long-term goals, you can afford to take on more risk for the potential of higher returns.

Determining Your Risk Tolerance

Understanding your risk tolerance is vital when determining your investment choices. Your risk tolerance reflects how much market volatility you can comfortably withstand. It’s essential to assess your comfort level with potential losses and align your investments accordingly.

You might consider using a risk assessment questionnaire to gauge your risk tolerance. Knowing whether you are conservative, moderate, or aggressive in your investment approach will guide you in selecting appropriate investment vehicles. For instance, conservative investors may prefer bonds and stable dividend-paying stocks, while aggressive investors might lean towards growth stocks and more volatile assets.

The Importance of Diversification

Diversification is a key strategy in investing that involves spreading your investments across various asset classes to mitigate risk. By diversifying, you can reduce the impact of poor performance from any single investment on your overall portfolio.

A well-diversified portfolio might include a mix of stocks, bonds, and perhaps real estate or commodities. This approach can help you achieve more stable returns over time, as different asset classes often perform differently under various market conditions. Additionally, diversification can help you capitalize on various market opportunities, as different sectors may perform well at different times.

Getting Started with Investing

Choosing a Brokerage Account

Selecting the right brokerage account is an important step for new investors. Consider what features matter most to you—such as low fees, a wide range of investment options, research tools, and quality customer service. Different brokerages cater to different types of investors, so it’s worth comparing options to find one that suits your needs.

Many brokerages offer user-friendly platforms with educational resources to help you get started. Look for brokerages that provide access to a variety of investment options, including stocks, bonds, mutual funds, and ETFs. Additionally, consider whether you prefer a full-service brokerage that offers personalized advice or a discount brokerage that allows for more independent investing.

Making Your First Investment

Once you’ve selected a brokerage account, it’s time to make your first investment. Start small and gradually increase your investment as you become more comfortable. It’s essential to conduct thorough research on your chosen investments and understand the associated risks before committing your money.

Consider beginning with index funds or ETFs, which provide instant diversification and are generally easier for beginners to manage. As you gain experience and confidence, you can explore individual stocks or other more complex investment vehicles. Setting up automatic contributions to your investment account can also help you build your portfolio over time without requiring constant attention.

Frequently Asked Questions

How much money do I need to start investing?

You can start investing with as little as $100, thanks to many brokerages offering fractional shares. This allows you to buy portions of stocks, making investing accessible to everyone.

What are the best investments for beginners?

Index funds and ETFs are often recommended for beginners due to their diversification and low fees. They provide an excellent way to gain exposure to a broad range of securities without needing extensive knowledge of the market.

How often should I invest?

Regular investing, such as monthly or quarterly contributions, can help you take advantage of dollar-cost averaging. This strategy involves investing a fixed amount of money at regular intervals, which can reduce the impact of market volatility.

Should I invest in individual stocks?

While individual stocks can offer high returns, they come with higher risks. It’s advisable for beginners to start with index funds or ETFs, which are generally less risky and easier to manage.

How do I know if I’m making the right investment decisions?

It’s important to do your research, understand the risks, and monitor your investments regularly. Consider consulting with a financial advisor for personalized guidance to ensure you’re on the right track.

Conclusion

Navigating the world of investing may seem daunting at first, but understanding the basics can empower you to make informed decisions about what to do with your money. By familiarizing yourself with different investment options, defining your goals, assessing your risk tolerance, and building a diversified portfolio, you can set yourself up for financial success.

Starting your investment journey today can lead to significant financial growth over time. Remember that investing is a long-term endeavor, and patience is key. By opening a brokerage account, researching your options, and taking that crucial first step, you can work towards securing your financial future while enjoying the process of growing your wealth.

MORE FROM pulsefusion.org