Why A Roth Ira Might Not Be The Best Choice For Near-retirees: Exploring Why Roth Ira Is Bad

Retirement planning often involves considering a Roth IRA, but a growing number of financial experts are questioning its universal suitability, especially for those nearing retirement. While the allure of tax-free withdrawals during retirement is undeniable, a significant portion of near-retirees find themselves in a position where a Roth IRA might actually be detrimental to their long-term financial well-being. This article delves into the reasons why a Roth IRA may not be the best choice for everyone, particularly those approaching their golden years.

Why Roth IRA is Bad: The Roth IRA – Not Always a Tax-Free Dream for Near-Retirees

A Roth IRA is often viewed as a golden ticket for retirement savings, primarily due to its promise of tax-free withdrawals when the time comes. However, this perception can be misleading, especially for individuals nearing retirement.

The Allure of Tax-Free Growth

The Roth IRA’s appeal is rooted in its potential for tax-free growth. Contributions are made with after-tax dollars, allowing your investments to grow without the burden of future taxes on withdrawals. For many, this seems like a prudent strategy, ensuring a secure financial future.

The Pros:

- Tax-Free Withdrawals: One of the key benefits is that funds can be withdrawn tax-free in retirement, providing a sense of financial freedom.

- Potential for Higher After-Tax Returns: If your investments perform well, the tax-free nature of withdrawals can lead to significant savings.

The Cons:

- Higher Tax Burden Upfront: The immediate tax hit can be substantial, particularly for those in their peak earning years.

- Opportunity Cost: If tax rates decrease in retirement, the upfront tax payment may not be justified, making the Roth IRA less advantageous.

The Reality Check for Near-Retirees

For individuals nearing retirement, the financial landscape often shifts dramatically. Many expect to earn less in retirement, which raises questions about the wisdom of paying taxes now through a Roth IRA.

Key Points to Consider:

- Time Horizon for Tax-Free Growth: The longer your money has to grow, the more beneficial a Roth IRA can be. However, for those close to retirement, this advantage diminishes.

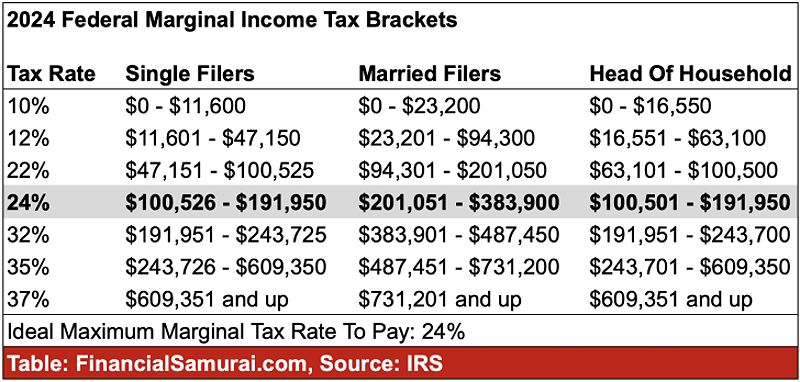

- Potential for Lower Tax Rates in Retirement: If you anticipate being in a lower tax bracket during retirement, the rationale for paying taxes upfront becomes questionable.

- Income Limitations: Near-retirees must consider how their income might affect their eligibility for contributions or conversions.

A Compelling Example: Imagine a 60-year-old named Sarah who decides to convert her Traditional IRA to a Roth IRA. While she dreams of tax-free growth, the immediate tax liability from the conversion can place a significant financial strain on her. If Sarah finds herself in a higher tax bracket now than she would in retirement, she may end up paying more in taxes than if she had left her money in a Traditional IRA.

Traditional IRA: A Powerful Option for Near-Retirees

While the Roth IRA captures much attention, the Traditional IRA remains a powerful and often overlooked tool for retirement savings. Its tax-deferred benefits can be particularly advantageous for those nearing retirement.

The Power of Tax Deferral

A Traditional IRA allows individuals to contribute pre-tax dollars, effectively reducing their taxable income in the year contributions are made. This immediate tax benefit can be a game-changer for those in their peak earning years.

