The Average 529 Balance By Age: Are You On Track For Your Child’s College?

Meta Description: Discover the average 529 balance by age and see if you’re on track for your child’s college savings goals. Learn strategies for maximizing contributions and navigating rising tuition costs.

Saving for college is a daunting task, especially with tuition costs rising at an average of 5% annually. Knowing the average 529 balance by age can help parents gauge their progress and make informed decisions about their savings strategy. While a 529 plan offers tax advantages, reaching the average balance requires careful planning and consistent contributions.

Understanding the Average 529 Balance by Age

This section delves into the average 529 balance at different ages, providing a benchmark for parents to compare their own savings progress.

Average 529 Balances: A Snapshot

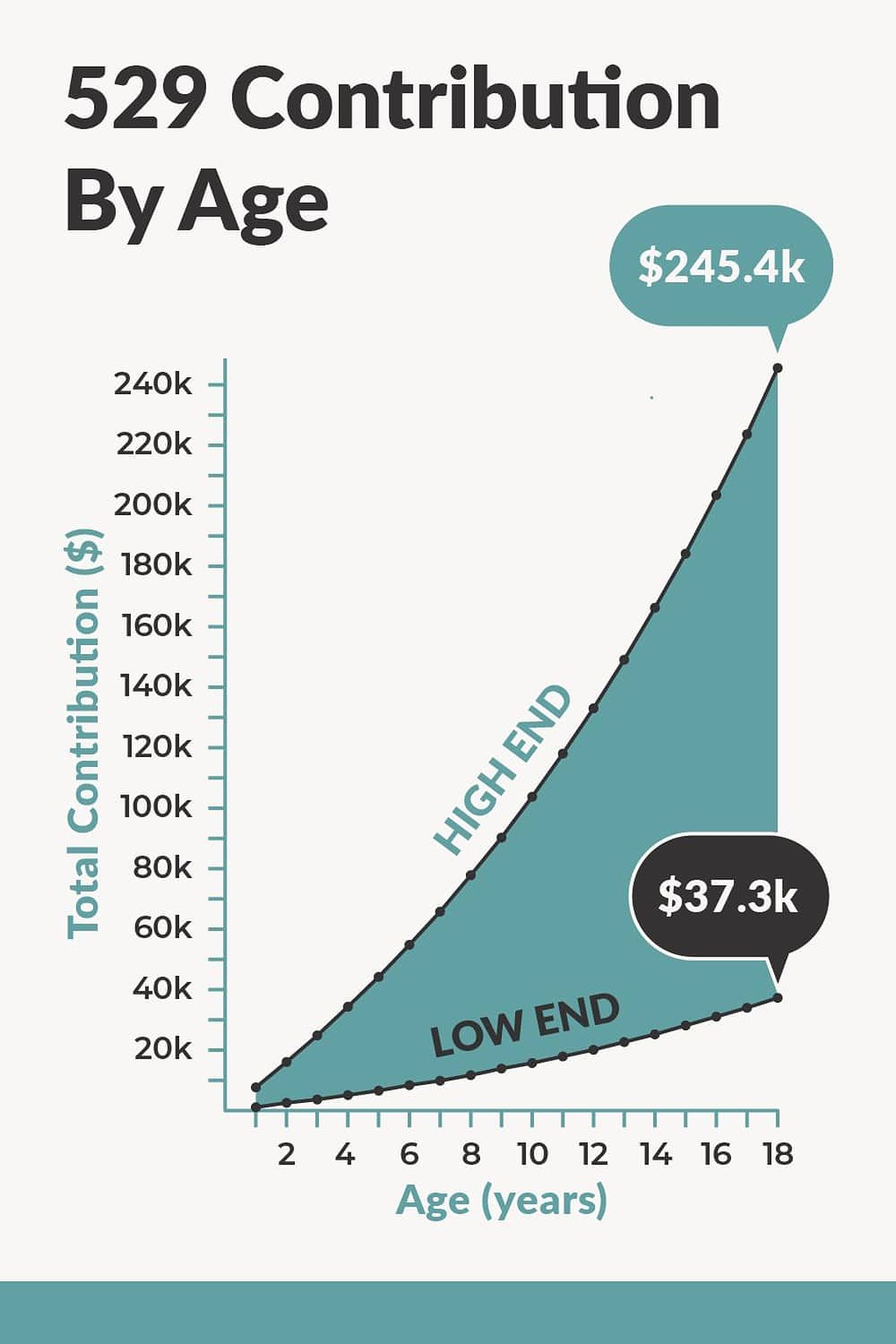

The table below illustrates the average 529 balances at various ages, assuming your child will attend a public, four-year college with in-state tuition. These figures consider a 5% annual increase in college costs and an average investment return of 4.96%.

| Age | Low End | Medium End | High End |

|---|---|---|---|

| 1 | $3,576 | $7,152 | $10,728 |

| 2 | $7,328 | $14,656 | $21,984 |

| 3 | $11,265 | $22,529 | $33,794 |

| 4 | $15,395 | $30,789 | $46,184 |

| 5 | $19,728 | $39,456 | $59,184 |

| 6 | $24,275 | $48,549 | $72,824 |

| 7 | $29,045 | $58,090 | $87,135 |

| 8 | $34,050 | $68,100 | $102,150 |

| 9 | $39,301 | $78,603 | $117,904 |

| 10 | $44,811 | $89,622 | $134,433 |

| 11 | $50,592 | $101,183 | $151,775 |

| 12 | $56,657 | $113,313 | $169,970 |

| 13 | $63,021 | $126,040 | $189,061 |

| 14 | $69,698 | $139,393 | $209,091 |

| 15 | $76,703 | $153,403 | $230,105 |

| 16 | $84,053 | $168,102 | $252,153 |

| 17 | $91,764 | $183,525 | $275,287 |

| 18 | $99,855 | $199,706 | $299,561 |

The “Low End” column assumes you will cover 50% of the college costs with your 529 plan, while the “High End” column represents the assumption that the entire cost will be covered. The “Medium End” provides a balanced perspective.

These figures are averages, meaning your actual savings may vary based on several factors.

Factors Influencing Average 529 Balances

Understanding the variables that affect the average 529 account balance by age can help you make better financial decisions:

