How To Earn Millions A Year: A Practical Guide For Aspiring Millionaires

Imagine a world where earning a million dollars a year is not just a dream, but a realistic goal within your reach. While this may sound like an unrealistic aspiration, experts estimate that 20% of individuals with the right skillset and financial acumen can achieve this milestone within a decade. This highlights the importance of continuous learning and adapting to the evolving economic landscape to unlock your financial potential.

This guide will provide you with a roadmap to financial success, covering essential steps for how to earn millions a year. We’ll explore lucrative career paths, master investment strategies, and uncover the secrets to maximizing your earning potential, all while building a solid foundation for wealth accumulation.

Choosing a High-Earning Career Path: How to Earn Millions a Year

The first step towards achieving your financial goals is selecting the right career path. This section will guide you towards high-paying professions that align with your skills and interests.

High-Paying Industries

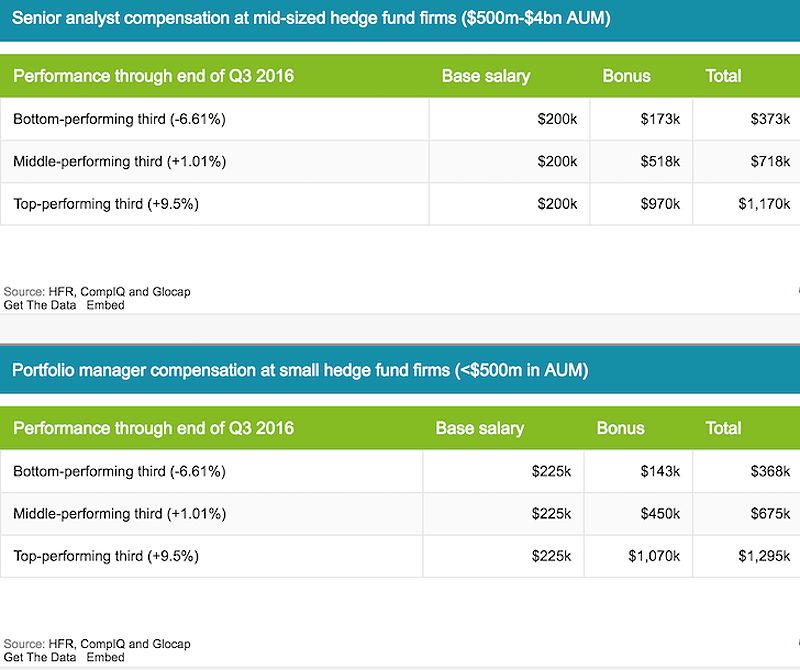

Certain sectors consistently offer substantial salaries and opportunities for advancement. Industries such as finance, technology, healthcare, and law are known for their lucrative compensation packages. For instance, professionals in investment banking or hedge fund management can earn salaries that often exceed a million dollars a year, especially for top performers.

These high-paying fields frequently include significant bonuses and stock options, which can dramatically enhance your total earnings. A leading investment banker, for example, may command a base salary of $200,000, with bonuses pushing their total compensation well over a million dollars. By targeting these industries, you can significantly increase your chances of reaching your financial aspirations.

Developing In-Demand Skills

To thrive in high-paying sectors, acquiring in-demand skills is crucial. Employers are seeking candidates with expertise in areas such as data analysis, software engineering, and financial management. Pursuing advanced education, obtaining professional certifications, and gaining hands-on experience can set you apart from the competition.

Consider enrolling in specialized training programs, attending industry workshops, or exploring online courses that focus on critical skills relevant to your desired field. By continuously upgrading your knowledge and expertise, you position yourself for higher salaries and greater career advancement opportunities.

Networking and Building Relationships

Networking plays a vital role in career success, particularly in high-earning industries. Establishing connections with professionals in your field can open doors to job opportunities, mentorship, and potential collaborations. Attend industry conferences, join professional organizations, and utilize platforms like LinkedIn to connect with influential figures in your sector.

Building strong relationships with mentors can provide invaluable guidance as you navigate your career. They can offer insights into industry trends, help you refine your skills, and introduce you to key contacts that can accelerate your journey toward earning a million dollars a year.

Mastering the Art of Smart Investing

Earning a high salary is only part of the equation; smart investing is equally important for wealth accumulation. Understanding how to manage and grow your finances through investments can significantly impact your financial trajectory.

Diversification

Diversification is a key principle in investing that helps mitigate risk. By spreading your investments across various asset classes—such as stocks, bonds, and real estate—you can protect your portfolio from market volatility. This strategy ensures that if one investment underperforms, others may compensate for the loss.

Consider developing a balanced investment portfolio that aligns with your financial goals and risk tolerance. Tools like online brokerage accounts and robo-advisors can assist in managing your investments effectively, making it easier to achieve your long-term financial objectives.

Growth Stocks and High-Yield Investments

Investing in growth stocks and high-yield assets can yield substantial returns over time. While these investments often come with higher risks, the potential rewards can be significant. Many successful investors have built their wealth by identifying promising companies early and capitalizing on their growth.