The Pros:

- Lower Tax Burden Upfront: Contributions can be deducted from taxable income, leading to immediate tax savings.

- Tax-Deferred Growth: Funds grow without being taxed until they are withdrawn, which can be beneficial for those who expect to have lower income in retirement.

The Cons:

- Taxable Withdrawals in Retirement: When funds are withdrawn, they are subject to income tax, which can be a shock if tax rates rise.

- Potential for Lower After-Tax Returns: If tax rates increase in the future, the benefits of tax deferral may diminish.

Traditional IRA’s Appeal for Near-Retirees

For many nearing retirement, the Traditional IRA presents several compelling advantages.

Key Points:

- Lower Tax Rates in Retirement: Many retirees find themselves in a lower tax bracket, making the tax burden on withdrawals less impactful.

- Maximizing Contributions with Immediate Tax Relief: By contributing to a Traditional IRA, individuals can maximize their retirement savings while enjoying tax deductions.

A Compelling Example: Consider a 55-year-old named Tom who opts to contribute to a Traditional IRA. By doing so, he not only benefits from immediate tax relief but also positions himself for potentially higher after-tax returns in retirement, especially if his income decreases significantly.

Key Factors to Consider When Choosing Between a Roth IRA and a Traditional IRA

When weighing the benefits of a Roth IRA against a Traditional IRA, several key factors should guide your decision, especially for those approaching retirement.

- Current and Future Tax Bracket: Understanding your current tax situation compared to projected future rates is crucial. If you expect to be in a lower tax bracket during retirement, a Traditional IRA may be more advantageous.

