When To Buy A Car Financially: A Guide For Budget-conscious Parents

Buying a car for your teenager can be a challenging task, especially when trying to balance safety, reliability, and affordability. This guide will help budget-conscious parents navigate the car buying process, providing insights on when to buy a car financially and avoiding common financial pitfalls.

Understanding the Car Buying Cycle: Seizing Opportunities

The car buying market is influenced by seasonal trends and market fluctuations, which can significantly impact prices. Dealerships often offer discounts during specific periods to meet sales targets or clear inventory for new models, presenting savvy shoppers with opportunities to secure great deals.

One of the most influential factors is the end of the month and quarter. As sales personnel strive to hit their goals, they may be more inclined to negotiate and provide incentives to close deals. Similarly, major holiday weekends, such as Memorial Day, Labor Day, and Black Friday, can present parents with increased sales and promotional offers that further sweeten the deal.

Additionally, the transition between model years is a strategic time for car buyers. Dealers typically offer discounts on outgoing models to make room for the latest versions, allowing budget-conscious parents to potentially score a fantastic deal on a slightly older, but still highly capable, vehicle.

Understanding these cycles can empower you to make informed decisions about when to buy a car financially, ensuring you maximize your savings and avoid overspending.

Choosing the Right Car for Your Teenager

Finding a safe and reliable car for your teenage driver is a top priority. Consider these factors when making your decision:

Safety Features: Prioritizing Protection

Look for vehicles with essential safety features like airbags, anti-lock brakes, electronic stability control, and lane departure warning systems. These features can help keep your teenager safe on the road.

When it comes to safety, the Insurance Institute for Highway Safety (IIHS) and the National Highway Traffic Safety Administration (NHTSA) are great resources to research the safety ratings of different models. Prioritize vehicles that have earned top safety ratings from these organizations.

Fuel Efficiency: Balancing Performance and Economy

Fuel efficiency is important, especially for teenage drivers who may be learning to drive and driving more frequently. Look for models that offer a good balance of performance and economy.

Consider the average fuel economy of the vehicle, as well as the fuel tank size and range. This can help you estimate the ongoing fuel costs and ensure your teenager isn’t constantly stopping to refuel.

Reliability and Maintenance: Minimizing Costs

Choose a reliable car with a good track record for maintenance and repair costs. This can help you avoid unexpected expenses down the road.

Consult reliability ratings from sources like Consumer Reports and J.D. Power to identify models that are known for their durability and low maintenance requirements. Additionally, research the average repair costs for different makes and models to ensure you’re choosing a vehicle that fits your budget.

When to Buy a Car Financially: Optimal Times for Savings

End of the Month and Quarter: Leveraging Dealer Motivation

As the month or quarter draws to a close, dealers become increasingly eager to meet their sales targets. This can translate into more favorable negotiating conditions for buyers. By timing your purchase towards the end of the month or quarter, you may be able to leverage the dealer’s motivation and secure a better price.

For example, in August 2024, a parent named Sarah was able to negotiate a $2,500 discount on a used 2021 Toyota Camry simply by waiting until the last week of the month to make her purchase. The dealer was eager to close the sale and meet their monthly goal, allowing Sarah to drive away with a great deal.

Negotiation Strategies:

- Arrive Late: Visiting the dealership late in the day or towards the end of the month/quarter can increase your chances of getting a deal. Salespeople may be more willing to negotiate as they try to hit their targets.

- Be Prepared to Walk Away: If the price isn’t right, be ready to walk away. This tactic can show the dealer you are serious about your budget and willing to explore other options.

- Use Online Resources: Utilize online tools like Kelley Blue Book or Edmunds to research fair market values. This knowledge will help you understand what a good deal looks like and strengthen your negotiating position.

Holiday Weekends and Sales: Capitalizing on Increased Incentives

Major holiday weekends, such as Memorial Day, Labor Day, and Black Friday, are often prime times for car sales. Dealers may offer special incentives, discounts, and promotions to attract more customers during these high-traffic periods. However, it’s important to note that competition can also be fiercer, so it’s crucial to do your research and be prepared to negotiate.

In June 2024, for instance, a parent named Michael was able to take advantage of the Memorial Day weekend sales to secure a $3,000 discount on a 2020 Honda Civic. By comparing prices across multiple dealerships and being willing to walk away if the deal wasn’t right, he was able to find the best possible price.

Tips for Success During Holiday Sales:

- Research in Advance: Before the holiday weekend, compare deals and promotions offered by different dealerships. This preparation can help you identify the best offers available.

- Negotiate Aggressively: Be prepared to negotiate the price, financing terms, and any add-ons. The more informed you are about the market, the better your chances of securing a favorable deal.

- Be Patient: Don’t rush into a decision. Take your time to compare offers and ensure you’re getting the best deal possible. A little patience can lead to significant savings.

Model Year Changeover: Seizing Discounts on Outgoing Models

As new car models are introduced, dealers often offer discounts on the outgoing versions to clear their inventory. This can be an excellent opportunity for budget-conscious parents to get a great deal on a slightly older, but still high-quality, vehicle.

