When To Take Profits On Stocks: A Comprehensive Guide For Individual Investors

The allure of a soaring stock price can be intoxicating, but holding on too long can lead to a painful reversal. While many investors believe they can time the market, the reality is that even seasoned traders struggle to consistently predict when to take profits. This comprehensive guide explores the art of mastering profit taking, equipping you with the knowledge and strategies to maximize your returns while mitigating risk. This guide will teach you when to take profits on stocks.

Understanding the Psychology of Profit Taking

Profit taking is the practice of selling a stock or other investment to lock in gains. It’s a crucial component of active trading strategies, as it allows you to secure your profits and free up capital for new opportunities. However, the decision to sell a winning stock can be fraught with psychological challenges.

The fear of missing out on potential future gains can make it tempting to hold onto a stock even as it continues to rise. Similarly, the sunk cost fallacy — the belief that you shouldn’t sell a losing stock because you’ve already invested in it — can lead to poor decision-making. Overcoming these emotional biases is key to successful profit taking.

The Emotional Rollercoaster of Investing

Emotions play a significant role in investment decisions. The thrill of a rising stock can create a sense of euphoria, making it difficult to consider selling. Conversely, the anxiety of potential losses can lead to hasty decisions. Understanding these emotional triggers is essential for developing a disciplined approach to profit taking.

To combat these emotional challenges, it’s crucial to cultivate a trader’s mindset that emphasizes rationality over emotion. This involves setting clear goals, establishing a well-defined trading plan, and adhering to it, regardless of market fluctuations. By doing so, you can minimize the impact of emotions on your trading decisions.

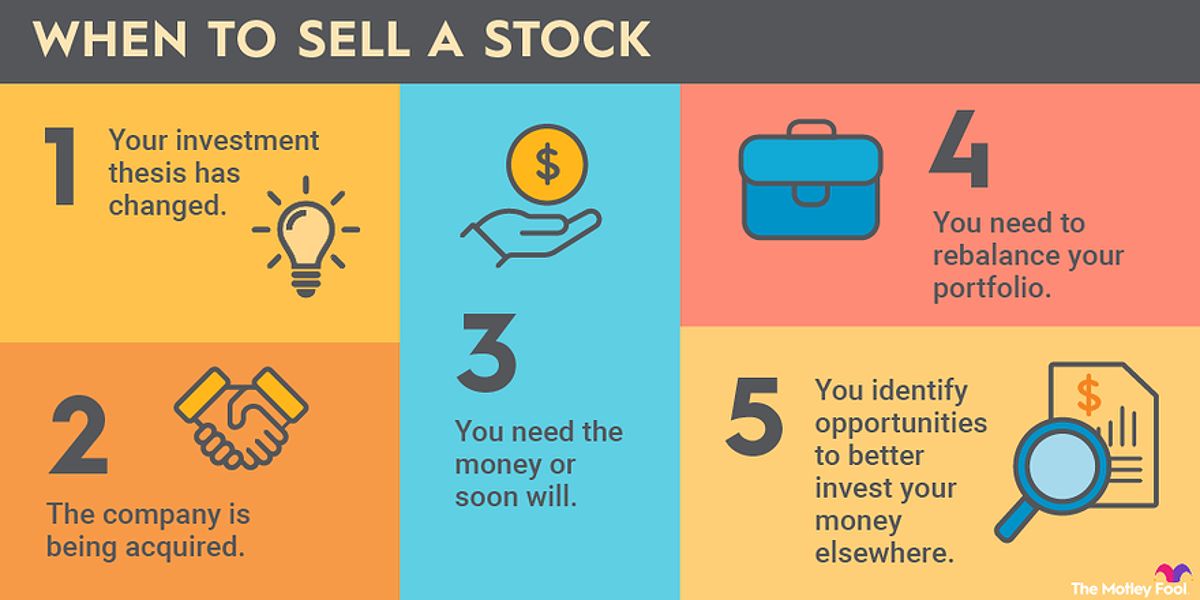

When to Take Profits on Stocks: Identifying the Right Time

Determining the optimal time to take profits on your stocks involves analyzing both technical and fundamental indicators. Let’s explore some of the key factors to consider:

Technical Indicators

-

Relative Strength Index (RSI): The Relative Strength Index is a momentum indicator that can signal overbought or oversold conditions. If a stock’s RSI rises above 70, it may indicate that the stock is overbought and due for a pullback — a potential signal to take profits. Conversely, an RSI below 30 suggests that a stock may be oversold, indicating a potential buying opportunity.

