Passive Income From $10 Million Dollars: Strategies For Sustainable Wealth

Imagine waking up every morning knowing your investments are working tirelessly for you, generating a steady stream of passive income. This is the reality for many high-net-worth individuals who have successfully built portfolios that yield consistent returns. In this article, we will guide you through the process of creating a passive income strategy for your $10 million, helping you achieve financial independence and live life on your terms.

Understanding Passive Income and Your Financial Goals

Before diving into specific strategies for generating passive income from $10 million dollars, it’s essential to grasp what passive income truly means and how it aligns with your financial aspirations.

Defining Passive Income

Passive income refers to earnings derived from investments that do not require your active involvement in their day-to-day management. This is in stark contrast to active income, which demands continuous effort and engagement. The allure of passive income lies in its potential to grant you financial freedom, allowing you to pursue interests outside of work or simply enjoy a more relaxed lifestyle.

Common sources of passive income include rental income from real estate, dividends from stocks, and interest from bonds. By understanding these sources, you can better appreciate how to invest 10 million dollars wisely to achieve consistent returns.

Setting Your Financial Goals

To create a successful passive income strategy, begin by defining your financial goals. Are you aiming for early retirement, seeking financial independence, or looking to fund specific projects? Identifying clear objectives will guide your investment decisions and help you stay focused on what truly matters.

Consider conducting goal-setting exercises that involve both short-term and long-term objectives. Determine how much passive income you would like to generate and how it aligns with your lifestyle desires. This clarity will serve as a beacon as you navigate the complexities of investing.

Diversification: The Cornerstone of Generating Passive Income from $10 Million Dollars

When it comes to generating passive income, diversification is not just a buzzword; it’s a fundamental principle that can significantly mitigate risk and enhance your income streams.

Building a Balanced Portfolio

To achieve diversification, it’s crucial to spread your investments across various asset classes. This includes stocks, bonds, real estate, and alternative investments. Each asset class carries its unique risk profile and potential return.

Historically, equities have provided robust returns, while bonds have been known for their stability and predictable income. Understanding the characteristics of these asset classes can empower you to build a well-rounded portfolio that generates passive income from your $10 million.

The Role of Alternative Investments

Alternative investments, such as private equity, hedge funds, and private credit, offer unique opportunities for diversification and potentially higher returns. However, these investments often come with increased risk and less liquidity. Carefully evaluating the pros and cons of each alternative investment can help you make informed decisions that align with your risk tolerance.