Researching industries poised for expansion, such as technology and renewable energy, can lead to lucrative investment opportunities. However, it’s essential to conduct thorough analysis and due diligence before committing your capital to ensure you make informed decisions.

Long-Term Investing

Adopting a long-term investment mindset is crucial for building wealth. Short-term market fluctuations can be disheartening, but maintaining a disciplined approach will help you ride out the volatility. Stay focused on your long-term goals and avoid making impulsive decisions based on temporary market trends.

Consider setting up automatic contributions to your investment accounts to ensure consistent growth over time. This strategy not only helps you stay disciplined but also takes advantage of dollar-cost averaging, which can enhance your returns.

Maximizing Your Earning Potential

Beyond selecting a high-paying career and investing wisely, there are additional strategies to maximize your earning potential. Implementing these tactics can further accelerate your journey toward financial success.

Negotiating Your Salary

One of the most effective ways to increase your income is by negotiating your salary. Many individuals leave money on the table simply by accepting the initial offer without discussion. Researching market rates for your position and preparing a compelling case can empower you to negotiate effectively.

When discussing salary, emphasize your skills, experience, and contributions to the organization. Practice your negotiation skills to build confidence and ensure you advocate for the compensation you deserve.

Side Hustles and Entrepreneurship

Exploring side hustles or entrepreneurial ventures can provide additional income streams. Many successful individuals have built wealth by starting businesses alongside their full-time jobs. Identify your passions and skills to discover potential side hustles that align with your interests.

Consider options such as freelancing, consulting, or creating an online business. By dedicating time to a side project, you can generate extra income while developing valuable skills that may enhance your primary career.

Continuous Learning and Skill Development

The job market is ever-evolving, making continuous learning vital for maintaining your earning potential. Stay informed about industry trends and emerging technologies to remain competitive. Regularly seek opportunities for professional development through workshops, conferences, and online courses.

Investing in your education not only enhances your skill set but also demonstrates your commitment to growth, making you a more valuable asset to employers.

Financial Discipline and Avoiding Debt

Maintaining financial discipline is essential for anyone seeking to earn millions a year. Establishing a solid financial foundation can help you maximize your income and achieve your financial goals.

Creating a Budget

Developing a budget is a fundamental step in managing your finances. A well-structured budget allows you to track your income and expenses, ensuring you allocate funds toward savings and investments. Consider using budgeting methods such as the 50/30/20 rule, which allocates 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

Utilizing budgeting apps can simplify the process, making it easier to monitor your spending habits and adjust as necessary. By adhering to a budget, you can gain greater control over your financial future.

Managing Debt

Effectively managing debt is crucial for financial success. Prioritize paying off high-interest debt, such as credit card balances, to free up cash flow for savings and investments. Implementing debt repayment strategies, such as the snowball or avalanche method, can help you systematically reduce your debt burden.

Avoid accumulating unnecessary debt by living within your means and being mindful of your spending habits. This discipline will enable you to focus on wealth-building strategies rather than debt repayment.

Avoiding Lifestyle Inflation

As your income increases, it’s easy to fall into the trap of lifestyle inflation, where your expenses rise along with your earnings. To achieve financial success, strive to live below your means and resist the urge to upgrade your lifestyle excessively.

By maintaining a modest lifestyle, you can allocate a larger portion of your income toward savings and investments. This approach will significantly enhance your ability to accumulate wealth over time.

Seeking Mentorship and Building a Network

Building a strong professional network and seeking mentorship can greatly enhance your journey to financial success. Connecting with experienced individuals can provide guidance, support, and valuable insights into achieving your goals.

Finding a Mentor

Having a mentor can significantly impact your career trajectory. A mentor can provide advice, share experiences, and help you navigate challenges. To find a mentor, identify individuals in your field who inspire you and reach out to them.

Approaching potential mentors with a clear purpose and specific questions can foster a productive relationship. Establishing a mentor-mentee connection can provide you with the support and knowledge necessary to accelerate your path to earning a million dollars a year.

Networking and Building Relationships

Networking is essential for professional growth. Engaging with peers and industry leaders can lead to new opportunities and collaborations. Attend conferences, join professional associations, and actively participate in discussions to expand your network.

Building relationships with like-minded individuals can provide motivation and encouragement as you pursue your financial goals. The connections you make today may lead to lucrative opportunities in the future.

Conclusion

In summary, learning how to earn millions a year involves a multifaceted approach that includes selecting a high-paying career, mastering investment strategies, and maximizing your earning potential. Establishing financial discipline, seeking mentorship, and continuously developing your skills will further enhance your journey toward achieving millionaire status.

Take action by setting financial goals, creating a budget, and starting to invest. Your financial goals are within reach with dedication and the right strategies. Remember, the path to earning millions a year is challenging, but with the right mindset and approach, it is an attainable dream.

MORE FROM pulsefusion.org