-

Moving Averages: Crossing above or below key moving averages, such as the 50-day or 200-day, can provide clues about a stock’s underlying trend. When a stock’s price crosses below a moving average, it may be a sign to consider taking profits. Additionally, moving average crossovers can signal shifts in momentum, further aiding your decision-making process.

-

Bollinger Bands: Bollinger Bands provide a measure of price volatility. When a stock’s price approaches the upper Bollinger Band, it might indicate an overbought condition, suggesting a potential profit-taking opportunity.

Fundamental Indicators

-

Earnings Reports: Paying attention to a company’s earnings reports and how the stock reacts to the news can be a valuable signal for profit taking. If a stock price spikes significantly after a positive earnings announcement, it may be a good time to consider selling a portion of your position. Conversely, if earnings disappoint and the stock price drops, it might be wise to reevaluate your investment.

-

Valuation Metrics: Look at valuation metrics like Price-to-Earnings ratio (P/E) and Price-to-Book ratio (P/B). If a stock’s valuation becomes significantly inflated compared to its historical levels or peers, it could signal a potential overvaluation and a reason to consider taking profits.

-

Analyst Ratings: Pay attention to analyst ratings and price targets. If analysts downgrade a stock or lower their price targets, it might indicate a potential decline in the future, providing a signal to consider taking profits.

Profit Taking Strategies for Individual Investors

As an individual investor, you have several profit-taking strategies at your disposal to help you maximize your returns. Let’s explore a few of the most effective approaches:

Selling a Portion on Gains

One simple yet effective strategy is to sell a portion of your position when the stock price reaches a certain profit target, such as doubling from your initial entry point. This allows you to lock in a significant portion of your profits while keeping the remaining shares in the game, potentially allowing for further gains.

The advantages of this approach include securing a guaranteed profit and reducing your overall risk exposure. By taking some profits off the table, you can mitigate the impact of any potential downturns in the stock price. However, it also means you may miss out on additional upside if the stock continues to rise.

Trailing Stop-Loss Orders

Trailing stop-loss orders are a dynamic way to protect your profits while still allowing for potential further gains. With this strategy, your stop-loss level moves up as the stock price rises, but it never falls below your original purchase price. For example, if you buy a stock at $100 and set a trailing stop at 10%, your stop would initially be at $90. If the stock rises to $120, your stop would move up to $108, locking in profits.

By using trailing stops, you can ensure that your gains are locked in, even if the stock experiences a sudden downturn. This helps mitigate the risk of giving back your profits, but it also means you may be stopped out prematurely during market fluctuations. To address this, you can consider using a more sophisticated trailing stop strategy, such as one based on the Average True Range (ATR) of the stock.

Target Price Strategies

Setting a specific target price at which you’ll sell your stock is another effective profit-taking strategy. This pre-defined exit point removes the emotion from the decision-making process and helps you stick to your plan. You can establish target prices based on technical analysis, historical price levels, or expected earnings growth.

The benefits of this approach include a clear, objective decision-making process and the elimination of second-guessing. However, it also means you may miss out on further gains if the stock continues to rise beyond your target price. To counter this, consider using a tiered approach where you sell portions of your position at different price levels, allowing you to capitalize on rising prices while still securing profits.

Leveraging Tools and Resources for Profit Taking

To make informed profit-taking decisions, individual investors can leverage a variety of tools and resources:

-

Trading Platforms: Advanced trading platforms, such as those offered by major brokerages, often provide a range of charting tools, technical indicators, and real-time data analysis capabilities to help you identify potential profit-taking opportunities. These platforms may also offer features like automated trading and portfolio management tools to streamline your investment strategies.

-

Stock Screening Services: Specialized stock screening services like Finviz, Stock Rover, and TradingView allow you to filter and analyze stocks based on specific criteria, such as price movement, volume, and technical indicators, to uncover potential profit-taking opportunities. These tools can save you time and help you identify stocks that meet your profit-taking criteria quickly.

-

Financial News and Analysis Websites: Reputable financial news and analysis websites can provide you with timely market news, expert insights, and commentary to help inform your profit-taking decisions. Staying updated on market trends, economic indicators, and industry developments is crucial for making informed choices about when to take profits.