According to data from Edmunds, the average price reduction during a model year changeover can range from $2,000 to $4,000. By keeping an eye on upcoming model releases and proactively contacting dealers, you can position yourself to take advantage of these savings.

Strategies for Finding Deals During Model Year Changeover:

- Research Upcoming Releases: Stay informed about new car announcements and research upcoming model year releases. Knowing when new models will hit the market can help you time your purchase.

- Contact Dealerships: Reach out to dealerships and inquire about potential discounts on outgoing models. Some dealers may have additional incentives to move their inventory.

- Be Willing to Compromise: Consider purchasing a slightly older model if it means getting a significant discount. Many outgoing models still have great features and reliability.

Avoiding Common Pitfalls: Staying on Track Financially

While timing the car purchase is crucial, budget-conscious parents should also be mindful of common pitfalls that can undermine their financial goals.

Overspending: Sticking to Your Budget

It’s easy to get carried away with the excitement of a new car purchase and end up spending more than you can comfortably afford. Stick to your predetermined budget and avoid impulse buys that could stretch your finances too thin.

“I learned this the hard way when I first started car shopping,” says Sarah, the parent from the earlier example. “I got caught up in the latest features and ended up looking at cars that were way out of my price range. It took some discipline, but sticking to my budget ultimately allowed me to find a reliable vehicle that fit my needs without breaking the bank.”

Tips for Avoiding Overspending:

- Set a Realistic Budget: Determine how much you can afford to spend on a car before you start shopping. This figure should include not just the purchase price, but also taxes, registration, and insurance.

- Track Expenses: Use online tools or spreadsheets to track your expenses and ensure you’re staying within your budget. This will help you visualize your spending and make necessary adjustments.

- Resist Sales Pressure: Don’t let salespeople pressure you into buying a car that’s outside your budget. Remember, there will always be other cars and other deals.

Unnecessary Extras: Prioritizing Value Over Upsells

Dealers often try to upsell various add-ons and accessories, such as extended warranties, rustproofing, or fancy sound systems. While some of these may have value, it’s important to research their true worth and negotiate the prices accordingly. Avoid getting pressured into purchasing extras you don’t truly need.

“I remember the dealer trying to convince me that the $500 window tint was an essential upgrade,” recalls Michael, the parent from the Memorial Day weekend example. “But after doing some research, I realized I could get the same quality tint installed for less than half the price at a local shop. Knowing when to say ‘no’ to the dealer’s add-ons was key to staying within my budget.”

Strategies for Avoiding Unnecessary Extras:

- Research Add-on Value: Investigate the true value of extras like extended warranties, rustproofing, and fabric protection. This knowledge can help you negotiate better or decline unnecessary purchases.

- Negotiate Prices: Don’t be afraid to negotiate the price of add-ons or consider purchasing them aftermarket. Many times, you can find better deals outside the dealership.

- Say “No” to Pressure: Don’t feel pressured to purchase add-ons you don’t need. Be firm in your decision-making.

Financing Pitfalls: Exploring Alternative Options

While taking out a loan may seem convenient, it’s essential to weigh the pros and cons carefully. Paying cash whenever possible is the best option, as it allows you to avoid interest payments and potential debt. If financing is necessary, be sure to shop around for the most favorable terms and negotiate aggressively.

“I made the mistake of going with the dealer’s financing the first time I bought a car,” says Sarah. “The monthly payments ended up being more than I had budgeted for, and it took me years to pay it off. Now, I always explore alternative financing options and negotiate hard to get the best deal possible.”

Tips for Avoiding Financing Pitfalls:

- Pay Cash if Possible: Save up for a car and pay cash to avoid interest payments and debt. This can save you money in the long run.

- Shop Around for Financing: If financing is necessary, compare loan terms from multiple lenders to find the best rates. Don’t settle for the first offer you receive.

- Negotiate Loan Terms: Don’t accept the first financing offer you receive. Negotiate the interest rate, loan term, and any fees. A little negotiation can lead to significant savings.