-

Contribution Amount: Consistent and higher contributions generally lead to larger balances. The earlier you start saving, the better off you’ll be.

-

Investment Returns: The performance of your chosen investments within the 529 plan directly affects growth. Diversifying your portfolio can help mitigate risks and enhance returns.

-

College Plans: The type of institution your child intends to attend—whether it’s a public in-state, public out-of-state, or private college—will significantly influence your savings goals.

-

Financial Aid: Scholarships, grants, and other forms of financial assistance can lessen the burden of college costs, allowing you to save less in your 529 plan.

How to Use Average 529 Balances Effectively

While the average 529 balances provide a useful benchmark, it’s important to remember that they are just averages. Your individual situation and goals may differ, so use these numbers as a guide rather than a rigid target.

By understanding the average 529 balance by age, you can:

-

Assess Your Progress: Compare your current 529 balance to the averages to determine if you’re ahead, behind, or on track.

-

Adjust Your Strategy: If your balance is lower than the average, consider increasing contributions or exploring better investment options. Conversely, if you’re ahead, you may choose to reduce contributions and allocate funds elsewhere.

-

Stay Motivated: Knowing you’re on the right path can encourage you to remain committed to your college savings plan, especially as education costs continue to rise.

Strategies for Building a Strong 529 Plan

This section will offer practical strategies for parents to maximize their 529 plan contributions and ensure they’re on track for their college savings goals.

Maximize Contributions

The contribution limits for 529 plans vary by state, but most plans have an aggregate limit ranging from $300,000 to $500,000 per beneficiary. To make the most of your 529 plan, consider the following strategies:

-

Regular Savings: Set up automatic transfers from your bank account to your 529 plan. This makes saving a habit and helps you stay consistent.

-

Gift Giving: Encourage family members and friends to contribute to your child’s 529 plan for birthdays or holidays. This not only increases your savings but also engages others in your child’s future.