-

Trading Journals: Maintaining a detailed trading journal can be invaluable for tracking your performance, analyzing your profit-taking decisions, and identifying areas for improvement. Documenting your trades, including the reasons for entering and exiting positions, can help you refine your strategies over time and develop a deeper understanding of your own trading behavior.

Building a Robust Profit Taking Plan

Creating a robust profit-taking plan is essential for any individual investor. This plan should encompass your investment goals, risk tolerance, and specific strategies for maximizing your returns. Here are some key components to consider:

Define Your Investment Goals

Before you start investing, it’s crucial to define your investment goals. Are you looking for short-term gains, long-term growth, or a combination of both? Understanding your objectives will help you tailor your profit-taking strategies accordingly and ensure that your decisions align with your overall financial plan.

Establish Risk Tolerance

Your risk tolerance plays a significant role in your profit-taking decisions. Assess how much risk you’re willing to take on each trade and adjust your strategies to align with your comfort level. This will help you avoid emotional decision-making and stick to your plan.

Create a Detailed Trading Plan

Your trading plan should outline your entry and exit strategies, including when to take profits on stocks. Incorporate technical and fundamental indicators into your plan, and set clear profit targets based on your analysis. Having a well-structured plan will provide you with a roadmap for navigating the market.

Regularly Review and Adjust Your Plan

The market is constantly changing, and your trading plan should be flexible enough to adapt to new information and trends. Regularly review your performance, assess your strategies, and make adjustments as necessary to stay aligned with your goals. This could involve tweaking your profit-taking thresholds, modifying your risk management approach, or exploring new trading techniques.

Navigating Market Volatility

Market volatility can create both opportunities and challenges for individual investors. Understanding how to navigate these fluctuations is essential for successful profit taking. Here are some tips to consider:

Stay Informed

Keeping abreast of market news, economic indicators, and industry trends can help you make informed decisions about when to take profits on stocks. Follow reputable financial news sources and utilize market analysis tools to stay updated on the latest developments.

Embrace Flexibility

Market conditions can change rapidly, and being flexible in your trading approach can help you capitalize on new opportunities. If a stock is exhibiting strong momentum, you may want to adjust your profit-taking strategy to maximize gains. Conversely, during periods of high volatility, you might consider taking profits more frequently to minimize potential losses.

Maintain Emotional Discipline

Market volatility can trigger emotional reactions, such as fear and greed. It’s crucial to maintain emotional discipline and stick to your pre-defined profit-taking strategy, even during periods of market uncertainty. Avoid making impulsive decisions based on short-term fluctuations, which can undermine your long-term investment success.

FAQ

Q: What if I sell a stock and it continues to rise after I sell?

A: While it’s a common fear, predicting future market movements is impossible. Focus on your pre-defined exit strategy and trust your analysis. Selling a winning stock is better than watching your gains evaporate.

Q: How often should I take profits on stocks?

A: The frequency depends on your investment goals, risk tolerance, and market conditions. Some investors take profits weekly or monthly, while others have a longer-term approach. The key is to be consistent and disciplined in your profit-taking strategy.

Q: Should I take profits on all my winning stocks?

A: Not necessarily. Consider the individual stock’s performance, your overall portfolio strategy, and your investment goals. Factors like the company’s growth potential, industry trends, and your conviction in the investment may influence your decision to hold or take profits.

Q: How can I avoid emotional decision-making when taking profits?

A: Establish a clear profit-taking strategy that includes pre-defined targets and exit points. Stick to your plan and avoid making impulsive decisions based on short-term market fluctuations or your emotions. Maintaining a trading journal can also help you analyze your decision-making process and identify areas for improvement.

Conclusion

Profit taking is a crucial aspect of successful investing, allowing you to secure gains, mitigate risk, and free up capital for new opportunities. By implementing the strategies and tools discussed in this comprehensive guide, you can master the art of profit taking and elevate your investment performance.

Start by identifying your profit targets, exploring technical and fundamental indicators, and utilizing trading platforms and resources to make informed decisions. Remember, a well-defined profit-taking strategy is essential for maximizing returns and achieving your investment goals. With the right approach, you can navigate the complexities of the stock market with confidence, ensuring that you reap the rewards of your investments.

In summary, knowing when to take profits on stocks is not just about timing; it’s about understanding market dynamics, employing effective strategies, and maintaining emotional discipline. By honing your skills in profit taking, you can enhance your investment performance and build a more resilient portfolio that aligns with your long-term financial objectives.

MORE FROM pulsefusion.org