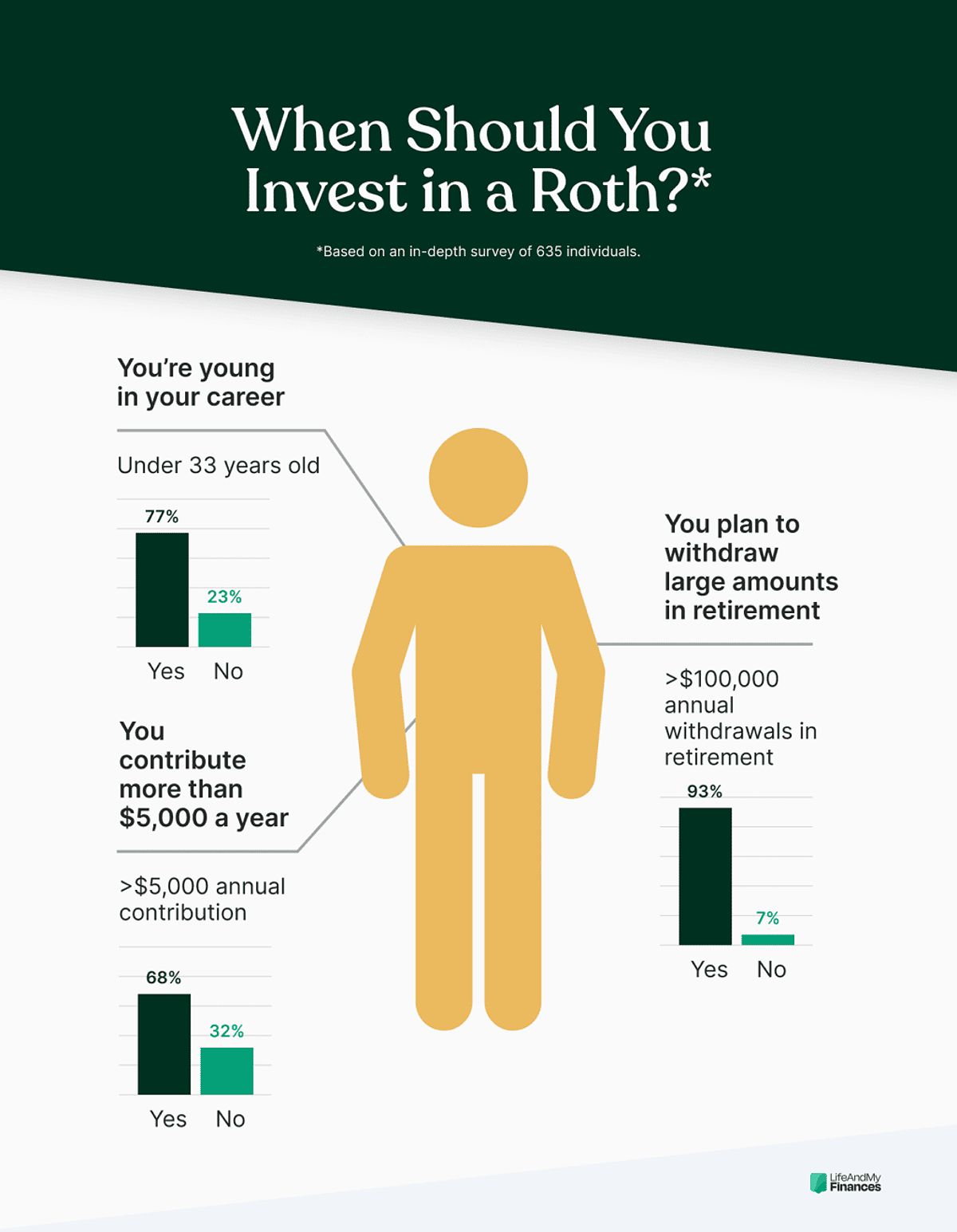

- Time Horizon for Retirement Savings: The time left until retirement can significantly influence your choice. Younger individuals may find more value in a Roth IRA, while those closer to retirement might benefit from the Traditional IRA.

- Projected Retirement Income and Expenses: Estimating future income and expenses can clarify which option may provide better tax efficiency.

- Estate Planning Considerations: If leaving a tax-free inheritance is a priority, the Roth IRA may seem appealing. However, the tax implications for heirs should also be weighed.

- Availability of Other Tax-Advantaged Accounts: Consider how 401(k)s and other retirement accounts interact with both IRA options.

Beyond the IRA: Exploring Other Retirement Savings Strategies

While Roth and Traditional IRAs are popular choices, there are alternative strategies worth considering for retirement savings.

Annuities: A Steady Income Stream

Annuities can provide guaranteed income streams during retirement, alleviating the pressure to make large withdrawals from IRAs. This can be particularly beneficial for near-retirees who want to ensure a consistent cash flow without the risk of market fluctuations.

Roth Conversions: Timing Matters

For near-retirees, the decision to convert a Traditional IRA to a Roth IRA requires careful consideration. While this strategy can lead to tax-free growth, the timing of the conversion is crucial. Conducting a conversion during a year of lower income can help minimize the tax burden.

Non-IRA Retirement Accounts

Other tax-advantaged retirement accounts, such as 401(k)s and 403(b)s, should not be overlooked. These accounts often come with employer matching contributions, significantly boosting retirement savings.

The Importance of Seeking Professional Advice

Navigating the complexities of retirement planning can be challenging, making it essential to consult with a qualified financial advisor or tax professional. Personalized guidance can help you understand the implications of your choices, ensuring that your retirement savings strategy aligns with your individual circumstances and goals.

Given the intricacies involved in choosing between a Roth IRA and a Traditional IRA, professional advice can be invaluable. A financial advisor can help you evaluate your current situation, project future income needs, and recommend the most suitable retirement savings options.

FAQ

Q: If I’m already contributing to a Roth IRA, should I switch to a Traditional IRA?

A: It depends on your individual circumstances and financial goals. Consider your current tax bracket, projected future tax bracket, and time horizon for retirement. Consulting with a financial advisor or tax professional can help you make an informed decision.

Q: What are the tax implications of withdrawing money from a Roth IRA before age 59.5?

A: You can withdraw your contributions to a Roth IRA tax-free and penalty-free at any time. However, withdrawing earnings before age 59.5 is subject to a 10% penalty and taxes.

Conclusion

In summary, while a Roth IRA may seem like an attractive option for retirement savings, it is essential to weigh the potential drawbacks, especially for those nearing retirement. Factors such as current and future tax brackets, time horizon, and individual circumstances can significantly influence whether a Roth IRA is the right choice. By considering alternative strategies and seeking professional advice, individuals can make informed decisions that align with their financial goals and retirement plans.

MORE FROM pulsefusion.org