-

Tax Deductions: Investigate any state tax deductions or credits available for 529 contributions. These can significantly boost your overall savings.

-

Superfunding: You can front-load contributions by gifting up to five years’ worth of contributions (currently $80,000 for single filers or $160,000 for married couples) without incurring gift tax. This strategy can jumpstart your savings.

Smart Investment Choices

Selecting the right investments within your 529 plan can make a significant difference in your overall savings. Consider the following when choosing your investments:

-

Risk Tolerance and Time Horizon: Align your investments with your comfort level for risk and the time you have until your child starts college.

-

Investment Options: Explore the different types of investment options available in your 529 plan, including age-based portfolios, which automatically adjust the asset allocation as your child gets closer to college age.

-

Choosing Investments Wisely:

- Diversification: Spread your investments across various asset classes—stocks, bonds, and cash—to manage risk effectively.

- Fees: Opt for plans with low management fees, as high fees can diminish your investment returns over time.

- Performance History: Research the historical performance of investment options to make informed decisions.

Additional Savings Strategies

While a 529 plan is a powerful tool for college savings, you may want to explore complementary strategies to build your college fund:

-

Custodial Roth IRA: Opening a Roth IRA in your child’s name can provide another tax-advantaged avenue for saving for college and beyond.

-

Cash Back Programs: Services like Upromise allow you to earn rewards on everyday purchases, which can be transferred to your 529 plan, adding to your savings effortlessly.

-

Birthday and Holiday Money: Encourage your child to save any monetary gifts they receive for their college fund. This practice instills good saving habits early on.

Navigating the Rising Cost of College

The Reality of Rising Tuition

The cost of college has been rising faster than inflation for decades. According to the College Board, the average annual cost of tuition, fees, and room and board at a public four-year university was approximately $21,370 for the 2022-2023 academic year, reflecting a 22% increase over the past decade.

As college costs continue to escalate, it’s crucial to adjust your 529 plan savings strategy accordingly. The average 529 balance by age may not keep pace with the increasing price tag of higher education.

Adjusting Your Savings Strategy

To adapt to the rising costs of college, consider the following strategies:

-

Increase Contributions: Review your budget and look for ways to boost your monthly or annual contributions to your 529 plan.

-

Re-evaluate College Plans: Consider less expensive options, such as in-state public colleges, to align your savings with projected costs.

-

Explore Financial Aid Opportunities: Research scholarships, grants, and other financial aid options that can supplement your 529 plan savings.

Alternative Funding Sources

While a 529 plan should serve as the foundation of your college savings strategy, you may need to explore additional funding sources to cover the full cost of your child’s education:

-

Student Loans: Understand the pros and cons of student loans and help your child develop a responsible borrowing plan.

-

Part-Time Work: Encourage your child to consider part-time jobs or work-study programs to contribute to their education expenses.

FAQ

Q: What if I’m behind on my 529 savings goals?

A: Don’t worry if you’re behind on your 529 savings goals. It’s never too late to catch up. Increase your contributions, explore additional savings strategies, and consider adjusting your college plans to align with your budget.

Q: Should I use a 529 plan for all my college savings?

A: While 529 plans are an excellent option, they shouldn’t be the only tool in your college savings arsenal. Consider a combination of 529 plans, custodial Roth IRAs, and other savings accounts to diversify your strategy.

Q: What happens if my child doesn’t go to college?

A: Most states allow you to change the beneficiary of a 529 plan to another family member. Additionally, you can withdraw funds for qualified education expenses, such as vocational training or apprenticeship programs.

Conclusion

Understanding the average 529 balance by age is a helpful benchmark for parents saving for their child’s college education. By reviewing these figures and considering the factors that can influence your own 529 plan, you can assess your progress and make necessary adjustments to your savings strategy.

Remember, the average 529 balance is just that—an average. Your individual circumstances, investment choices, and college plans will ultimately determine the appropriate savings goal for your family. Stay diligent in your savings efforts, explore alternative funding sources, and consult with a financial advisor if you need personalized guidance. With a well-rounded college savings plan, you can help ensure your child’s educational dreams become a reality.

MORE FROM pulsefusion.org