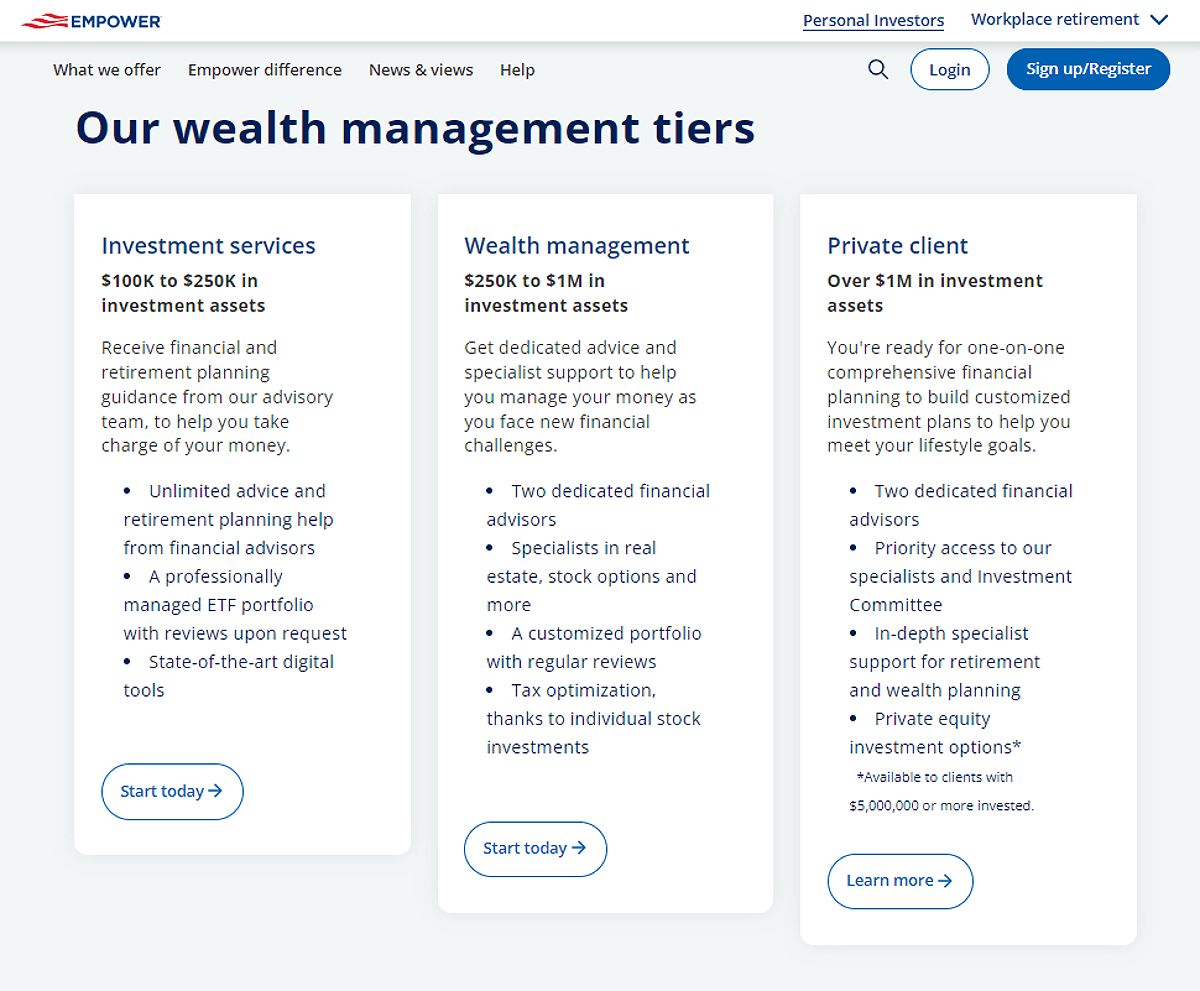

The Importance of Professional Guidance

Navigating the complexities of a $10 million portfolio can be daunting. This is where professional guidance becomes invaluable. A qualified financial advisor can help you tailor your investment strategy to align with your goals, risk tolerance, and the intricacies of various asset classes. They can also provide insights into market trends and help you identify unique opportunities.

Passive Income Strategies for a $10 Million Portfolio

Now that you understand the importance of setting goals and diversifying your portfolio, let’s explore specific strategies for generating passive income from your $10 million investment.

Dividend-Paying Stocks

One of the most popular methods for generating passive income is investing in dividend-paying stocks. These stocks provide regular cash payouts, typically on a quarterly basis, allowing you to benefit from both dividend income and potential capital appreciation.

When selecting dividend stocks, consider factors such as the dividend yield, payout ratio, and the stability of the company. Companies with a history of increasing dividends often exhibit strong financial health, making them attractive options for passive income. With an average dividend yield ranging from 2% to 5%, your $10 million investment in dividend stocks can yield substantial income.

Real Estate Investment Trusts (REITs)

If you’re looking to invest in real estate without the complexities of direct ownership, Real Estate Investment Trusts (REITs) might be the right choice for you. REITs generate income through rental payments and property appreciation, distributing a significant portion of their earnings to shareholders in the form of dividends.

Investing in REITs offers the benefits of liquidity and diversification, as they are traded on stock exchanges like traditional stocks. However, it’s essential to assess the specific types of REITs available. Some may focus on residential properties, while others invest in commercial real estate. Historically, REITs have offered average annual returns between 8% to 12%, making them an appealing option for passive income generation.

Bonds and Fixed Income Investments

Bonds are another reliable avenue for generating passive income. They provide predictable interest payments, creating a stable component of your portfolio. Various types of bonds are available, including government bonds, corporate bonds, and high-yield bonds, each with different risk and return profiles.