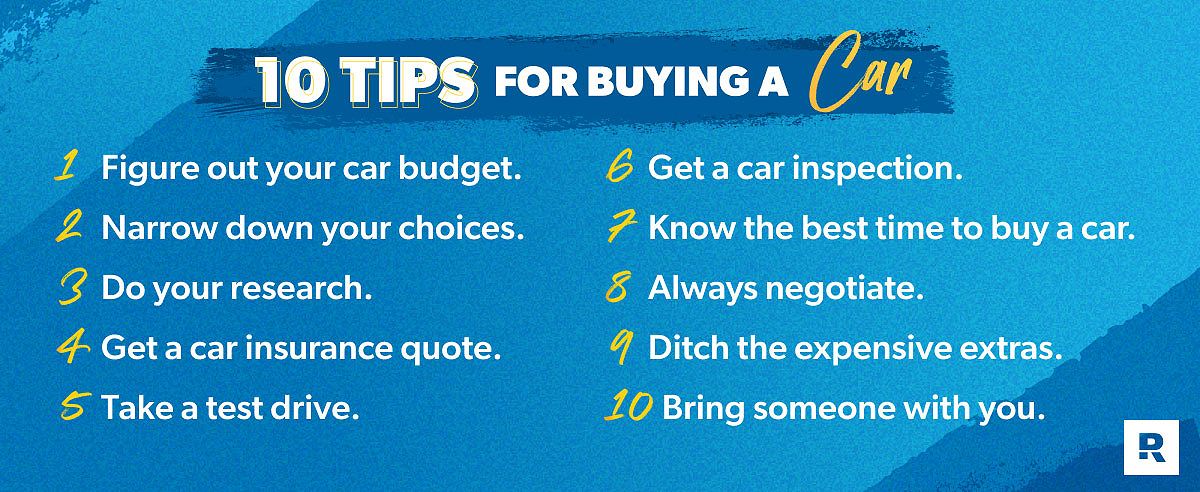

Additional Tips for Successful Car Buying

Here are some additional tips to help you find the perfect car for your teenager while staying within your budget:

Research Thoroughly: Informed Decision-Making

Thoroughly research different models, compare prices, and read reviews from trusted sources like Kelley Blue Book, Edmunds, and Consumer Reports. This will help you make an informed decision and avoid overpaying.

- Use Online Resources: Consult websites like Kelley Blue Book, Edmunds, and Consumer Reports for car reviews, pricing information, and safety ratings.

- Compare Models: Research different models and trim levels to find the best fit for your needs and budget. This can help you narrow down your options and focus on what’s essential.

- Read Reviews: Check out reviews from other car owners to get insights into real-world performance, reliability, and ownership experiences.

Get a Pre-Purchase Inspection: Protecting Your Investment

Before finalizing the purchase, have a qualified mechanic inspect the used car you’re considering. This can help identify any underlying issues or potential problems that could end up costing you more in the long run.

- Find a Reputable Mechanic: Locate a trusted mechanic who specializes in pre-purchase inspections. This step can save you from unexpected repair costs.

- Schedule an Inspection: Schedule an inspection before finalizing the purchase. This will give you peace of mind and ensure you’re making a sound investment.

- Review the Report: Carefully review the inspection report and address any issues identified by the mechanic. If there are significant problems, consider negotiating a lower price or walking away from the deal.

Negotiate Aggressively: Leveraging Your Financial Savvy

Don’t be afraid to negotiate the price, financing terms, and any add-ons. Remain confident and assertive, and be prepared to walk away if the dealer won’t meet your terms.

- Research Fair Market Value: Use online tools to determine the fair market value of the car you’re interested in. This knowledge will help you in negotiations.

- Be Prepared to Walk Away: Have a “walk-away” price in mind and be prepared to leave if the dealership won’t meet your terms. Sometimes, walking away can bring the dealer back to the table with a better offer.

- Negotiate Everything: Don’t be afraid to negotiate the price, financing terms, and any add-ons. The more you negotiate, the more you can save.

Don’t Be Afraid to Walk Away: Prioritizing Your Needs

If the deal doesn’t feel right or the price is too high, don’t hesitate to walk away. Stick to your budget and be willing to continue your search until you find the perfect car at the right price.

- Stick to Your Budget: Don’t let pressure from salespeople or the excitement of a new car lead you to overspend. Stay firm in your financial goals.

- Be Patient: Don’t rush into a decision. Take your time to compare offers and ensure you’re getting the best deal. Patience can lead to better opportunities.

- Explore Other Options: If one dealership won’t meet your terms, consider visiting other dealerships or looking for cars online. The right deal is out there waiting for you.

FAQ

Q: What are some safe and reliable car options for teenage drivers?

A: Some popular and safe options for teenage drivers include the Honda Civic, Toyota Corolla, Subaru Outback, and Volvo XC40. These models are known for their strong safety features, reliability, and affordability.

Q: How can I find a good mechanic for a pre-purchase inspection?

A: Start by asking for recommendations from friends, family, or local car enthusiast groups. You can also check online reviews and certifications to find a reputable mechanic in your area. It’s a good idea to establish a relationship with a trusted mechanic before your car search begins.

Q: What are some common scams to watch out for when buying a used car?

A: Be wary of sellers who offer unrealistic deals, pressure you to make a quick decision, or have incomplete or suspicious documentation. Potential scams include odometer fraud, title washing, and concealing prior damage or accidents. Always inspect the vehicle thoroughly and consider a pre-purchase inspection to ensure you’re not falling victim to a scam.

Conclusion: Driving Away with Financial Confidence

By understanding the car buying cycle, identifying the best times to buy, and avoiding common pitfalls, budget-conscious parents can save significant money and find a safe and reliable vehicle for their teenage driver. Remember to research thoroughly, negotiate aggressively, and be willing to walk away if the deal doesn’t feel right. With these strategies, you can drive away with the perfect car for your family and budget, empowered by your financial savvy and knowledge of when to buy a car financially.

This text was generated using a large language model, and select text has been reviewed and moderated for purposes such as readability.

MORE FROM pulsefusion.org