When considering how to invest 10 million dollars in bonds, evaluate the average yields and how interest rates may affect bond prices. Government bonds typically offer lower yields but come with lower risk, while corporate bonds can provide higher yields at a greater risk. Understanding these dynamics will allow you to construct a balanced approach to fixed income investments.

Private Equity and Venture Capital

For those willing to embrace higher risk for potentially greater rewards, private equity and venture capital investments present attractive opportunities. These investments involve funding private companies or startups in exchange for equity stakes, often leading to significant returns if the companies succeed.

While the potential for profit is high, it’s crucial to recognize the liquidity concerns and longer time horizon associated with these investments. Conducting thorough due diligence and understanding the risks involved is vital before committing capital. Returns in this space can exceed 20% annually, but they come with higher volatility and the risk of total loss.

Annuities and Structured Products

Annuities offer a way to generate guaranteed income for a specified period or for life, appealing to those seeking financial security during retirement. Various types of annuities exist, including fixed, variable, and indexed annuities, each with different features and benefits.

While annuities can provide predictable income streams, they may also come with high fees and limited liquidity. Weighing the pros and cons of annuities is essential to determine if they align with your overall investment strategy for generating passive income from $10 million.

Tax Considerations and Strategies

Understanding the tax implications of your passive income investments is critical for optimizing your returns. Different types of passive income are taxed at varying rates, which can significantly impact your overall income strategy.

Investments in tax-advantaged accounts, such as municipal bonds or Roth IRAs, can provide opportunities for tax-free income. Structuring your investments to minimize tax liability can enhance your net returns, enabling you to achieve your financial goals more effectively. Consulting with a tax professional can help you navigate these complexities and implement strategies that align with your investment approach.

Managing Your Passive Income Portfolio

Once you have established your passive income portfolio, regular monitoring and management are essential. The financial landscape is continually evolving, and adjustments may be necessary to maintain your income levels and meet your goals.

Conducting regular portfolio reviews can help you assess performance and make informed decisions about rebalancing. This process involves adjusting your asset allocation in response to market fluctuations or changes in your financial objectives. Staying proactive in managing your investments ensures that your portfolio continues to generate the desired passive income.

Beyond Investing: Other Passive Income Opportunities

In addition to traditional investments, consider exploring alternative passive income streams that can further diversify your income sources. Options such as royalties from intellectual property, licensing agreements, or income from online businesses can provide additional income streams.

These alternative sources can complement your primary investments, offering diversification and potential growth. For instance, creating an online course or writing a book can yield ongoing royalties, providing a unique way to leverage your expertise for additional income.

FAQ

Q: What is the best way to invest $10 million for passive income?

A: The best approach depends on your risk tolerance, financial goals, and time horizon. A diversified portfolio that includes a mix of asset classes, such as stocks, bonds, real estate, and alternative investments, is key to achieving balanced and sustainable passive income.

Q: How much passive income can I expect from $10 million?

A: The amount of passive income you can generate varies based on your investment choices and market conditions. However, with a well-structured portfolio, it’s possible to achieve a steady stream of income without depleting your principal.

Q: Are there any tax-free passive income opportunities?

A: Yes, tax-advantaged investments like municipal bonds and Roth IRAs can generate tax-free income. It’s advisable to consult with a financial advisor to explore options that align with your financial goals and tax situation.

Conclusion

Generating passive income from $10 million dollars is not just a possibility; it’s an achievable goal with the right investment strategies and a well-diversified portfolio. By understanding your financial objectives and exploring various asset classes, you can create a sustainable income stream that supports your lifestyle and long-term aspirations. Regular management and consideration of tax implications will further enhance your investment success, ensuring that your wealth continues to grow.

As you embark on this journey toward financial independence, remember that consulting with a financial advisor can provide valuable insights and guidance tailored to your unique situation. With careful planning and execution, your $10 million can work for you, delivering the passive income necessary to enjoy the life you desire.

MORE FROM pulsefusion.org